Trade Trends News

Trade Trends News

2025-07-25

2025-07-25

The European Automobile Manufacturers' Association (ACEA) reported on Thursday that new car sales in Europe fell by over 5% in June, highlighting the global challenges faced by automakers.

Despite overall growth in electric vehicle (EV) sales, Tesla's market share declined for the sixth consecutive month, and all four of Europe's top-selling automotive groups—Volkswagen, Stellantis, Renault, and Hyundai—posted lower sales in June 2024.

European carmakers have collectively lost billions of dollars, struggling to cope with increased competition from China, the 25% U.S. import tariffs, and domestic regulations aimed at accelerating the EV transition, prompting a wave of profit warnings across the industry.

According to ACEA, total car registrations in the EU, UK, and European Free Trade Association (EFTA) countries dropped 5.1% year-over-year, reaching 1.24 million units in June.

Specifically:

·Volkswagen Group: -6.1%

·Stellantis: -12.3%

·Renault: -0.6%

·Hyundai: -8.7%

Tesla suffered a 22.9% decline in sales, with its market share shrinking from 3.4% a year ago to 2.8%.

Brands not individually tracked by ACEA—such as Chinese automakers like BYD—saw their market share more than double to 4.5%.

In the EU alone, despite registrations of Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs) increasing by 7.8%, 41.6%, and 6.1% respectively, total car sales still dropped 7.3% year-over-year.

In June, the combined market share of these three EV types reached 59.8% of EU passenger car registrations, up from 50% in the same month last year.

Regional breakdown:

·Germany: -13.8%

·France: -6.7%

·Italy: -17.4%

·UK: +6.7%

·Spain: +15.2%

Ben Nelmes, founder of EV data analytics firm New AutoMotive, commented:

“As drivers demand cleaner and cheaper cars, some vibrant new brands are stepping in to fill the gaps left by legacy automakers who have been too slow to respond to consumer needs.”

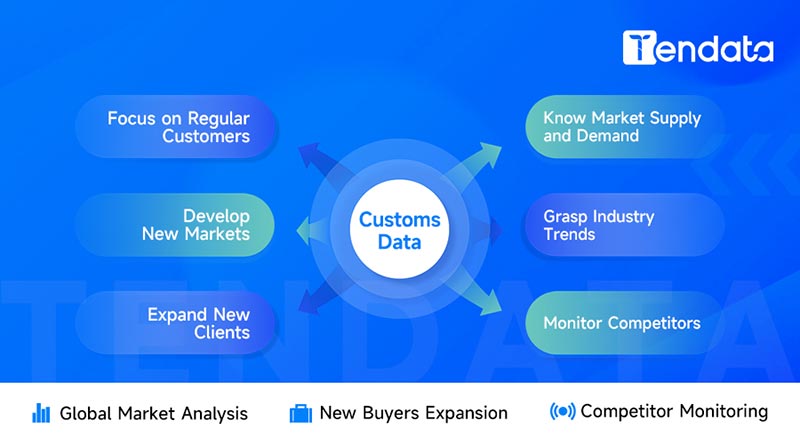

Tendata provides more than 10 billion trade data, covering 228 countries and regions, accumulating more than 10 billion trade transaction details, and a trade database of more than 230 sub-industries.

Searching product keywords or HS codes in Tendata iTrader will allow you to view tens of thousands of active potential customers in the past year, as well as customers' purchase records, including purchase amount, quantity, time, frequency, and their suppliers/buyers. These companies in the Customers List are all customers with needs, and can be used for foreign trade customer development.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship