Import News

Import News

2023-10-12

2023-10-12

Importing goods from Spain to the USA can be a rewarding business endeavor. However, to navigate this journey successfully, it's crucial to comprehend the intricate world of import taxation. Import tax, also known as customs duty or tariff, is a tax levied by the U.S. government on foreign goods brought into the country. This tax is a vital source of revenue for the federal government and serves various purposes, including protecting domestic industries and regulating international trade.

>>>Learn More about Spain Imports<<<

How Is Import Tax Calculated?

The process of calculating import tax from Spain to the USA can seem daunting, but with the right information and guidance, it becomes more manageable. Import tax is calculated based on several factors:

· HS Code Classification: Every product imported into the USA is assigned a Harmonized System (HS) code, which is a standardized code that classifies products. The first step in calculating import tax is determining the correct HS code for your product. The HS code will determine the applicable tax rates and regulations.

· Customs Valuation: The value of the imported goods, known as the customs value, is crucial for calculating import tax. This value typically includes the cost of the product, shipping and insurance costs, and any other associated charges. The customs value is essential because import tax is often calculated as a percentage of this value.

· Tax Rates: Once you've identified the HS code and determined the customs value, you can consult the U.S. International Trade Commission (USITC) to find the applicable tax rate for your product. The tax rates can vary widely depending on the product's classification and country of origin.

· Additional Fees: In some cases, you may be subject to additional fees or taxes, such as the Merchandise Processing Fee (MPF) or the Harbor Maintenance Fee (HMF). These fees are typically calculated based on the customs value of the goods.

>>>Click to Check More Import And Export News from Tendata<<<

Tips for Calculating Import Tax

Consult a Customs Broker: The world of customs and import taxation is intricate. It's advisable to work with a licensed customs broker who can provide expert guidance on classifying your products, calculating taxes, and ensuring compliance with all regulations.

· Use Online Resources: Several online tools and resources are available to help importers calculate import tax. These tools often provide access to tariff schedules, tax rates, and duty calculators. Utilizing such resources can simplify the process.

· Double-Check for Free Trade Agreements: The USA has free trade agreements with several countries, and Spain is part of the European Union, which enjoys certain trade benefits. Be sure to check if your product qualifies for any reduced or zero import tax rates under these agreements.

· Stay Informed About Regulatory Changes: Import regulations, tax rates, and fees can change, so it's essential to stay updated with the latest information from U.S. Customs and Border Protection (CBP) and other relevant authorities.

The Future of Import Tax from Spain to the USA

As trade relations evolve and international policies change, import tax rates and regulations can also fluctuate. It's essential for businesses involved in importing goods from Spain to the USA to remain flexible and adaptive to these shifts. Staying informed about changes in trade agreements and tax policies will be crucial in planning import strategies and optimizing costs.

In conclusion, calculating import tax from Spain to the USA is a pivotal aspect of international trade. By understanding the process and seeking expert advice when needed, businesses can navigate the complexities of import taxation and make informed decisions to ensure their importing ventures are both profitable and compliant with U.S. laws and regulations.

>>>Click to Get Free Access to Customs Data from 80+ Countries<<<

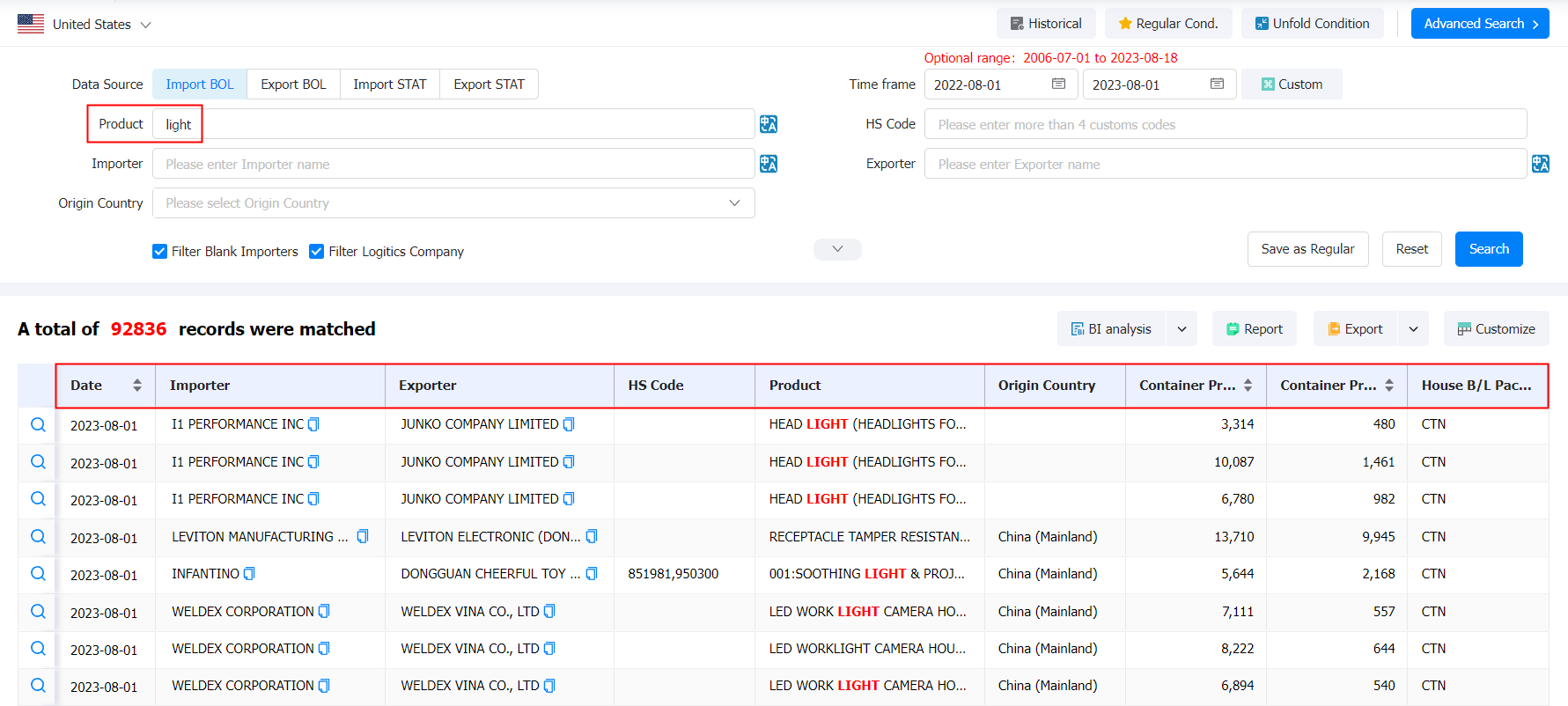

Obtain Customs Data from 80+ Countries to Find Suitable Buyers

Tendata Customs Database provides real-time access to customs data from over 80 countries, 42 countries along the Europe-Asia route, 10+ billion real-time trade data, and a database of 130 million importers and exporters. This assists you in understanding global market trade trends and distribution, allowing you to quickly, accurately, and scientifically target hot-selling countries and emerging markets for your products. >>>Inquire Online

Tendata Customs Data Platform offers nearly 20 types of market analysis reports (>>>Click to Use Data Analytics for Free Online) that can be customized and analyzed in a multi-dimensional, visual manner. This enables you to effortlessly identify your peers' primary export markets and buyers. Through analyzing transaction quantities, prices, and supply chains of target buyers, as well as examining bill of lading details of successful buyers and competitor information, various data analysis reports are intelligently generated to highlight your competitive advantages, aiding you in capturing a larger market share.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship