Export News

Export News

2023-09-15

2023-09-15

California, known for its diverse economy and strategic location, is a hub

for import and export businesses. If you're looking to start or expand your

import-export venture in the Golden State, obtaining the necessary licenses is a

crucial first step. In this guide, Tendata will explore the process of getting an

import-export license in California and the key considerations involved.

>>>Get A Free Demo For California Export Shipment<<<

1. Understanding Import-Export Licenses

Federal Requirements: Before delving into state regulations, it's essential to understand that most import-export activities are subject to federal regulations administered by U.S. Customs and Border Protection (CBP). These federal requirements apply regardless of the state you operate in.

2. Determine Your Business Structure

Sole Proprietorship, LLC, or Corporation: Your business structure impacts the type of import-export license you need. Sole proprietors, LLCs, and corporations have different requirements. Decide on the structure that suits your business goals.

3. Register Your Business

California Secretary of State: Register your business with the California Secretary of State's office. This step ensures your business is legally recognized in the state.

4. Apply for an EIN

Employer Identification Number (EIN): Obtain an EIN from the Internal Revenue Service (IRS). This unique identifier is necessary for tax purposes and is often required when applying for import-export licenses.

5. Determine Your Import-Export License Needs

Type of Goods: Determine the type of goods you plan to import or export. Depending on the nature of your products, you may need specific licenses or permits.

6. Importer of Record (IOR) or Exporter of Record (EOR)

IOR or EOR Responsibility: Decide whether you will act as an Importer of Record (IOR) or Exporter of Record (EOR). This role entails responsibilities such as customs clearance, compliance with regulations, and record-keeping.

7. Compliance with CBP Regulations

Customs and Border Protection: Ensure compliance with CBP regulations, including customs duties, tariffs, and import-export restrictions. This step involves thorough research and understanding of federal laws.

8. Apply for Relevant Licenses

Bureau of Industry and Security (BIS): Depending on the nature of your products, you may need licenses from agencies such as BIS. For instance, exporting controlled items requires compliance with Export Administration Regulations (EAR).

9. Documentation and Record-Keeping

Maintain Accurate Records: Develop a robust system for record-keeping, including invoices, shipping documents, and compliance records. Proper documentation is critical to demonstrate compliance with regulations.

10. Seek Legal Counsel

Consult an Attorney: Import-export regulations can be complex. It's advisable to consult an attorney or trade expert to ensure full compliance with federal and state laws.

Conclusion

Obtaining an import-export license in California is a multi-step process that involves federal and state-level considerations. By understanding the specific requirements of your business, complying with federal regulations, and seeking legal guidance when necessary, you can navigate the licensing process successfully. California's strategic location and diverse economy make it an attractive destination for import-export businesses, but adherence to regulatory requirements is key to long-term success in this industry.

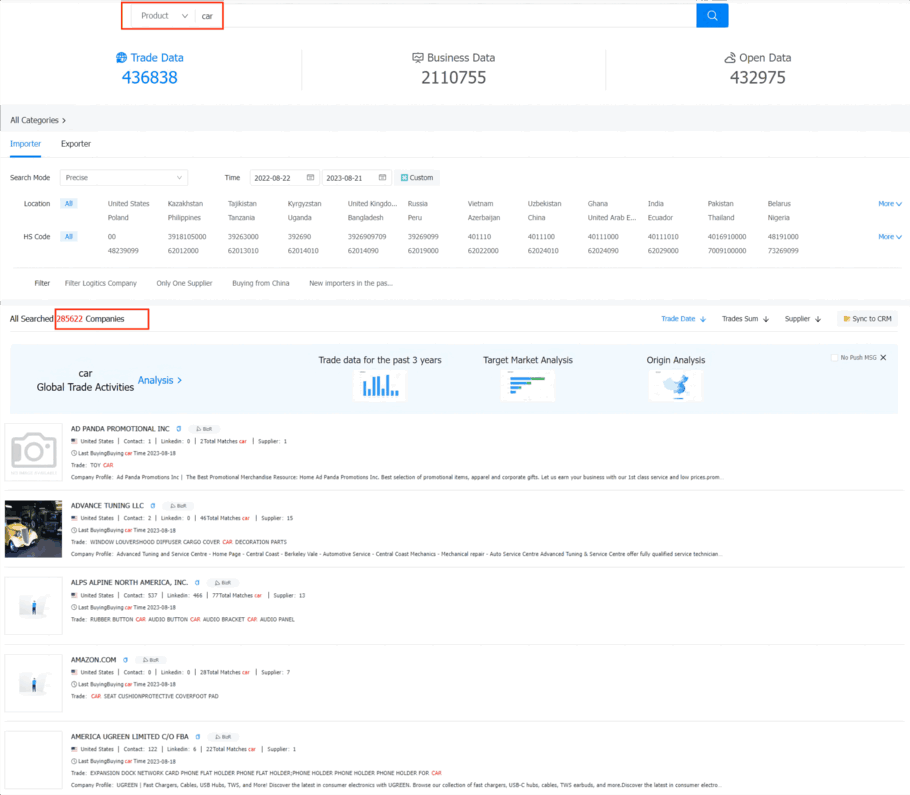

Customs data contains a vast amount of information, and extracting relevant customer contact information can be time-consuming. Is the outcome truly unsatisfactory, or is it due to using customs data in the wrong way, resulting in wasted effort and time?

Utilizing customs data for customer development involves accurately profiling all purchasers and their procurement systems in the target market. This approach swiftly identifies the highest compatibility customers, assesses their credit systems and procurement details, pinpoints premium customers and profit potential, enhances development efficiency, and elevates results. When developing new clients using customs data, consider the following three approaches for reference. (>>>Click to Get Free Access to Customs Data from 80+ Countries<<<)

All three strategies for utilizing customs data to develop customers can be tailored to your company's actual needs. Depending on market conditions, industry specifics, strategic requirements, etc., find the approach that suits you best, with the sole aim of classifying and organizing your premium customers. Once you've found suitable customers, the next step is to contact them precisely, employing various methods such as phone calls, emails, and online chats.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship