Export News

Export News

13-09-2023

13-09-2023

The world of beauty, an arena of colors, innovations, and allure, has been a thriving hub of international trade and commerce. However, in the ever-evolving landscape of global economics, even the most robust industries can experience fluctuations. In this discourse, Tendata examines the top beauty exporting nations and delve into the regions that encountered the fastest declines in Beauty Exporter product export sales from 2021 to 2022.

>>>Click to Request A Free Demo - Quick Find Potential Customers<<<

Unveiling the Export Landscape

In 2022, the collective export value of beauty, cosmetics, and skincare products reached a staggering $68.5 billion. This marked an impressive growth of 15.6% from five years prior, as the industry showcased its ability to adapt to shifting trends and preferences. Despite this growth, a closer inspection reveals a year-on-year decline of -4.2% in export value compared to the previous year's $71.5 billion. This intriguing dichotomy reflects the complex interplay between trade, market dynamics, and economic fluctuations.

Examining Export Declines: The Factors at Play

· Japan: A Notable Downturn

Among the top beauty exporting nations, Japan faced a significant decline in Beauty Exporter sales, with a marked -20.6% decrease from 2021 to 2022. This decline prompts a deeper exploration into the factors influencing the Japanese beauty market. Evolving consumer preferences, heightened competition, and external economic pressures might contribute to this contraction.

· Hong Kong: Navigating Challenges

Hong Kong, known for its vibrant commerce, witnessed a notable decline of -15.8% in Beauty Exporter product export sales. This decline could be attributed to a range of factors, including changing consumer behaviors, geopolitical shifts, and altered global market dynamics.

· Taiwan: Navigating Uncharted Waters

Taiwan's Beauty Exporter sales experienced a decline of -13.5%, signifying potential challenges in the face of evolving global trade patterns. As the landscape shifts, maintaining competitiveness and exploring new market avenues could be essential for recovery.

· South Korea: Pondering the Shifts

South Korea, a powerhouse in the beauty industry, faced a decline of -12.7% in Beauty Exporter sales. Despite its reputation for innovative products and trends, South Korea's export landscape might be influenced by evolving consumer preferences and heightened competition.

· Sweden: Grappling with Change

Sweden, known for its distinct approach to beauty and design, encountered a -10% decline in Beauty Exporter sales. As global beauty preferences shift and consumer demands transform, Sweden may need to recalibrate its strategies to regain momentum.

Unveiling Resilience Amidst Challenges

· Innovative Agility: Nations that prioritize continuous innovation and remain attuned to emerging trends can potentially mitigate the impact of export declines.

· Diversification of Markets: Exploring new markets and diversifying export destinations can help countries navigate challenges in specific regions.

· Consumer-Centric Approaches: Understanding and adapting to changing consumer preferences and behaviors are crucial for sustaining export growth.

· Trade and Geopolitical Dynamics: Navigating geopolitical shifts and trade agreements can impact export performance, prompting countries to adopt flexible strategies.

· Adaptation to Global Trends: Rapid shifts in global beauty preferences require nations to proactively adjust their product offerings and marketing strategies.

Weathering the Storms, Nurturing Growth

The beauty industry, like any other, encounters waves of change that test its resilience. While certain regions faced export declines from 2021 to 2022, the ability to weather challenges and emerge stronger is a testament to the industry's adaptive capacity. As Beauty Exporters recalibrate strategies, harnessing the power of innovation, diversification, and consumer insights will be instrumental in nurturing growth and navigating the ever-evolving tides of international trade.

Customs data contains a vast amount of information, and extracting relevant customer contact information can be time-consuming. Is the outcome truly unsatisfactory, or is it due to using customs data in the wrong way, resulting in wasted effort and time?

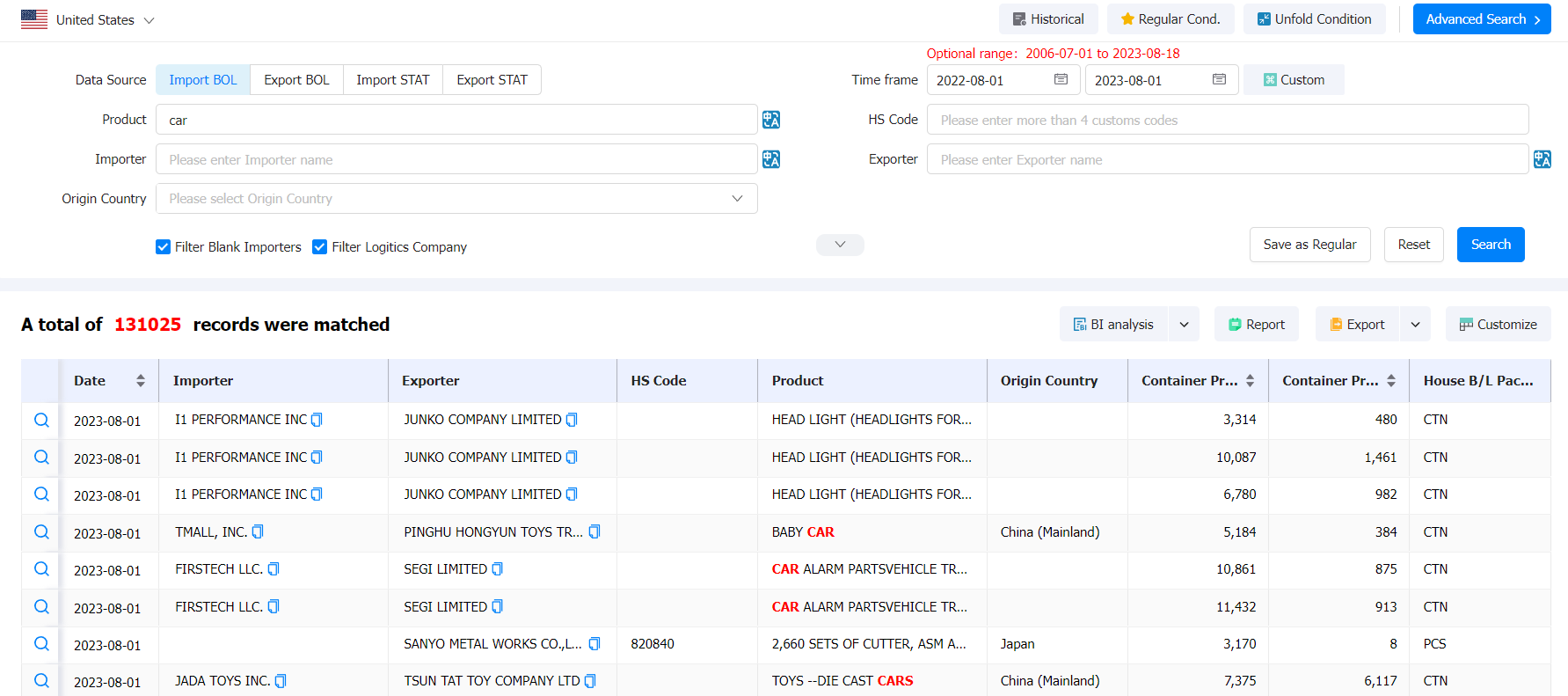

1. Establishing a Customer Resource Repository by Country

Creating a customer resource repository is akin to your own work record sheet. Begin by utilizing trade tracking functionality to compile a list of all customers from a particular country. Next, perform specific analyses based on factors such as each purchaser's procurement volume, purchase cycle, product specifications, and supplier systems (with emphasis on examining the diversity or singularity of their supply channels; preferably retaining customers with diversified suppliers, as those relying on a single supply channel may be harder to develop). Lastly, filter out the potential high-quality customers constituting 30% of this country's total, and record them in your customer resource repository, allowing flexible categorization by country, time, customer name, follow-up steps, contact numbers, emails, and contacts. (>>>Click to Start Developing Customers for Free<<<)

2. Creating a Customer Resource Repository by Peer Companies

Have a solid understanding of peer companies' English names (including full names, abbreviations, etc.). Utilize the global networking capability of suppliers to generate a list of all clients associated with peer companies within the system. Following this, perform essential analyses on these clients based on factors like procurement volume, procurement cycle, product models, and others. Ultimately, identify and record the key customers of your targeted peer companies in your customer resource repository.(>>>Click to Start Developing Customers for Free<<<)

3. Cataloging New Customers from Each Country

For newly emerging customers from specific countries, use the trade search function to select the country, set the date range and limit product names or customs codes. Check "Newest," and the search results will display high-quality customers that emerged most recently in that country within the designated timeframe. Since these customers are newly established, with recent procurement transactions, their supplier stability might be unsteady. Therefore, prioritize following up with these new potential buyers. Lastly, record all these new prospects in your customer resource repository.、(>>>Click to Start Developing Customers for Free<<<)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship