Market Insights

Market Insights

2023-10-23

2023-10-23

Graphite is a soft carbon that is a key component of electric vehicle batteries. Natural and synthetic forms of graphite are essential for building anodes, a component that allows current to flow through the battery. Global graphite demand is estimated at 770,000 tons this year and is expected to triple by 2033, according to Fastmarkets graphite analyst Georgi Georgiev.

According to the US Geological Survey (USGS), China is the world's largest producer of graphite, accounting for 64% of the world's natural graphite production and more than half of the world's manufactured graphite production. What's more, China refines more than 90 percent of its graphite into high-purity materials for electric vehicle batteries.

China announced on October 20 that it would impose export licensing requirements on some graphite products used in electric vehicle batteries. This comes on the heels of new U.S. restrictions on chip exports, which are tit-for-tat. With almost all of the world's iron black material processing capacity in China's hands, it will be difficult for global automakers to diversify.

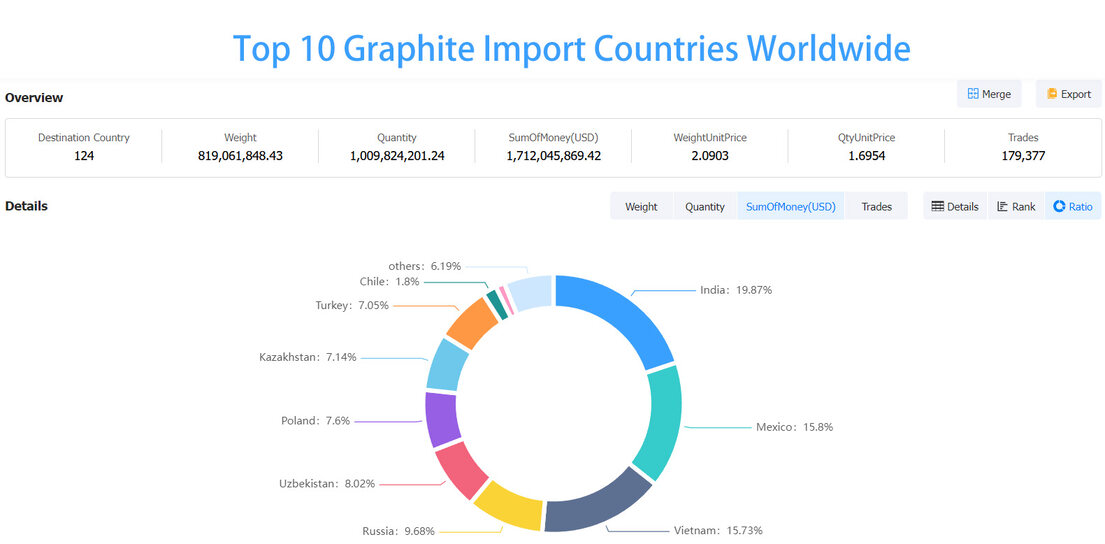

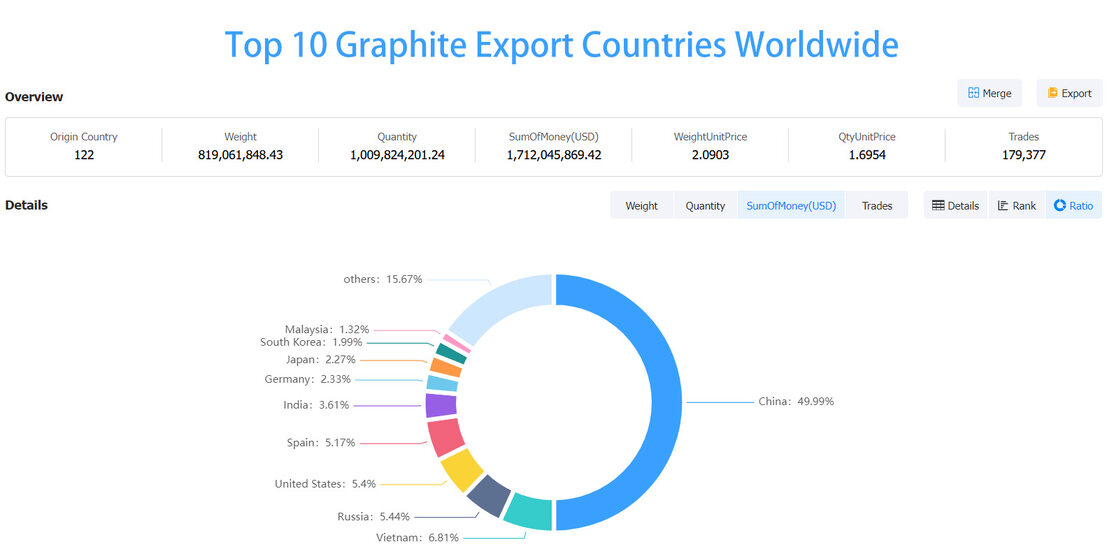

Global Graphite Trade

According to import data from Tendata iTrader, the top importers of graphite from October 2022 to October 2023 are India (19.87%), Mexico (15.80%), Vietnam (15.74%), Russia (9.68%), Uzbekistan (8.02%), Poland (7.60%), Kazakhstan (7.15%), Turkey (7.05%), Chile (1.80%), and Argentina (1.12%).

According to Tendata iTrader's export data, the top exporters of graphite from October 2022 to October 2023 are China (49.99%), Vietnam (6.81%), Russia (5.44%), United States (5.40%), Spain (5.17%), India (3.61%), Germany (2.33%), Japan (2.27%), South Korea (1.99%), and Malaysia (1.33%).

As can be seen from the table, besides China, the largest graphite exporter, Vietnam is the second largest graphite exporter and the third largest graphite importer. Russia is the third largest graphite exporter and the fourth largest graphite importer. India is the sixth largest graphite exporter and the first graphite importer. All of these countries have a high demand for graphite.

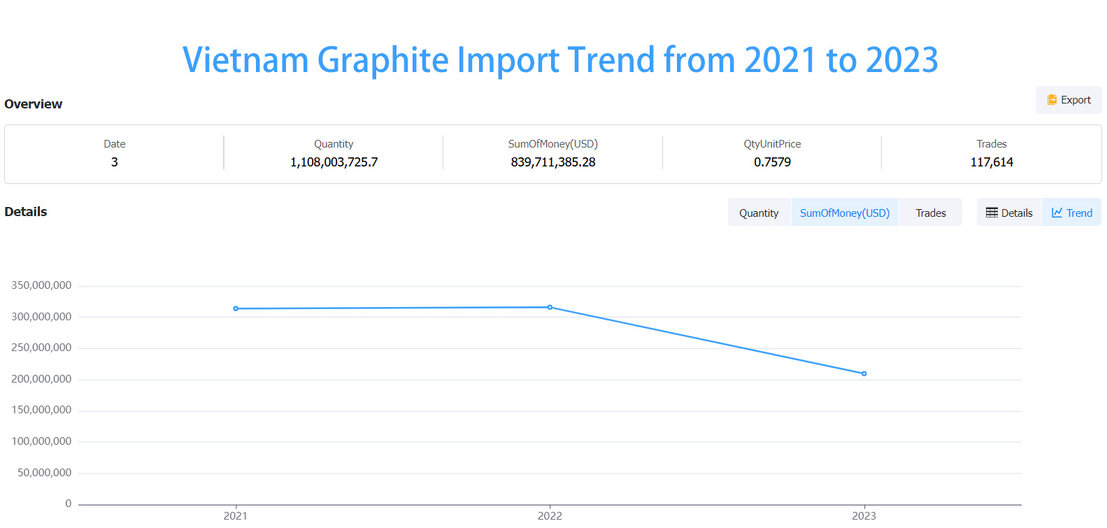

Vietnam's Graphite Imports And Exports - Alternatives After China's Ban On Graphite Exports

In 2021, Vietnam's graphite imports amounted to US$314 million and 492 million tons; in 2022, Vietnam's graphite imports amounted to US$315 million and 366 million tons, a 0.63% rise in imports compared to the previous year; and by September 2023, Vietnam's graphite imports in 2023 amounted to US$209 million and 249 million tons. Over the past five years, Vietnam's graphite imports have grown at an average annual rate of 2.7%, and imports are expected to continue to grow steadily in 2023.

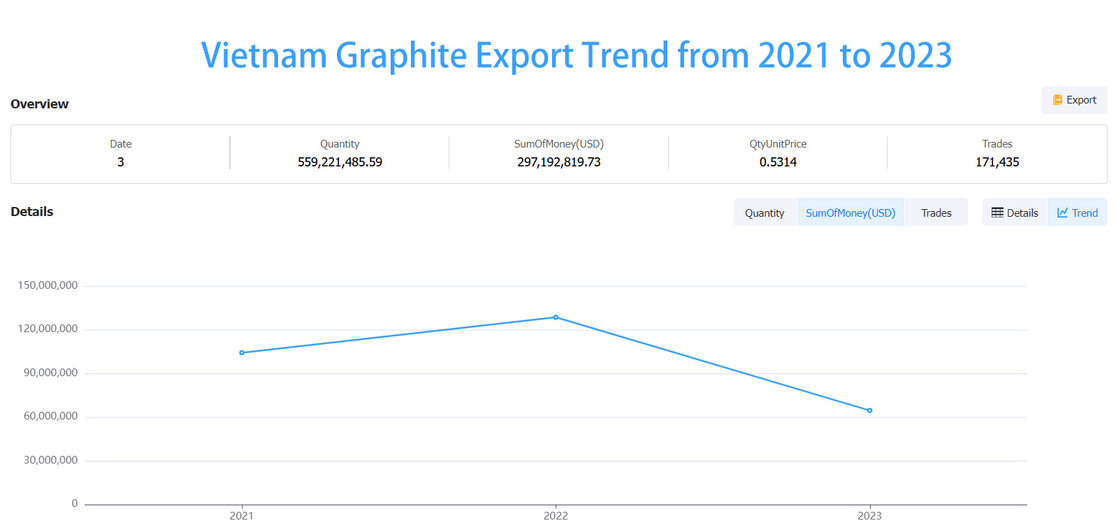

For exports, in 2021, Vietnam's graphite export value reached US$104 million and export volume of 294 million tons; in 2022, Vietnam's graphite export value reached US$128 million and export volume of 154 million tons; and by September 2023, Vietnam's graphite export value in 2023 reached US$64 million and export volume of 110 million tons.

Vietnam's Import And Export Partners

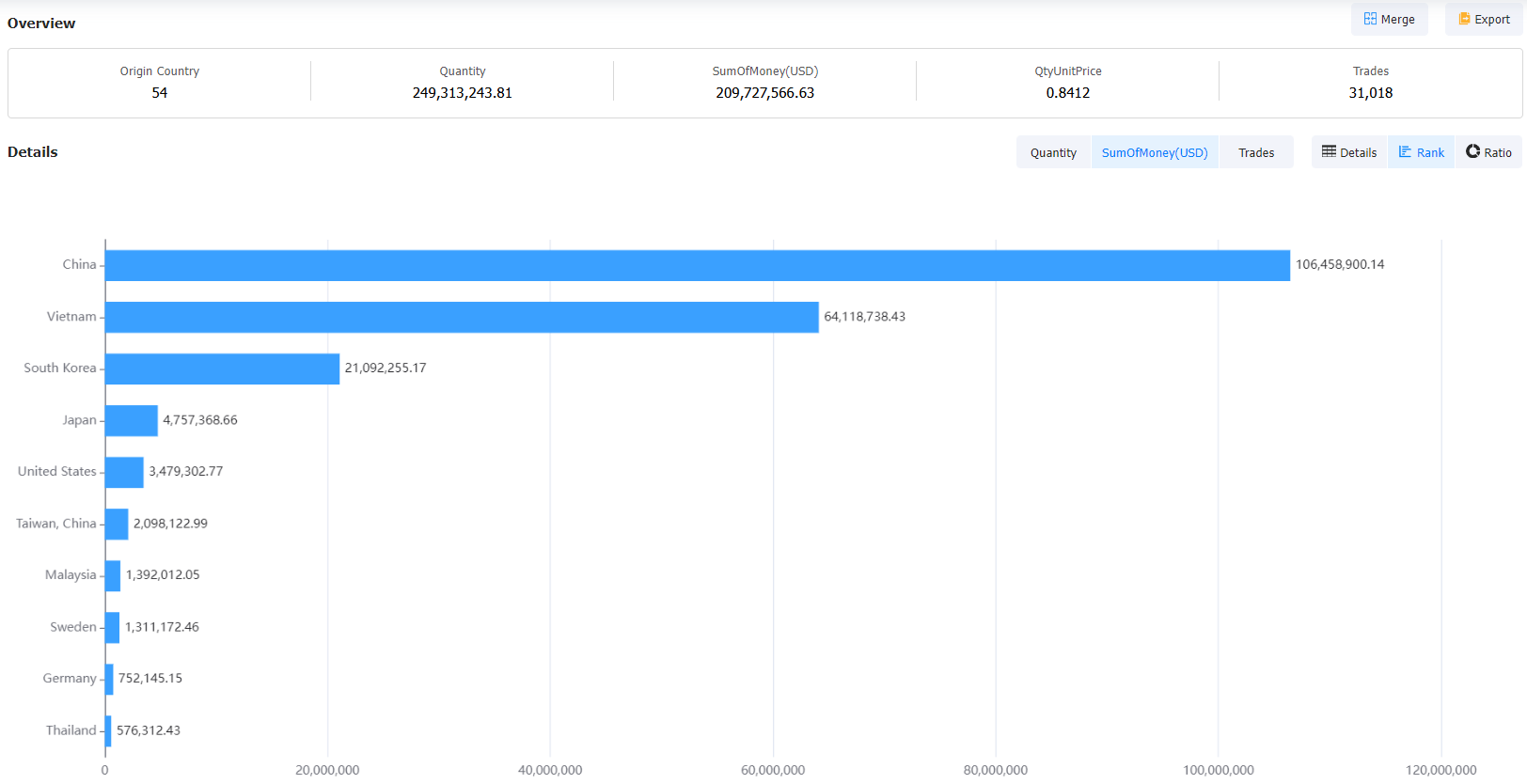

As of September 2023, this year, Vietnam imports graphite mainly from these countries: China (50.76%), South Korea (10.06%), Japan (2.27%), and the United States (1.66%). China is Vietnam's largest graphite import partner, with graphite imports from China five times higher than the second-place South Korea.

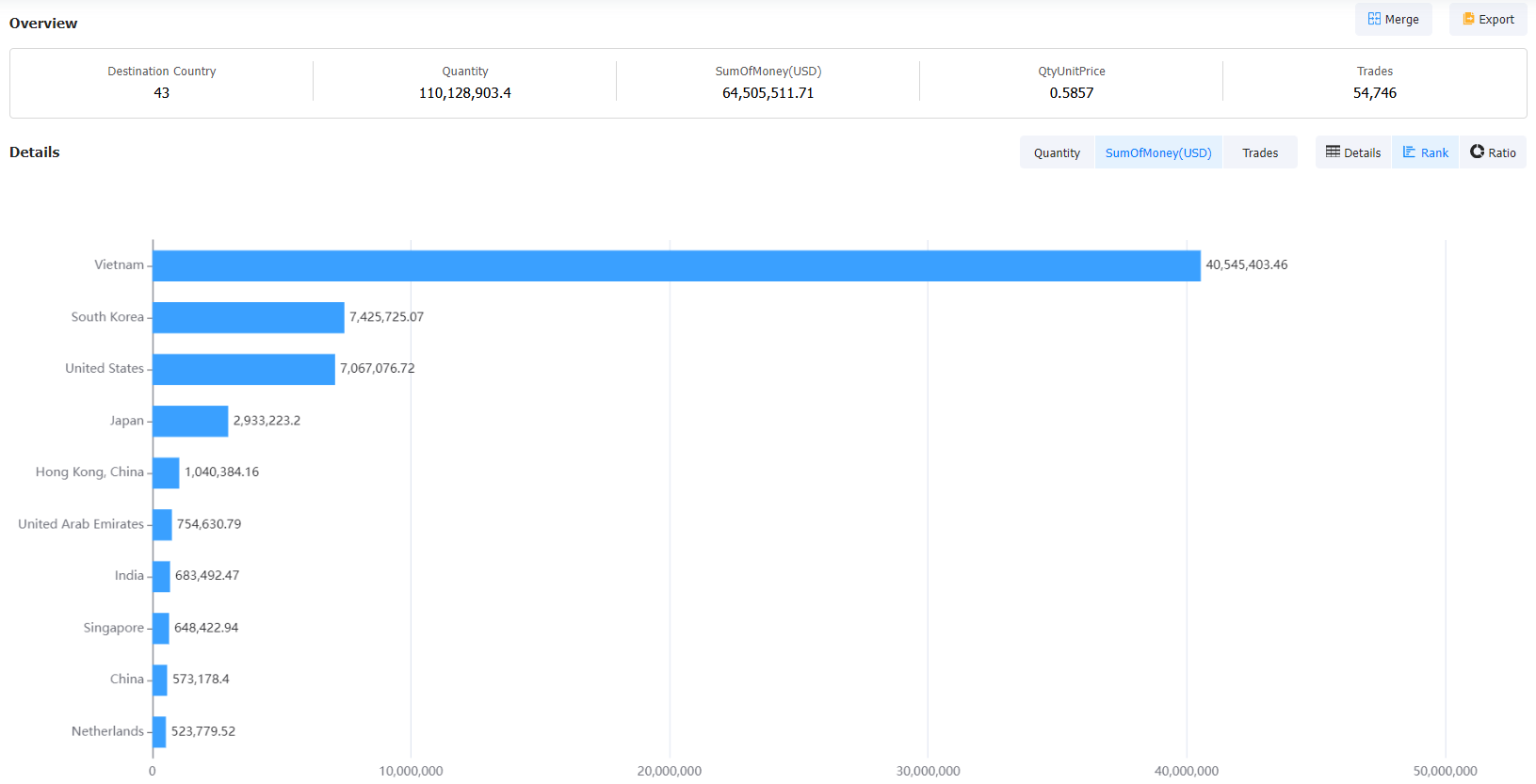

As of September 2023, this year, Vietnam exported graphite mainly to these countries: South Korea (11.51%), the United States (10.96%), Japan (4.55%), Hong Kong (1.61%), and the United Arab Emirates (1.17%).

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship