Market Insights

Market Insights

2025-07-25

2025-07-25

One of the most notable trends in the last year has been the accelerated growth in U.S.-Vietnam trade. According to Tendata, Vietnam's exports to the United States have surged by more than 20% year-over-year in 2024, with a significant portion of this growth coming from electronics and consumer goods.

Vietnam's Electronics Export Boom

In 2023, Vietnam emerged as one of the fastest-growing suppliers of electronics to the U.S. market. As per Tendata, Vietnam's export of electronic components, including semiconductors, mobile phones, and computing equipment, hit a record high of $4.5 billion in Q3 2023 alone—a staggering 27% increase compared to the previous year.

U.S. imports of Vietnamese electronics totaled $12 billion in 2023, accounting for nearly 15% of the country's total electronics imports.

Semiconductor imports from Vietnam to the U.S. alone grew by 31% between January and June 2024, driven by strong demand from the tech and automotive sectors.

>>>> Get Trade Data for Free <<<<

Key Players in U.S.-Vietnam Trade

Several large U.S. importers have expanded their partnerships with Vietnamese manufacturers. Tendata highlights companies such as Apple, Intel, and Samsung that have significantly increased their purchasing volumes from Vietnam-based suppliers.

Apple saw a 35% increase in its supplier base from Vietnam in the first quarter of 2024, with the company securing more contracts for the assembly of its upcoming line of iPhones and AirPods in Vietnamese factories.

Intel, which operates several manufacturing facilities in Vietnam, has ramped up its semiconductor shipments by nearly 40% to meet increasing global demand.

In the consumer electronics segment, Vietnam’s export volume to the U.S. includes a wide array of goods, from smartphones to computers and accessories. These goods are primarily being sourced from large-scale factories in areas like Ho Chi Minh City and Hanoi, which have become increasingly equipped to handle the demands of global electronics brands.

>>>> Register Trade Data for Free <<<<

Vietnam's Competitive Advantage

Vietnam's rise as a major player in the U.S. electronics market is also a result of its growing manufacturing capabilities, which are supported by strong foreign direct investment (FDI) from global technology companies. Companies such as Foxconn, LG Electronics, and Samsung Electronics have made significant investments in Vietnamese manufacturing plants in recent years.

The government’s commitment to improving infrastructure and fostering a conducive business environment through tax incentives and free trade agreements (FTAs) has also played a key role. The Vietnam-EU Free Trade Agreement (EVFTA), which came into effect in 2020, has paved the way for more Vietnamese-made goods to access European and North American markets with lower tariffs.

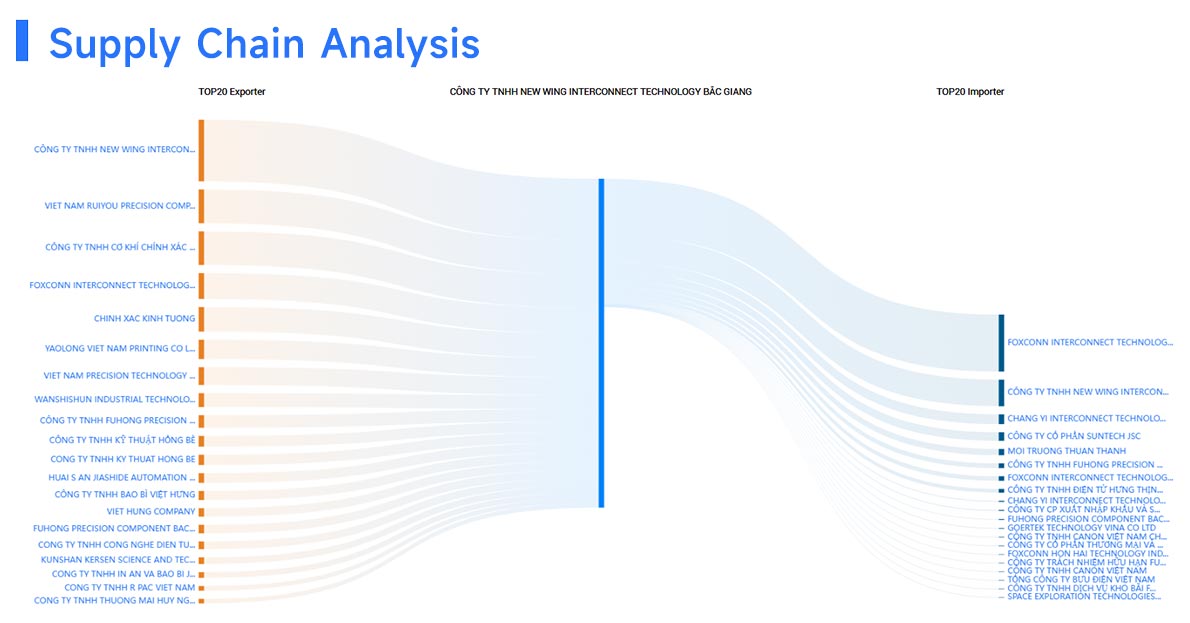

Analyzing the Data on Supply Chain

The latest data from Tendata reveals a deeper trend within the U.S.-Vietnam trade relationship: diversification of supply chains. In addition to electronics, Vietnam has seen notable growth in the exports of industrial machinery, textiles, and footwear.

The U.S. is now the top market for Vietnamese textile exports, which rose by 14% in Q1 alone.

Industrial machinery exports, driven by rising demand in sectors such as construction and logistics, surged 17% year-over-year.

This indicates that Vietnam is increasingly becoming a go-to hub not only for electronics but also for other key sectors, furthering its role as a strategic partner in global supply chains.

>>>> Get Trade Data for Free <<<<

What's Next for U.S.-Vietnam Trade?

Looking ahead, the U.S.-Vietnam trade relationship appears poised for continued growth. With the increasing trend of onshoring and reshoring activities from American companies, Vietnam will likely continue to play a crucial role in meeting the demand for consumer electronics and other industrial goods.

Furthermore, the Vietnamese government’s push for greater digital transformation in its manufacturing sector is expected to boost its ability to meet high-quality standards required by U.S. buyers. As more companies explore ways to mitigate supply chain risks, Vietnam’s position in the global supply chain is set to solidify, especially as its trade agreements with the EU and ASEAN deepen.

Conclusion

The surge in U.S.-Vietnam trade, particularly in electronics and industrial goods, is a clear indicator of the ongoing shift in global supply chains. As companies seek to reduce dependence on traditional suppliers like China, Vietnam’s rise as an alternative manufacturing powerhouse is accelerating. With favorable trade policies, robust infrastructure, and growing FDI, Vietnam’s export growth is poised to continue its upward trajectory in the coming years.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship