Market Insights

Market Insights

2023-07-11

2023-07-11

India, the world's second-largest sugar producer and a major exporter in recent years, may see its role in the sugar export market shrink as its government-led ethanol program continues to expand, a report says.

India's quest to increase ethanol blending in gasoline as a way to cut import bills for petroleum products and reduce carbon emissions will continue to support sugar prices in the global economy, according to the Asia Biofuels Outlook report released by BMI, a research firm of Fitch Solutions.

BMI said that ethanol production capacity is currently growing rapidly in India, where the country's biofuel is made primarily from sugarcane.

As more and more ethanol plants begin production, more of the country's sugarcane crop will be used to make fuel, thus limiting sugar production.

According to the U.S. Department of Agriculture (USDA), India's ethanol blend has reached 11.5 percent, while the country's government aims to reach 20 percent by 2025.

While it is "doubtful" that India will be able to achieve this goal by 2025, the report said, the plan would limit exports of feedstock for ethanol production.

The chart below shows the evolution of India's sugar exports, as provided by Tendata. It can be seen that India's sugar exports have been on a downward trend in recent months:

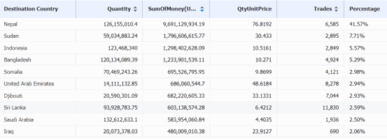

The major exporters of sugar from India are Nepal (41.57%), Sudan (7.71%), India (5.57%), Bangladesh (5.29%), Somalia (2.98%) and other countries. Sugar imports from these countries are likely to be affected to a greater extent. The following table lists the major sugar exporting countries of India:

For more details, please contact us!

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship