Export News

Export News

2025-07-10

2025-07-10

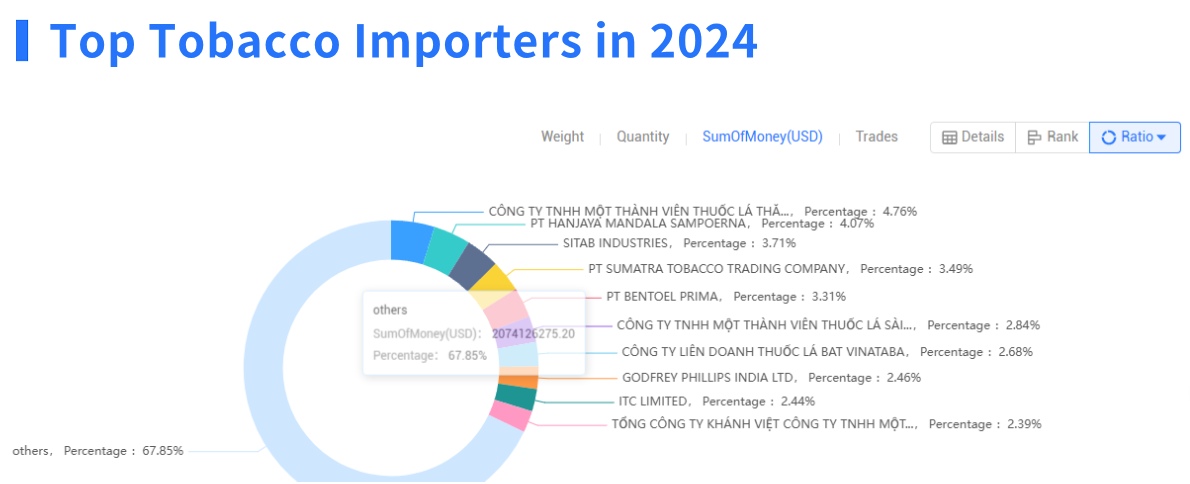

The global tobacco export market experienced a major shift in 2024, with total export value falling sharply from $54.99 billion in 2023 to around $6.8 billion. Tendata updates the latest list of tobacco exporters for global tobacco suppliers.

Export value shrank significantly: From approximately $55 billion in 2023 to just $6.7–6.8 billion in 2024 — a reflection of reduced global shipments.

Export volume also declined: Plummeting about 9% year-over-year, to roughly 572–573 thousand tonnes .

Segment breakdown (2024): Smoked tobacco (excluding water‑pipe) led with $4.1 billion (61%), followed by non‑smoking chew/snuff at $1.8 billion (26%) .

🚜 Production Trends: A Subtle Downturn

Global output is cooling off, with forecasts revised to a dip from ~6.4 million tonnes in 2023 to around 6.3 million by 2028—approximately a 0.4% annual decline.

Long-term trajectory shows a historical production rise averaging 0.6% per year since 1966.

Unmanufactured leaf exports dropped around 5% in 2024 to about 2.3 million tonnes, yielding $12.6 billion in value .

>>>>>Know More About Top Tobacco Exporters

🌱 Who Grows the Most?

Top leaf producers (2024):

Brazil (389 kt), Zimbabwe (275 kt), India (266 kt), China (187 kt), Belgium (156 kt), and the US (138 kt) — together covering ~62% of exports .

✈️ Top Tobacco Exporters in 2024)

Germany, $0.95 bn, ~14%

Netherlands, $0.80 bn, ~12%

Poland, $0.63 bn, ~9%

4–10. Belgium, India, Serbia, France, Philippines, Brazil (~23%)

Brazil: Exported 455 kt of leaf worth ~$2.98 bn — up ~9% in value though down ~11% in volume .

India: Posted record unprocessed leaf exports worth ₹12,005 crore (~$1.45 bn) with export volume jumping from 219 M kg (2019–20) to 315.5 M kg (2023–24) .

🚬 Products in Global Trade

Unmanufactured leaf: $12.6 billion, 2.3 million tonnes .

Manufactured products (cigarettes, cigars, snuff): Around $6.7–6.8 billion and 572–573 kt in 2024.

>>>>>Find Top Tobacco Exporters

🧭 Insights & Takeaways

Market contraction in 2024: Both tobacco export volumes and values pulled back sharply from the 2021 peak (~$10.4–10.5 bn).

Leaf vs. finished goods: Unprocessed tobacco still commands nearly double the export value of manufactured tobacco.

Leaf giants dominate: Brazil, Zimbabwe, India, and China export the majority of raw tobacco.

Case study nations:

Brazil leveraged processing expertise to edge its export value near $3 bn despite volume decline.

India boosted leaf exports via policy support, greatly enhancing farmer incomes.

Future projections: Expect a gentle further decline in global production (~0.4% annually), with export volumes bouncing around the 2.3 Mt mark and shifting demand globally.

✒️ Final Note

The tobacco export landscape is clearly evolving. Raw-leaf tobacco still leads in trade value, but overall export volumes and revenues are pulling back from their previous highs. Watching regional powerhouses like Brazil and India adapt—with value-added processing and pro-export initiatives—will be key to understanding who stays ahead in this shifting market.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship