Import News

Import News

2023-09-15

2023-09-15

Importing goods to Ireland can be a lucrative venture, but understanding the

tariff system is crucial to avoid unexpected costs and ensure a smooth process.

In this article, we will delve into the key aspects of calculating tariffs when

importing to Ireland. Whether you're a seasoned importer or just starting,

knowing how to navigate Ireland's tariff system is essential.

>>>Click to Check More Import And Export Information from Tendata<<<

Understanding Tariffs

· What Are Tariffs? Tariffs are taxes imposed on goods that are imported into a country. They are designed to protect domestic industries, generate revenue, and regulate trade. Tariffs can vary significantly from one country to another.

· Ireland's Tariff Structure: Ireland, as a member of the European Union (EU), follows the EU's Common Customs Tariff (CCT). This means that when importing to Ireland, you are subject to the EU's tariff rates, which are applied consistently across all EU member states.

Determining Tariff Rates

· Harmonized System (HS) Codes: To calculate tariffs accurately, you need to assign the correct HS code to your imported goods. The HS code is an internationally recognized classification system that categorizes products into specific groups. Each HS code corresponds to a particular tariff rate.

· Tariff Databases: Various online databases, including the European Commission's TARIC database, provide access to the EU's tariff rates. These databases allow you to search for your product's HS code and find the corresponding tariff rate when importing to Ireland.

Calculating Tariff Costs

· Ad Valorem vs. Specific Tariffs: Tariffs can be either ad valorem (a percentage of the product's value) or specific (a fixed amount per unit). Understanding which type applies to your product is essential for accurate calculations.

· Duty Calculation: To calculate the tariff cost, multiply the product's customs value (including shipping and insurance costs) by the applicable tariff rate. The result is the amount of duty you must pay when importing to Ireland.

Tariff Exemptions and Preferences

· Free Trade Agreements: Ireland's participation in various free trade agreements, such as the EU's agreements with other countries, can lead to reduced or zero tariffs for specific products. Be sure to research whether your goods qualify for preferential treatment.

· Tariff Quotas: Some products may have tariff quotas, allowing a certain quantity to enter Ireland at a reduced or zero tariff rate. Once the quota is filled, higher tariffs apply. Understanding these quotas is crucial for importing to Ireland.

Tariff Management Tools

· Customs Brokers: Hiring a customs broker can streamline the tariff calculation and payment process. These professionals are well-versed in customs regulations and can help ensure compliance when importing to Ireland.

· Software Solutions: There are software tools and platforms available that can assist in tariff calculations and compliance management. These tools can be especially helpful for businesses with frequent imports.

Conclusion

Calculating tariffs for importing to Ireland is a complex but essential part of international trade. It involves understanding the HS code system, correctly determining the tariff rates, and considering any exemptions or preferences that may apply. Whether you're a small business or a multinational corporation, mastering tariff calculations will help you navigate the customs process effectively and avoid costly surprises when importing to Ireland.

>>>Click to Inquire for More Information about Tendata<<<

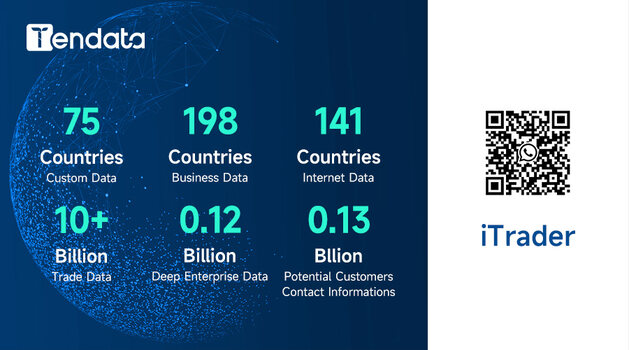

Shanghai Tendata Information Technology Co., Ltd. is headquartered in the Lujiazui Financial District and has been deeply involved in the import and export big data services industry for 17 years. Tendata Shanghai is a comprehensive information service provider that is rooted in the field of international trade, utilizing big data and artificial intelligence as its foundation. We specialize in data collection, mining, application, and services in the international trade sector. Additionally, we offer extended services such as industry consultation and trade facilitation.

Since its establishment in 2005, Shanghai Tendata has grown to have a workforce of over 500 dedicated professionals. We have provided effective market expansion and marketing solutions, as well as customer management services, to more than 40,000 domestic and international import-export enterprises. Rest assured when using Tendata data as we have an experienced product development team and a dedicated after-sales support department. (>>>Click to Inquire about Tendata Products<<<)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship