Market Insights

Market Insights

2024-05-17

2024-05-17

In Russia, by the end of 2023, fertilizer production exceeds the level of the last 10 years and reaches almost 60 million tons, which is 9% higher than in the previous year. In 2023, mineral fertilizer production at 100% nutrients reached 26 million tons, up 10.3% from 2022.

The growth of mineral fertilizer production in Russia in 2023 is associated with several factors. First, farmers' demand for fertilizers increases. Secondly, Russian fertilizer producers were able to increase production due to modernization of equipment and introduction of new technologies. Investments in fixed assets of fertilizer producers are at the highest level in the last 10 years.

In 2023, compared to 2022, capacity utilization in the potash production segment increased significantly, while the previous year capacity utilization decreased due to the geopolitical situation. For other types of fertilizers, capacity utilization remains almost unchanged compared to 2022.

Fertilizer production in Russia has grown by 40% in recent years, and domestic demand has tripled to 13.2 million tons.

By the end of 2023, nitrogen fertilizer production grew by 5.2% to 12.5 million tons. The main growth factors are the expansion of urea production capacity, particularly at the Akron plant in Veliky Novgorod, and the resumption of exports of such fertilizers to the US, the EU and India. Overall, growth in nitrogen fertilizer production is quite predictable, taking into account the investments made by producers in recent years to expand their ammonia and urea production sites.

By the end of 2023, potash production increased by 24.6% - 9.1 million tons. As a result of the impressive recovery of the logistic chain, the output in 2023 is still lower than the maximum output in 2021. the dynamics of phosphate fertilizers production at the end of 2023 is negative, with the output of 4.4 million tonnes, which is 0.2% lower than in 2022.

Russia's share in global mineral fertilizers exports is 16%, which is the second highest after China. Nitrogen fertilizers account for 13% of the total, phosphate fertilizers for 16%, and potash for 18%.

In 2022, Russian fertilizer exports to the West will decrease by 25-30% (minus 3-10 million tons). In 2023, another 15-20% reduction. total exports in 2023 exceed 33 million tons (up 5% from last year).

Constraints and challenges have led to a redirection of supply to Asian markets as well as to Latin American and African countries. Fertilizers are supplied to Brazil, India, China, Thailand, Mexico, Vietnam, Bangladesh, Myanmar, Indonesia and Turkey. Since June 2023, Russian manufacturers have been recovering from the pressure of sanctions. Increased supplies to markets in friendly countries. By the end of 2022, they accounted for 70% of fertilizer exports, and by 2023, their share will increase to 75%.

Of course, the main export destinations have become the countries of the southern hemisphere, to which three-quarters of exports already go. The largest sales markets are India (5.4 million tons) and Brazil (10.3 million tons). Promising markets are African countries, where the share of Russian products is 10%.

In 2023, China's imports of Russian mineral fertilizers increased by 1.7 times to almost 3.5 million tons. In value terms, this figure increased by 26% to $1.3 billion. Last year, the supply of potassium chloride (the main type of fertilizer China imports from Russia) reached 3 million tons, compared to 1.7 million tons in the same period of the previous year. In terms of value, it increased by a quarter to $1.1 billion.

Thanks to alternative supply routes, Russian fertilizer export revenues increased to $17.7 billion by the end of 2023. Manufacturers find alternative ways of supply, leaving the Baltic ports for the ports of the Russian Federation. The most important export channels are:

· Baltic terminals, St. Petersburg port and Ust-Luga on the Gulf of Finland coast;

· Taman, a large logistics center on the Black Sea coast;

· The ports of Murmansk, Novorossiysk, Tuapse.

Leaving the Baltic ports exempts Russia from transit costs of more than 200 million dollars per year. Currently, a large logistics center is being built in Taman on the Black Sea. Currently cargo turnover of export products is concentrated in the Gulf of Finland ports of St. Petersburg, Ust-Luga, Murmansk, Novorossiysk, and Tuapse. A fertilizer plant is being built in Nakhodka in the Far East to sell products to China and Vietnam, where demand for various types of fertilizers is growing.

As a result, the geographic structure of exports has changed dramatically in the last two years, with a significant drop in sales to Europe, but a significant increase in sales to Brazil, India and China.

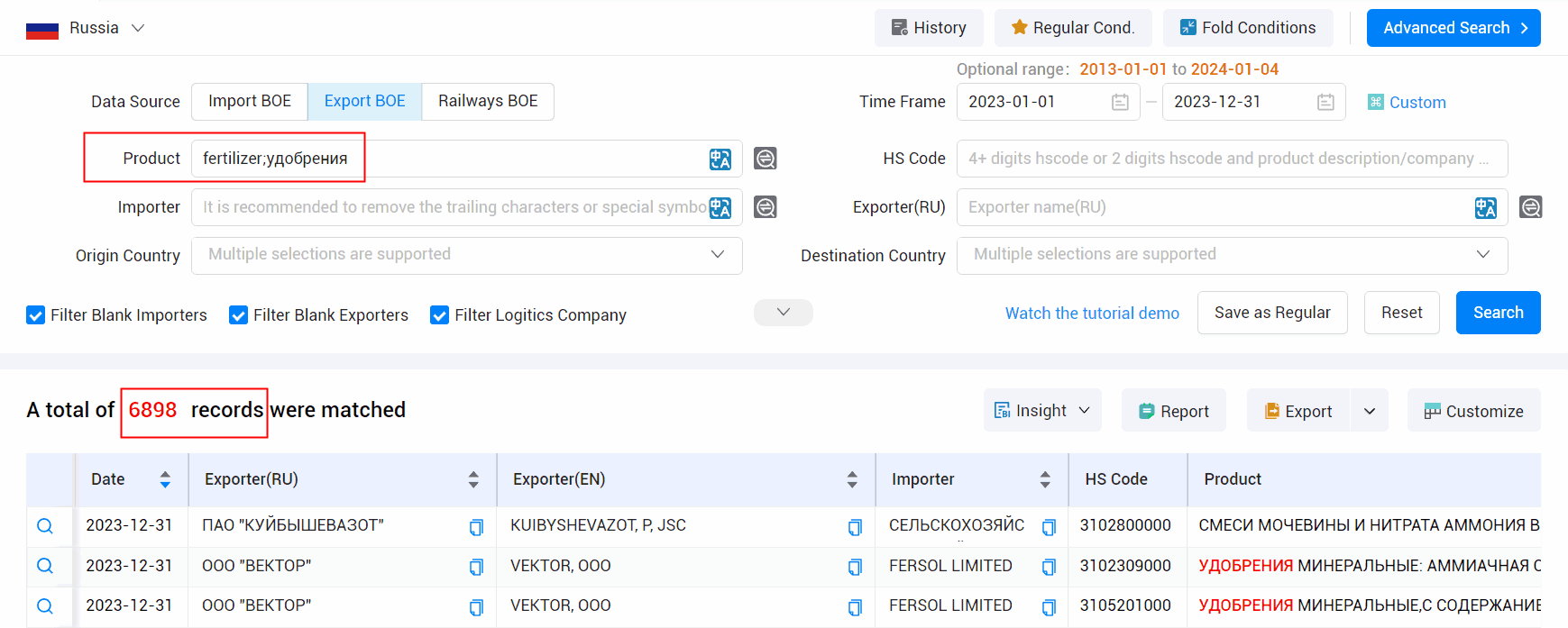

Would You like to See More Data on Fertilizer Exports from Russia?

Tendata provides you with more data on fertilizer exports from Russia.

Tendata iTrader allows you to seamlessly search customer information from over 218 countries. It empowers you to actively select and download data from a dynamic database of 130 million global industry buyers, including customer names, phone numbers, emails, and other SNS contact information. Tendata iTrader provides real-time monitoring and intelligent push notifications for instant updates on your buyers, suppliers, customers, and industry peers.

The 100 billion dynamic database of Tendata iTrader serves as a robust foundation for your market analysis.

Through a scientifically designed lightweight customer management system, Tendata iTrader establishes a sub-master account system, preventing customer loss due to employee turnover.

Now, Tendata iTrader introduces the visualization report feature, allowing you to clearly visualize market trends, price fluctuations, supplier changes, and more through charts. This enables precise market positioning. (>>>Click to Get Free Access to Customs Data for 90+ Countries)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship