Market Insights

Market Insights

2023-08-07

2023-08-07

· Adoption of electric vehicles in Vietnam is expected to increase from 2.9% a year ago to 13.6% in 2023, BMI Research said in a new report.

· Although electric vehicles represent only a small portion of Vietnam's passenger car market, the research firm expects strong growth in 2023.

· This growth will come from increased vehicle deliveries by local EV maker VinFast, which is set to ramp up production in 2023, as well as increased availability of affordable Chinese-made EVs.

Vietnam's EV market appears to be poised for rapid expansion over the next decade, but could encounter significant headwinds to this growth.

The country's passenger car EV sales are expected to at least double this year, according to BMI Research, the research arm of Fitch Solutions.

"We expect passenger electric vehicle sales to grow 114.8% year-over-year to around 18,000 units in 2023," BMI said in a report released Thursday.

Specifically, sales of pure electric vehicles (BEVs) are likely to grow 104.4 percent from the previous year to nearly 17,000 units, the report said. Plug-in hybrid electric vehicle (PHEV) sales could increase nine-fold year-over-year to nearly 1,100 units.

BMI said, "We currently expect passenger EV sales in Vietnam to grow at an average annual rate of 25.8% from 2023 to 2032, with annual sales increasing from 8,400 units in 2022 to approximately 65,000 units."

Penetration of passenger EVs, defined as passenger EV sales as a percentage of total passenger vehicle sales in the country, is expected to increase to 13.6% by 2030. This is a big jump from 2.9 percent last year.

The Vietnam Automobile Manufacturers Association forecasts that electric vehicle ownership will reach 1 million by 2028 and 3.5 million by 2040.

Last year, electric cars accounted for only a small portion of Vietnam's passenger car market. The Southeast Asian country sold about 284,000 passenger cars, "of which only a few thousand were electric," according to Tendata data.

>>>Click to Request A Free Demo - Quick Find Potential Customers<<<

What were Vietnam's automobile imports and exports last year?

According to Tendata data:

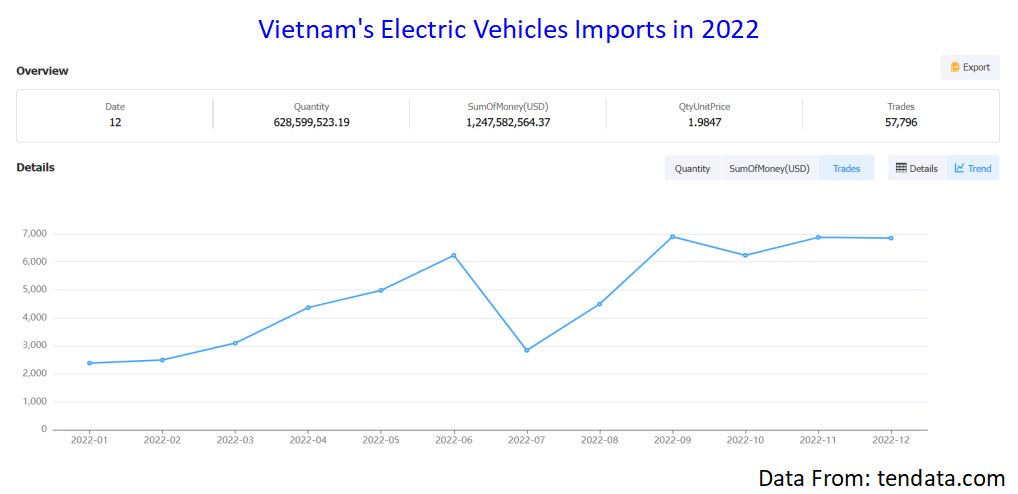

In 2022, Vietnam's full-line automobile imports reached 4.18 million units, with a trade value of $4.82 billion; of these, trade in electric vehicles reached 57,796 units, with an import value of $120 million.

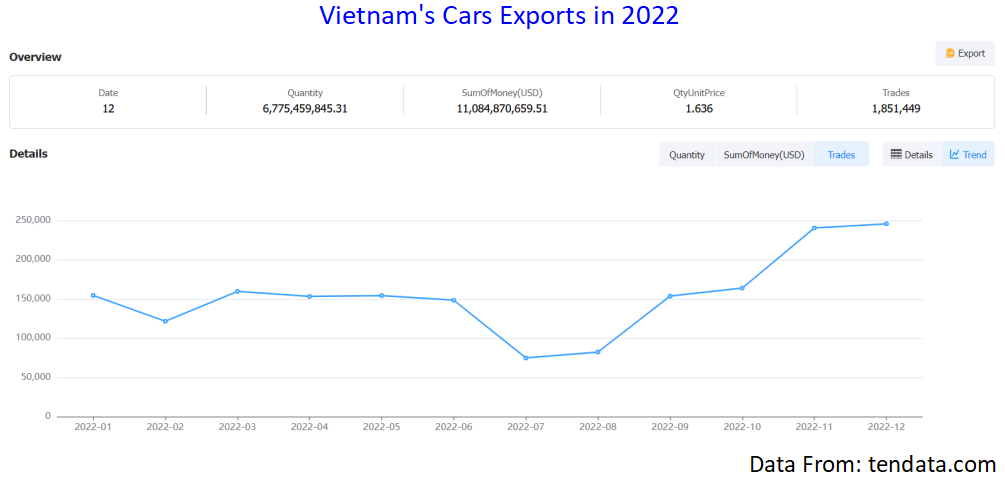

In 2022, Vietnam's full-line automobile export volume reached 1.85 million units and trade value reached $1.108 billion ; of which, trade volume of electric vehicles reached 35,293 units and export value reached $240 million.

Growth Drivers

However, increased deliveries of VinFast vehicles are expected to drive strong growth of electric vehicles as local electric vehicle manufacturers ramp up production in 2023.

BMI said, "Local production of electric vehicles under the VinFast, Wuling Hongguang, Skoda, and Hyundai brands is expected to drive strong market growth during our 2023 to 2032 forecast period."

BMI said the Vietnamese passenger EV market is currently dominated by VinFast, which will hold more than 50 percent of the market by 2022. The rest of the market is dominated by Chinese brands.

The increased availability of affordable Chinese-made EVs will also help fuel growth.

BMI said the launch of an affordable mini EV from Chinese brand Wuling Hongguang could help boost the passenger EV market. The Wuling Hongguang Mini EV is priced from VND239 million (US$10,065). By comparison, VinFast launched a cheap electric car priced at $23,000 in the Vietnamese market in April.

The research firm noted that the Association of Southeast Asian Nations, which consists of Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam, has seen an increase in EV production to fuel growth.

In January, the Vietnamese government said it would continue to exempt whole vehicles from the 10 member countries from import duties until the end of 2027.

>>>Click to Check More Import And Export Information from Tendata<<<

Amidst challenges

However, BMI expects EV adoption in Vietnam to decline due to low incomes and lack of incentives, the report said, without elaborating.

The battery leasing business model, which allows consumers to lease batteries with the purchase of a new EV, could help keep costs down. The measure will increasingly appeal to cab fleet operators, the report said.

In April, cab operator Green SM launched an all-electric cab service in Vietnam with the VinFast model.

The research firm said, "We expect that this initiative, and potentially similar developments by other local cab operators, will support the adoption of EVs in Vietnam, as it will raise awareness of EVs among citizens."

The current charging infrastructure may also limit the growth of the EV market in Vietnam.

Most charging stations currently charge electric two-wheelers, bicycles, and scooters.BMI expects more players to enter the market from 2023 onwards to drive the growth of EV charging networks.

Local EV charging operator EBOOST has pledged to expand its charging network in Vietnam and will deploy more charging stations.

Taiwanese electronics giant Foxconn has said it will invest US$250 million, partly to build an EV charging equipment and parts production plant in Vietnam, according to Taiwanese media reports.

BMI said, "This will help facilitate the rapid expansion of the EV charging network locally and in the wider Southeast Asian region."

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship