Export News

Export News

2025-07-10

2025-07-10

The global pharmaceutical trade continues to thrive in 2024, with some countries taking the lead in exporting life-saving medications to meet worldwide healthcare needs. Germany, Switzerland, and the United States are at the forefront, dominating the market with billions in exports. Tendata breaks down the top pharmaceutical exporters, emerging trends, and key insights shaping the market in 2024. Stay tuned for the latest data on pharmaceutical exports, global trade, and the biggest players in the industry.

The Top Exporting Nations: Leaders in Pharmaceutical Trade

Germany - $119.85 billion (14.4% of global exports)

Despite a slight 4% drop from 2023, Germany remains the world's largest pharmaceutical exporter. In the first quarter of 2024, it continues to lead with $32.32 billion in exports, largely driven by high-quality medicaments. Top German pharmaceutical companies, such as Bayer and Merck Group, maintain a strong presence in markets like the United States, where Germany exported $27.4 billion in pharmaceuticals in 2023.

Switzerland - $99.08 billion (11.9% of global exports)

With a steady growth of 1% year-over-year, Switzerland ranks second. The country's pharmaceutical exports are mainly centered around therapeutic blood products, with the U.S. being its largest market. In Q1 2024, Swiss exports reached $27.14 billion, underscoring the dominance of companies like Novartis and Roche.

United States - $90.30 billion (10.8% of global exports)

The U.S. continues to be a key player in global pharmaceutical trade, with an 8% growth in exports during 2023. The largest market for U.S. pharmaceuticals is China, where it exported $9.89 billion in 2023. However, the U.S. is also known for its export of blood products and advanced medical treatments, with companies like Johnson & Johnson and Pfizer leading the charge.

Belgium - $82.52 billion (9.9% of global exports)

Despite a decline of 20% in pharmaceutical exports in 2023, Belgium remains one of the top exporters. The U.S. continues to be its largest market, receiving over $16 billion in pharmaceutical exports in 2023. Belgium’s top pharmaceutical products include blood-related medicines and advanced therapeutics.

Ireland - $71.56 billion (8.6% of global exports)

Ireland, like its European counterparts, faces a decline in exports, but its pharmaceutical sector is still robust. The U.S. accounted for over 28% of Ireland's pharmaceutical exports, with $20.19 billion in shipments in 2023. Irish exports are primarily focused on therapeutic blood products and high-value medicaments.

Other Major Pharmaceutical Exporters in 2024

Italy: $50.32 billion (6% of global exports), primarily exporting medicaments to the U.S.

France: $38.01 billion (4.6% of global exports), with a focus on mixed or unmixed medications.

Netherlands: $34.19 billion (4.1% of global exports), showing a 20% increase from the previous year.

United Kingdom: $27.49 billion (3.3% of global exports), with strong exports to the U.S.

Spain: $21.86 billion (2.6% of global exports), primarily exporting to Belgium.

Pharmaceutical Exports by Region

In 2023, Europe dominated global pharmaceutical exports, contributing nearly 79.9% of the total value, or approximately $358.2 billion. This region has long been the center of pharmaceutical manufacturing, with major hubs in Germany, Switzerland, and Belgium.

Asia, with its growing pharmaceutical sector, accounts for 9.9% of global exports, while North America contributed 8.9%. Smaller regions, including Oceania (0.31%), Africa (0.26%), and Latin America (0.7%), continue to play a minimal but emerging role in the global pharmaceutical market.

>>>>Report of Pharmaceutical Exports<<<

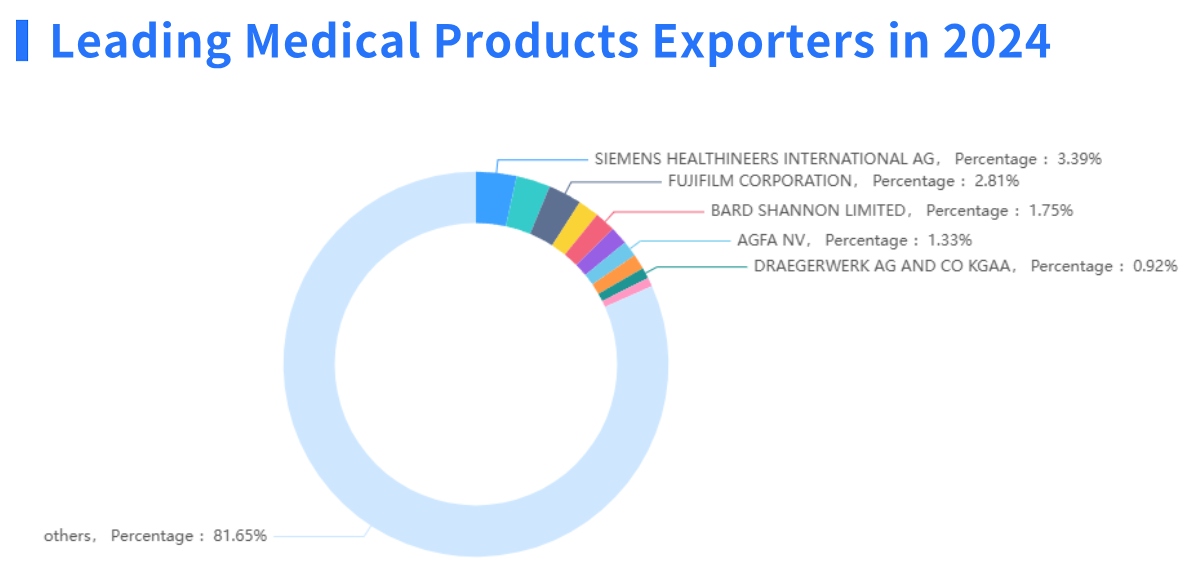

Pharmaceutical Giants: Leading Companies in 2024

The global pharmaceutical industry is not just driven by countries; major companies shape the direction of trade. The top 10 pharmaceutical companies alone represent a combined market value of over $4.7 trillion.

Eli Lilly (USA) – $578.3 billion

Specializing in diabetes and oncology medications, Eli Lilly remains the world’s most valuable pharmaceutical company.

Novo Nordisk (Denmark) – $452.8 billion

Known for its leadership in diabetes care, Novo Nordisk continues to expand its global footprint.

Johnson & Johnson (USA) – $377.7 billion

A diverse portfolio including medical devices, pharmaceuticals, and consumer health products.

Merck Group (Germany) – $263.9 billion

Focused on oncology, vaccines, and animal health.

AbbVie (USA) – $261.2 billion

A leader in immunology and oncology treatments.

Roche (Switzerland) – $222.4 billion

A major player in cancer treatment, diagnostics, and personalized medicine.

AstraZeneca (United Kingdom) – $212.2 billion

Known for its COVID-19 vaccine, AstraZeneca continues to lead in respiratory and oncology treatments.

Novartis (Switzerland) – $201.1 billion

Specializes in innovative treatments for diseases such as cancer and cardiovascular conditions.

Pfizer (USA) – $181.3 billion

Gained significant prominence for its COVID-19 vaccine and its leadership in oncology.

Amgen (USA) – $152.0 billion

Known for its expertise in biologics and oncology.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship