Market Insights

Market Insights

2025-08-12

2025-08-12

India is one of the fastest-growing consumers of steel products, with steel coils playing a central role in industries such as automotive, construction, shipbuilding, and manufacturing. In 2024, India imported an estimated 1.65 million tons of steel coils, valued at USD 1.4 billion, marking a 6.8% year-on-year growth. Tendata helps you find steel coils in India.

While India is also a major steel producer, certain high-grade and specialty steel coils—such as stainless, galvanized, and pre-painted coils—are sourced from global suppliers, primarily in Japan, South Korea, China, and Vietnam.

How to Connect with Steel Coil Buyers in India

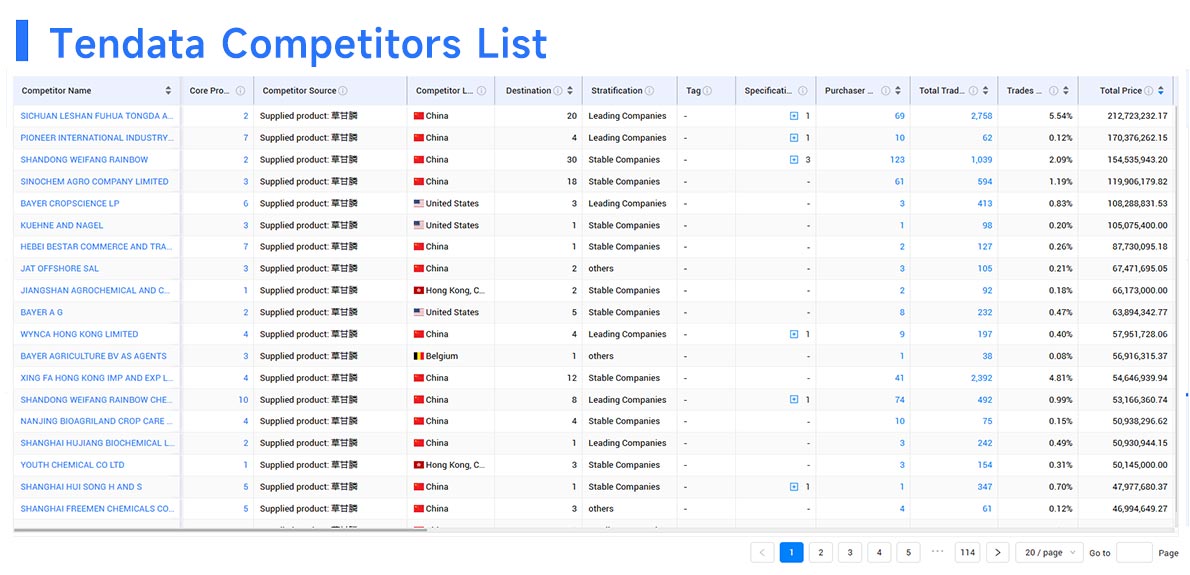

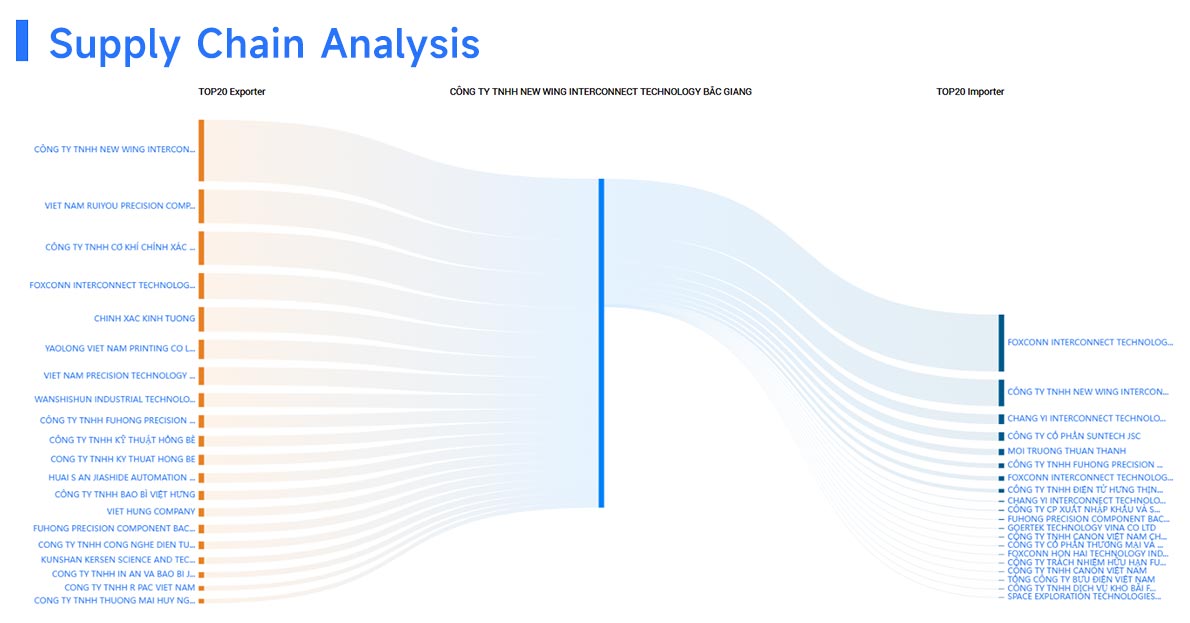

Trade Data Platforms – Use tools like Tendata, Panjiva, ImportGenius to track recent shipments and verify buyer credibility.

Industry Trade Fairs – Attend events such as India Steel Expo and Metal & Metallurgy Expo for in-person networking.

LinkedIn Outreach – Search for “Procurement Manager” or “Sourcing Head” at major Indian steel companies.

Partner with Local Distributors – Many buyers prefer importing through established distribution networks.

Top Steel Coil Buyers in India (Partial List)

Below is a verified list of active steel coil buyers in India, based on customs shipment records and industry directories:

Tata Steel Processing and Distribution Ltd. – Major buyer of galvanized and cold-rolled coils for domestic distribution.

JSW Steel Coated Products Ltd. – Purchases high-quality coated steel coils for automotive and roofing sectors.

Essar Steel India Ltd. – Imports hot-rolled and pre-painted steel coils for infrastructure projects.

Bhushan Steel Ltd. – Acquires specialty stainless steel coils for industrial applications.

Steel Authority of India Ltd. (SAIL) – Buys premium-grade coils for defense and railway projects.

POSCO India Pvt. Ltd. – Sources high-tensile steel coils from South Korea.

Larsen & Toubro Ltd. – Purchases custom-sized coils for engineering and construction projects.

Mahindra & Mahindra Ltd. – Imports automotive-grade steel coils for vehicle manufacturing.

>>>> Contact Steel Coil Buyers in India <<<<

Major Supplier Countries in 2024:

South Korea – 32% share, known for automotive-grade steel.

Japan – 27%, specializes in high-strength cold-rolled coils.

China – 22%, competitive on pricing for galvanized coils.

Vietnam & Taiwan – Niche suppliers for coated coils.

Pricing Trends: The average import price in 2024 was around USD 850–950/ton, slightly higher than 2023 due to rising global iron ore costs.

Demand Drivers:

Expansion of EV manufacturing plants in India.

Government infrastructure push through Gati Shakti master plan.

Surge in pre-engineered building projects.

Industry News & Developments

Auto Industry Steel Demand Surge – With India’s passenger vehicle sales hitting record highs in 2024, demand for automotive-grade steel coils has increased by 9%.

Tariff Policy Updates – India is considering anti-dumping duties on certain Chinese steel products to protect local manufacturers.

Green Steel Initiatives – Major buyers like Tata Steel are exploring low-carbon steel coil imports to meet ESG targets.

Port Expansion for Steel Imports – The JNPT and Kandla ports are expanding handling capacity for bulk steel shipments.

Opportunities for Exporters

If you are a steel coil supplier, India presents strong opportunities in specialty and high-grade steel segments. Buyers often look for:

Cold-rolled coils with tight dimensional tolerances.

Hot-dip galvanized coils for roofing and construction.

Pre-painted coils for aesthetic applications.

High-tensile automotive coils meeting OEM standards.

Pro Tip for Exporters: Use HS Code 721049 (Flat-rolled products of iron or non-alloy steel) and HS Code 722530 (Flat-rolled products of alloy steel) when searching Indian import data to identify active buyers.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship