Trade Trends News

Trade Trends News

2025-05-22

2025-05-22

In recent years, China-Russia trade data has reached unprecedented levels, reflecting deepening economic ties amid shifting global geopolitics. Bilateral trade started at over $140 billion in 2021. It grew to about $190 billion in 2022.

In 2023, it reached a record high of $240.1 billion. The upward trend continued in 2024. Total trade reached $244.8 billion, which is a 1.9% increase from last year, according to official customs data.

However, the first four months of 2025 signaled a temporary slowdown. From January to April 2025, trade between China and Russia was $71.12 billion.

This is a 7.5% drop from the same time in 2024. Chinese exports to Russia were down 5.3%, totaling $30.81 billion, while imports from Russia dropped 9.1% to $40.31 billion. Despite this dip, the broader trend suggests a resilient and evolving partnership.

? Export Growth: Chinese Products Diversify in Russian Market

Tendata's 2024 analytics show that China's exports to Russia are becoming more diverse. These exports include vehicles, smartphones, air conditioners, toys, computers, and industrial machinery. Automobiles, in particular, have taken a commanding lead in export value.

? Top 5 Chinese Exports to Russia in 2024 (by value):

| HS Code | Product Export | Value (USD) | Year-on-Year Change |

| 87032343 | Passenger cars with spark-ignition engines | $3.704 billion | +39.06% |

| 87032230 | Passenger cars with spark-ignition engines | $2.858 billion | -31.18% |

| 85171300 | Smartphones | $2.666 billion | -10.75% |

| 87012100 | Diesel-powered cars | $2.550 billion | -33.30% |

| 87032342 | Off-road vehicles | $2.533 billion | +97.34% |

Many types of vehicles saw big growth, showing Russia's increasing reliance on cars made in China. This comes as Western sanctions and the exit of European and Japanese carmakers affect the market.

Other fast-growing exports include portable data processing devices worth $1.178 billion. Low-value goods total $927 million. These goods rose by 22.10% from last year. This increase shows the growth of cross-border e-commerce.

>>>>> Get Report of China-Russia Trade Data <<<<<

?️ China's Imports from Russia: Energy Remains the Core

Energy products continue to dominate China's imports from Russia. In 2024, nearly half (48.58%) of all Chinese imports from Russia were crude oil, valued at $61.66 billion. Liquefied natural gas (LNG), refined oil products, and coal also constituted major import segments.

? Top 5 Russian Exports to China in 2024:

HS Code Product Import Value (USD) Year-on-Year Change

27090000 Crude oil $61.66 billion +3.79%

27112100 Natural gas $7.355 billion +14.29%

27101922 Fuel oil (5–7 grade) $4.763 billion +4.56%

27111100 LNG $4.527 billion +12.85%

27011210 Coking coal $4.383 billion -1.44%

One notable trend is the 23.35% increase in imports of unwrought non-alloy aluminum (HS 76011090), worth $3.308 billion, highlighting China's demand for Russian industrial raw materials amidst global supply constraints.

>>>>> Get Report of China-Russia Trade Data <<<<<

? Why Did Trade Dip in Early 2025?

The decline in early 2025 trade figures can be attributed to several key factors:

Global Economic Cooling: Sluggish recovery in Europe and delayed rebound in global manufacturing affected both demand and trade volumes.

Logistics Disruptions: New sanctions-related logistical bottlenecks and ongoing geopolitical tensions impacted transport routes and insurance costs.

Currency Volatility: Fluctuations in the ruble and yuan, along with tighter Russian currency regulations, created short-term hesitancy in settlements.

Seasonal Adjustments: Compared to the record-setting Q1 2024, the 2025 base was unusually high, amplifying year-on-year percentage declines.

Despite these challenges, the long-term strategic alignment between China and Russia remains intact. Trade is expected to rebound later in the year, especially with new infrastructure projects and energy deals on the horizon.

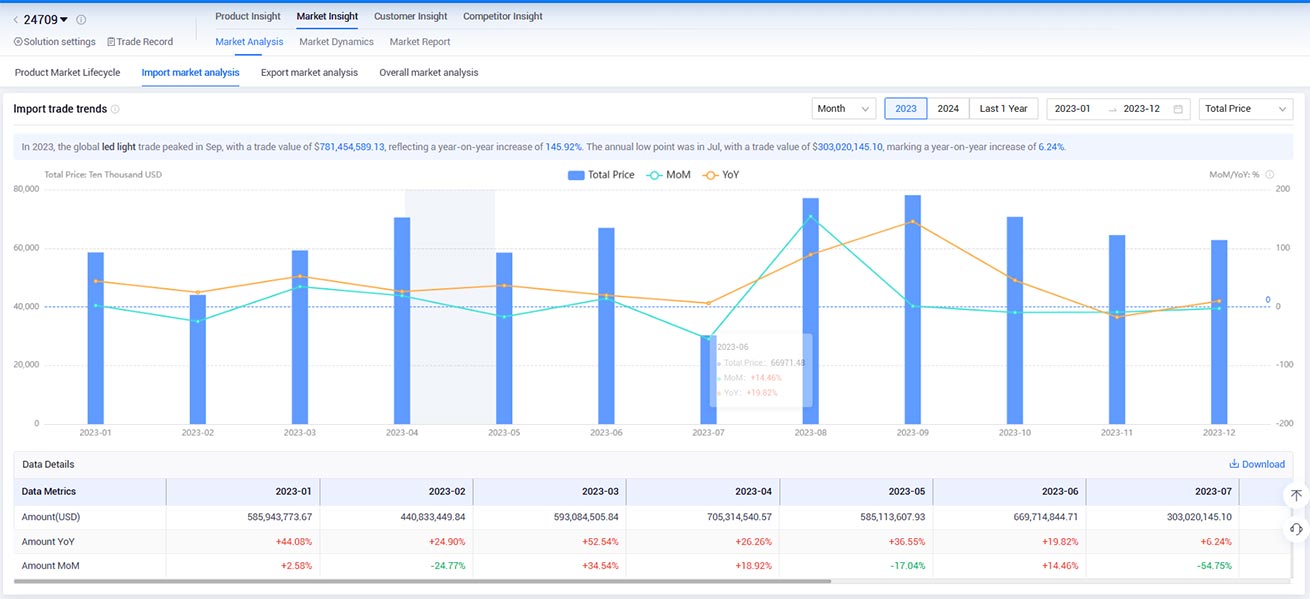

? How Tendata Empowers Market Intelligence

As international trade becomes more complex, platforms like Tendata offer indispensable tools for exporters, importers, and analysts alike. Tendata provides:

Real-time customs data on product-level trade flows.

HS code filtering to identify high-growth product categories.

Trade partner tracking to discover key buyers and sellers.

Market segmentation insights, helping businesses tailor their strategies.

Competitor intelligence, monitoring rival shipments and pricing trends.

For instance, automotive manufacturers using Tendata can track specific vehicle HS codes (like 87032343 or 87012100), monitor monthly growth patterns, and identify the largest Russian importers to approach with targeted offers.

>>>>> Register for Free Demo <<<<<

? Strategic Outlook: China-Russia Trade in a Multipolar World

As the global trade landscape becomes more regionalized and politically sensitive, China and Russia are expected to deepen economic integration — particularly in energy, technology, agriculture, and infrastructure.

Key trends to watch for in the remainder of 2025:

Digital Yuan & Ruble Transactions: Increasing use of local currencies in cross-border payments.

Joint Infrastructure Projects: Cross-border railways and logistics hubs along the Belt and Road.

Tech and Defense Cooperation: China may increase exports of dual-use technologies and components.

Energy Pipelines Expansion: Projects like Power of Siberia 2 could further enhance energy ties.

? Conclusion

Despite short-term fluctuations in 2025, the China-Russia trade relationship is stronger than ever. With bilateral trade maintaining momentum above $240 billion annually, both nations are building a more resilient, multipolar economic partnership. Exporters and importers looking to tap into this dynamic corridor can leverage platforms like Tendata to navigate complexity and uncover hidden opportunities.

For businesses seeking growth in an increasingly bifurcated world economy, the China-Russia trade data may offer one of the most promising avenues — provided they have the right data, insights, and partners.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship