Export News

Export News

2025-03-26

2025-03-26

International exports of petroleum gas reached a total value of $488.6 billion in 2023.

Over the past five years, the global petroleum gas export market has expanded significantly, increasing by 87.1% since 2019, when total shipments were valued at $261.2 billion. However, compared to $807 billion in 2022, worldwide petroleum gas exports saw a sharp decline of 39.5% in 2023.

The top five petroleum gas exporters—the United States, Norway, Australia, Qatar, and Russia—accounted for more than 55.5% of total global petroleum gas exports by value.

Countries within the Organization of the Petroleum Exporting Countries (OPEC) supplied 23.3% of global petroleum gas exports in 2023, a slight increase from 20.2% in 2022.

From a regional perspective, European nations led the way in petroleum gas exports, shipping $151.6 billion worth of products—31% of the global total. Asia (including the Middle East) followed closely behind, holding a 29.9% market share.

Other major contributors included:

· North America: 16.6%

· Oceania (led by Australia and Papua New Guinea): 11.7%

· Africa: 9.5%

· Latin America (excluding Mexico but including the Caribbean): 1.2%

For classification purposes, the Harmonized Tariff System (HTS) code 2711 is used for petroleum gas and related gaseous hydrocarbons.

Top 15 Petroleum Gas Exporting Countries (2023)

1.United States – $67.6 billion (13.8%)

2.Norway – $61.8 billion (12.7%)

3.Australia – $50.8 billion (10.4%)

4.Qatar – $50.8 billion (10.4%)

5.Russia – $40 billion (8.2%)

6.Algeria – $27.57 billion (5.6%)

7.Belgium – $16.72 billion (3.4%)

8.Malaysia – $14.59 billion (3%)

9.Azerbaijan – $13.7 billion (2.8%)

10.United Arab Emirates – $13.7 billion (2.8%)

11.Canada – $13.5 billion (2.8%)

12.France – $11.4 billion (2.3%)

13.Oman – $11 billion (2.2%)

14.Turkmenistan – $10.2 billion (2.1%)

15.Indonesia – $8.8 billion (1.8%)

Collectively, these 15 countries were responsible for 84.3% of global petroleum gas exports in 2023.

Market Growth & Declines

Among the top exporters, Oman was the only country to experience export growth, posting a 35.3% increase since 2022.

The biggest declines in petroleum gas exports came from:

· Belgium (-67%)

· United Arab Emirates (-59.1%)

· Norway (-57.1%)

· Russia (-50.5%)

· Canada (-44.5%)

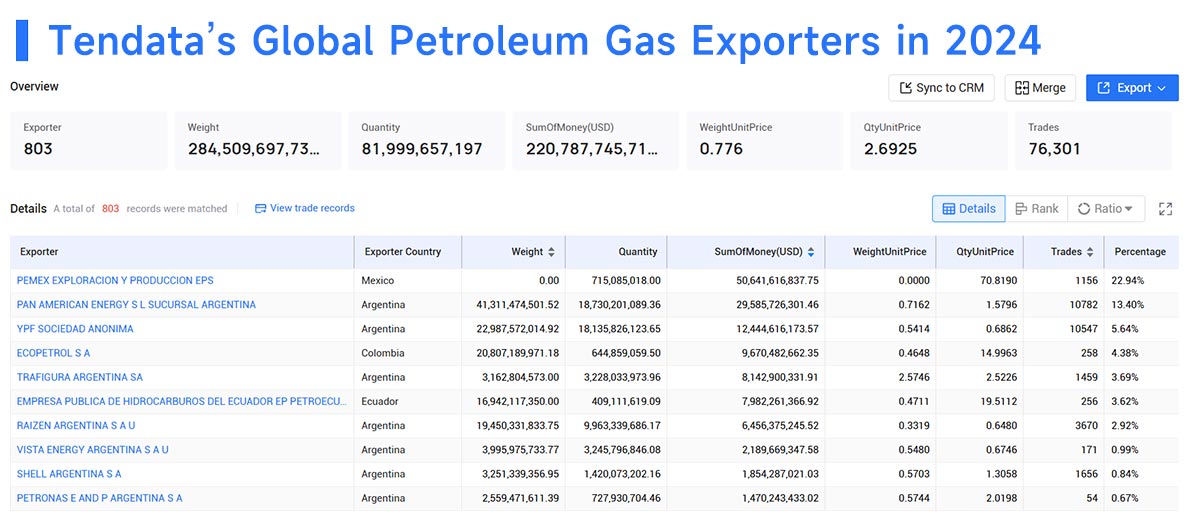

Major Petroleum Gas Exporting Companies (2024)

Several key companies dominate the global petroleum gas export industry. The top 10 firms based on export value include:

1.PEMEX Exploración y Producción EPS – $50.64 billion (22.94%)

2.Pan American Energy S.L. Sucursal Argentina – $29.59 billion (13.4%)

3.YPF Sociedad Anónima – $12.44 billion (5.64%)

4.Ecopetrol S.A. – $9.67 billion (4.38%)

5.Trafigura Argentina S.A. – $8.14 billion (3.69%)

6.Empresa Pública de Hidrocarburos del Ecuador EP Petroecuador – $7.98 billion (3.62%)

7.Raízen Argentina S.A.U. – $6.45 billion (2.92%)

8.Vista Energy Argentina S.A.U. – $2.19 billion (0.99%)

9.Shell Argentina S.A. – $1.85 billion (0.84%)

10.Petronas E&P Argentina S.A. – $1.47 billion (0.67%)

Conclusion

The petroleum gas export industry experienced a significant downturn in 2023, with most major exporters facing substantial declines. However, Oman emerged as a notable exception, demonstrating growth in a challenging market.

Looking ahead, fluctuations in global demand, geopolitical factors, and energy transitions will continue to shape the petroleum gas trade. The industry’s leading exporters and companies will need to adapt to market shifts and evolving energy trends to maintain a competitive edge.

Trade Data: Tendata has accumulated 10 billion+ trade transaction details

from 228+ countries and regions, supporting one-click query of major import and

export countries, customer distribution, product volume and price, etc., which

helps import and export enterprises to accurately understand the global market

and the trade environment of the target market.

Business Data: Tendata has a total of 500 million+ in-depth enterprise data, involving 198 countries and 230+ industry segments, covering the current operation status, financial information, product information, business relationships, intellectual property rights, etc. The data is fine, which makes it easy to assess the real strength of the target customers in depth, and expand the potential customer base.

Internet Data: Tendata's total of 850 million+ contact data, integrating social media, Collingwood, emails and other multi-channel contacts, helps to reach key contacts of enterprises with one click and improve the efficiency of customer development, as well as news and public opinion monitoring, which helps to grasp the Internet information in a timely manner.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship