Market Insights

Market Insights

2024-06-19

2024-06-19

In 2023, the global export value of milk reached a substantial US$44.3 billion, marking a significant increase of 53.81% since 2018 when milk exports were valued at $28.8 billion.

Year-over-year, the global value of milk exports rose by 21.7%, up from $36.4 billion in 2021.

The five largest milk exporters by dollar value in 2023 were New Zealand, Germany, the United States, the Netherlands, and Belgium. These top suppliers collectively accounted for 55.3% of global milk exports.

From a regional perspective, European countries led in milk exports, contributing 53.9% of the global total. Oceania, driven by New Zealand, was second with a 25.5% share. North America accounted for 10.1%, while Asian exporters contributed 5%.

Latin America, excluding Mexico but including the Caribbean, represented 4.5% of the total, with Africa providing 1%.

Milk is traded internationally under two major classifications based on the Harmonized Tariff System (HTS). The code 0401 covers milk and cream not concentrated nor containing added sugar or other sweetening matter. The code 0402 is for milk and cream that are concentrated or contain added sugar or sweetening matter.

In 2023, unsweetened milk exports (HTS 0401) amounted to $11.3 billion, representing 31.2% of the global total. Sweetened milk exports (HTS 0402) totaled $25 billion, accounting for 68.8%.

Top Milk Exporting Countries in 2023

Here are the 15 countries with the highest milk export values in 2023, including both sweetened and unsweetened milk products:

1. New Zealand: US$7.8 billion (21.4% of total milk exports)

2. Germany: $3.53 billion (9.7%)

3. United States: $3.45 billion (9.5%)

4. Netherlands: $3 billion (8.2%)

5. Belgium: $2.4 billion (6.5%)

6. France: $2.1 billion (5.9%)

7. Australia: $1.5 billion (4.1%)

8. Poland: $1.3 billion (3.6%)

9. Ireland: $1.2 billion (3.2%)

10. United Kingdom: $851.2 million (2.3%)

11. Czech Republic: $625.6 million (1.7%)

12. Uruguay: $622.5 million (1.7%)

13. Argentina: $590.3 million (1.6%)

14. Denmark: $516.8 million (1.4%)

15. Austria: $472.1 million (1.3%)

These 15 countries accounted for over four-fifths (82.1%) of global milk exports in 2023.

Among these, the fastest-growing milk exporters since 2018 were the United States (up 114.2%), Ireland (up 108.4%), Poland (up 65.5%), and Australia (up 64.1%). The United Kingdom had the smallest growth, with a 7.9% increase in exported milk sales from 2021.

Countries with Highest Trade Surpluses in Milk

The following countries had the highest positive net exports for milk in 2023, indicating a surplus between the value of exported and imported milk:

1. New Zealand: US$7.8 billion (up 41.7% since 2018)

2. United States: $3.2 billion (up 117.8%)

3. Australia: $1.21 billion (up 67%)

4. Netherlands: $1.11 billion (down -9.5%)

5. France: $1.07 billion (up 70.6%)

6. Germany: $744.4 million (down -26%)

7. Ireland: $667.5 million (up 360.7%)

8. Poland: $636.1 million (up 53.7%)

9. Uruguay: $616.8 million (up 31.4%)

10. Argentina: $586.2 million (up 45.8%)

11. Belgium: $579.4 million (up 118.9%)

12. Czech Republic: $533.4 million (up 22.2%)

13. Denmark: $329.6 million (up 2.6%)

14. United Kingdom: $321.2 million (up 4.9%)

15. Austria: $267.3 million (up 18.8%)

New Zealand had the highest surplus in milk trade, highlighting its competitive advantage in this sector.

Countries with Highest Trade Deficits in Milk

The following countries experienced the largest negative net exports for milk in 2023, reflecting a higher value of imports compared to exports:

1. China: -US$6.1 billion (up 80.8% since 2018)

2. Algeria: -$1.7 billion (up 50.2%)

3. Mexico: -$1.34 billion (up 155.2%)

4. Indonesia: -$1.28 billion (up 154%)

5. Italy: -$1.12 billion (up 12.8%)

6. Philippines: -$864.6 million (up 79.8%)

7. Malaysia: -$631.2 million (up 126.3%)

8. United Arab Emirates: -$564.3 million (up 122.4%)

9. Vietnam: -$559 million (up 72.9%)

10. Saudi Arabia: -$499.7 million (up 103.3%)

11. Bangladesh: -$468.2 million (up 32.1%)

12. Taiwan: -$436.6 million (up 51.6%)

13. Singapore: -$435.5 million (up 28.9%)

14. Thailand: -$419.3 million (up 60.2%)

15. Greece: -$392.2 million (up 66.6%)

China had the largest deficit in milk trade, underscoring significant opportunities for milk-exporting countries to meet the high demand in this populous nation.

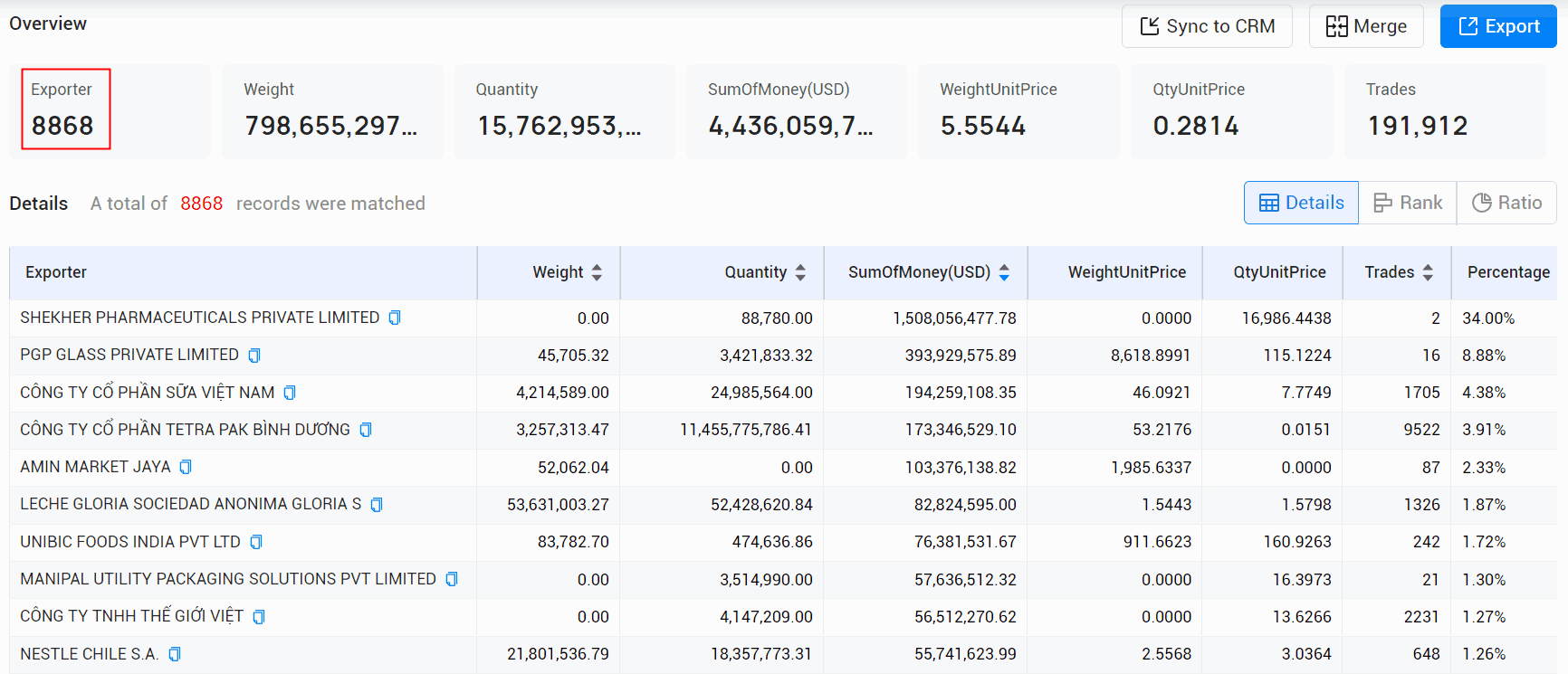

Notable Milk Exporting Companies

The following are major global milk-processing companies active in international trade. Many are cooperatives, and their home countries are listed in parentheses:

1. SHEKHER PHARMACEUTICALS PRIVATE LIMITED: 34%, $1508.06 million

2. PGP GLASS PRIVATE LIMITED: 8.88%, $393.93 million

3. CÔNG TY CỔ PHẦN SỮA VIỆT NAM: 4.38%, $194.26 million

4. CÔNG TY CỔ PHẦN TETRA PAK BÌNH DƯƠNG: 3.91%, $173.35 million

5. AMIN MARKET JAYA: 2.33%, $103.38 million

6. LECHE GLORIA SOCIEDAD ANONIMA GLORIA S: 1.87%, $82.82 million

7. UNIBIC FOODS INDIA PVT LTD: 1.72%, $76.38 million

8. MANIPAL UTILITY PACKAGING SOLUTIONS PVT LIMITED: 1.3%, $57.64 million

9. CÔNG TY TNHH THẾ GIỚI VIỆT: 1.27%, $56.51 million

10. NESTLE CHILE S.A.: 1.26%, $55.74 million

SHEKHER PHARMACEUTICALS PRIVATE LIMITED stands out as a major player in the global milk market.

Global Market Analysis

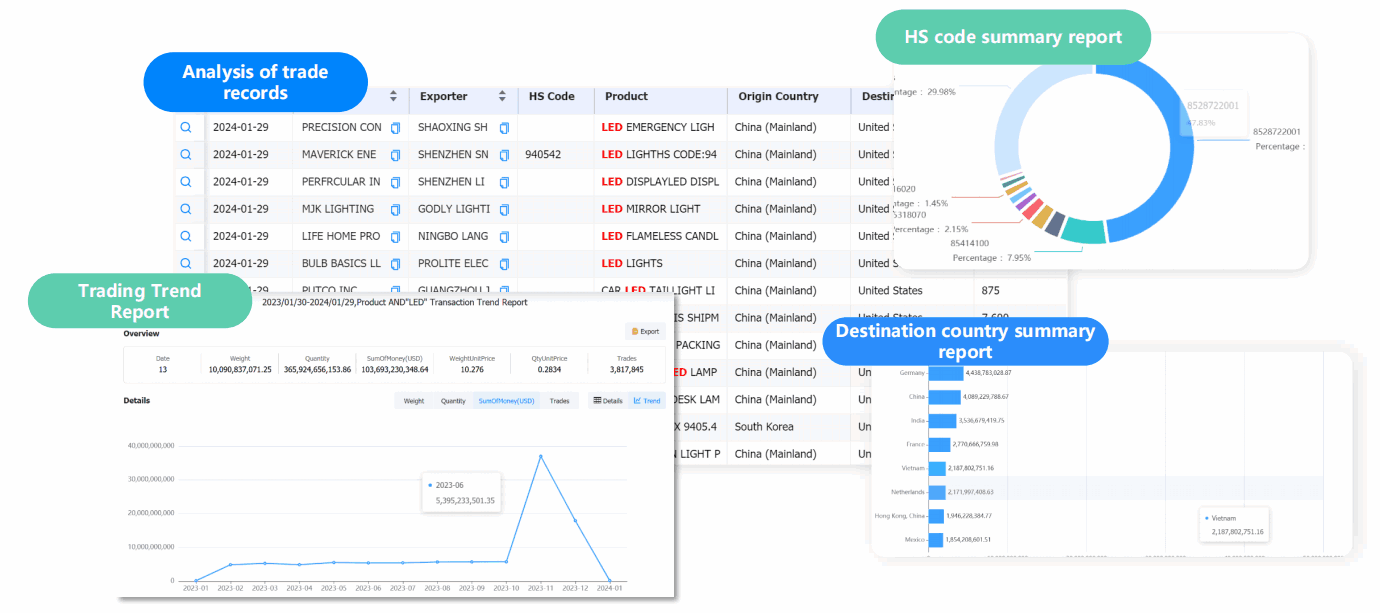

Analysis of the Overall Trade Situation and Trends in the Industry

Through its powerful digital platform and in-depth reporting services, Tendata helps users to analyse the overall situation and future trends of the industry, so as to achieve more accurate market positioning and strategic planning.

Analysis of Specific Product Trade Trends in the Target Market

Tendata can provide comprehensive data support and analytical reports for analysing trade trends for a product in a single market, helping you to understand how that product is being traded in that market and identify business opportunities.

Category

Leave Message for Demo Request or Questions

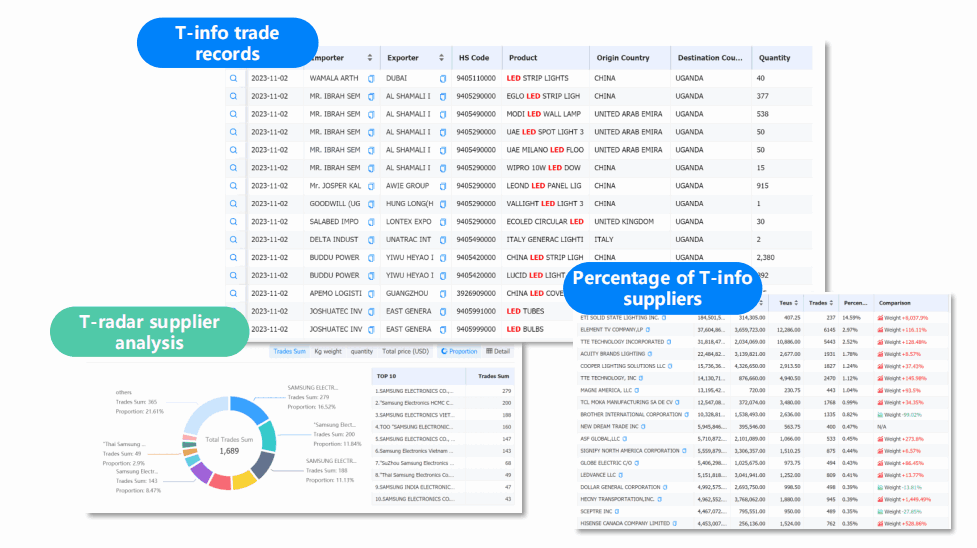

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship