Market Insights

Market Insights

2024-06-20

2024-06-20

In 2022, the global export market for natural rubber was valued at US$16.1 billion. This reflects a 21.9% increase from $13.2 billion in 2018. However, year-over-year, natural rubber exports saw a slight decline of 3% from $16.6 billion in 2021.

The top 5 exporters—Thailand, Indonesia, Ivory Coast, Vietnam, and Malaysia—dominated the market, contributing 79.6% of the total global exports of natural rubber in 2022.

From a continental perspective, Asia was the leading exporter, accounting for $12.4 billion or 77.3% of the global market. Africa followed with 14.9%, and Europe with 5.6%. Latin America, excluding Mexico but including the Caribbean, accounted for 1.5%, North America for 0.7%, and Oceania (mainly Papua New Guinea and Australia) for 0.04%.

The Harmonized Tariff System (HTS) code for natural rubber is 4001.

Leading Exporters of Natural Rubber

Here are the top 15 countries exporting natural rubber in 2022 by dollar value:

1. Thailand: US$5.1 billion (31.6% of total exports)

2. Indonesia: $3.5 billion (22%)

3. Ivory Coast: $1.9 billion (11.6%)

4. Vietnam: $1.3 billion (7.9%)

5. Malaysia: $1 billion (6.5%)

6. Laos: $407 million (2.5%)

7. Cambodia: $398.4 million (2.5%)

8. Belgium: $366.5 million (2.3%)

9. Myanmar: $261.2 million (1.6%)

10. Guatemala: $212.8 million (1.3%)

11. Ghana: $189.6 million (1.2%)

12. Philippines: $175.6 million (1.1%)

13. Germany: $130.7 million (0.8%)

14. Singapore: $125.6 million (0.8%)

15. Liberia: $112.7 million (0.7%)

These countries accounted for 94.4% of global natural rubber exports in 2022. The fastest-growing exporters from 2021 to 2022 were Laos (up 45.3%), Ghana (up 29.9%), Ivory Coast (up 21%), and the Philippines (up 8.7%). Conversely, Indonesia (down 11.8%), Myanmar (down 9.7%), Thailand (down 7.6%), Liberia (down 5.5%), and Singapore (down 5.3%) experienced declines.

Trade Surpluses in Natural Rubber

The following countries had the highest net exports of natural rubber in 2022:

1. Thailand: US$5.1 billion (net export surplus down 7.6% since 2021)

2. Indonesia: $3.4 billion (down 12.9%)

3. Ivory Coast: $1.9 billion (up 21%)

4. Vietnam: $832.9 million (reversing a $634.4 million deficit)

5. Laos: $405.3 million (up 47.4%)

6. Cambodia: $395.7 million (down 0.3%)

7. Myanmar: $260.7 million (down 9.6%)

8. Guatemala: $209.6 million (down 5.9%)

9. Ghana: $189.3 million (up 42.7%)

10. Philippines: $156.1 million (up 15.1%)

11. Liberia: $104 million (down 7.1%)

12. Ireland: $98.7 million (up 9.4%)

13. Cameroon: $83.3 million (up 43.9%)

14. Nigeria: $59.3 million (up 13.5%)

15. Guinea: $38 million (up 28.6%)

Trade Deficits in Natural Rubber

The following countries had the highest net import deficits for natural rubber in 2022:

1. China: -US$4 billion (net export deficit up 4.6% since 2021)

2. United States: -$2.3 billion (up 10.4%)

3. Japan: -$1.5 billion (up 11.3%)

4. India: -$1 billion (up 8.4%)

5. South Korea: -$717 million (up 16.7%)

6. Turkey: -$634.7 million (up 20.7%)

7. Malaysia: -$601.8 million (down 10%)

8. Brazil: -$453.9 million (up 9.2%)

9. Spain: -$449 million (up 13.7%)

10. Germany: -$447.3 million (up 5%)

11. Italy: -$315.9 million (up 5%)

12. Mexico: -$271.3 million (up 20%)

13. Poland: -$268.7 million (up 14.1%)

14. Canada: -$266.5 million (up 7%)

15. France: -$202.8 million (up 16.4%)

China recorded the largest deficit, highlighting its significant demand for natural rubber, which presents opportunities for exporting countries.

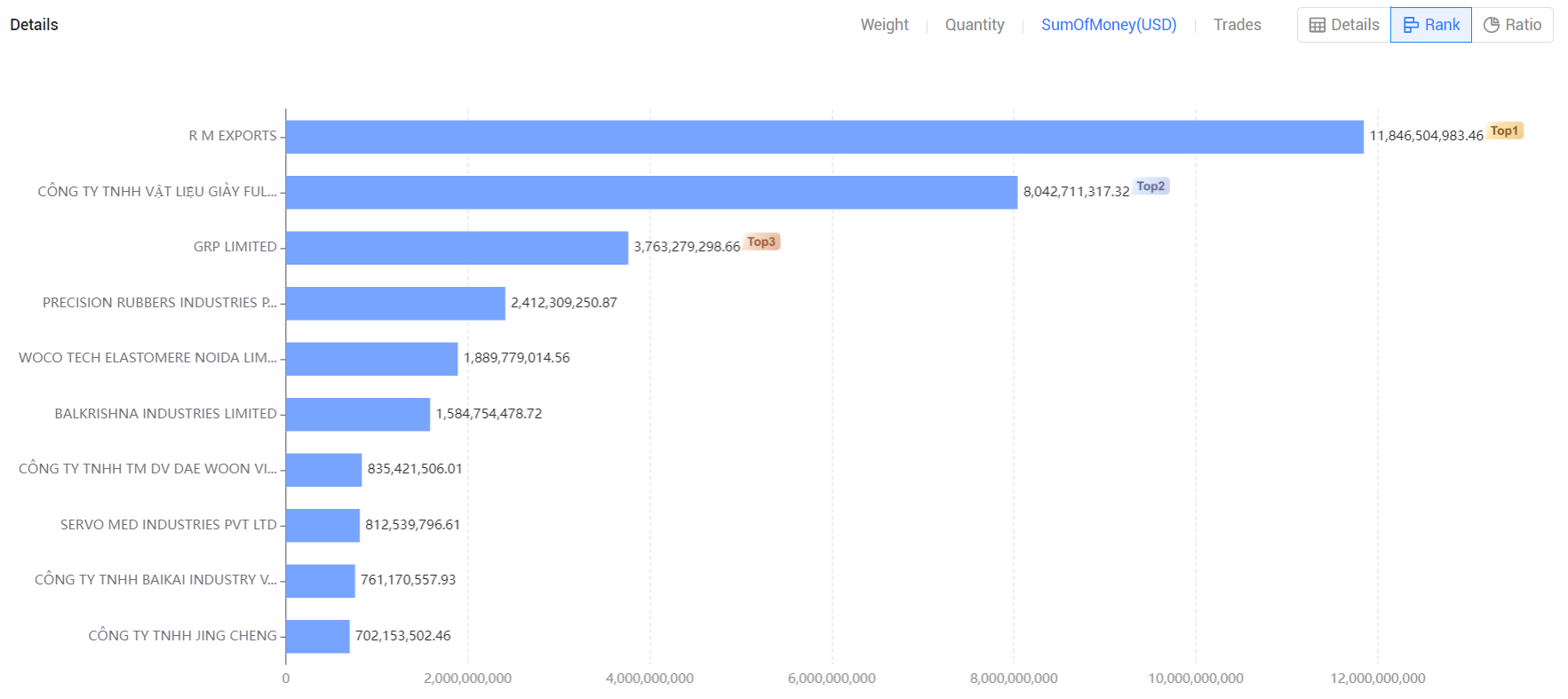

Leading Natural Rubber Exporting Companies

Notable companies in the natural rubber market for 2023, especially in rubber tire manufacturing, include:

1. R M EXPORTS: 17.69%, $11,846.5 million

2. CÔNG TY TNHH VẬT LIỆU GIÀY FULIAN: 12.01%, $8,042.71 million

3. GRP LIMITED: 5.62%, $3,763.28 million

4. PRECISION RUBBERS INDUSTRIES PRIVATE LIMITED: 3.6%, $2,412.31 million

5. WOCO TECH ELASTOMERE NOIDA LIMITED: 2.82%, $1,889.78 million

6. BALKRISHNA INDUSTRIES LIMITED: 2.37%, $1,584.75 million

7. CÔNG TY TNHH TM DV DAE WOON VIỆT NAM: 1.25%, $835.42 million

8. SERVO MED INDUSTRIES PVT LTD: 1.21%, $812.54 million

9. CÔNG TY TNHH BAIKAI INDUSTRY VIỆT NAM: 1.14%, $761.17 million

10. CÔNG TY TNHH JING CHENG: 1.05%, $702.15 million

These companies represent a significant portion of the global rubber tire market, based on data from 2023.

Global Market Analysis

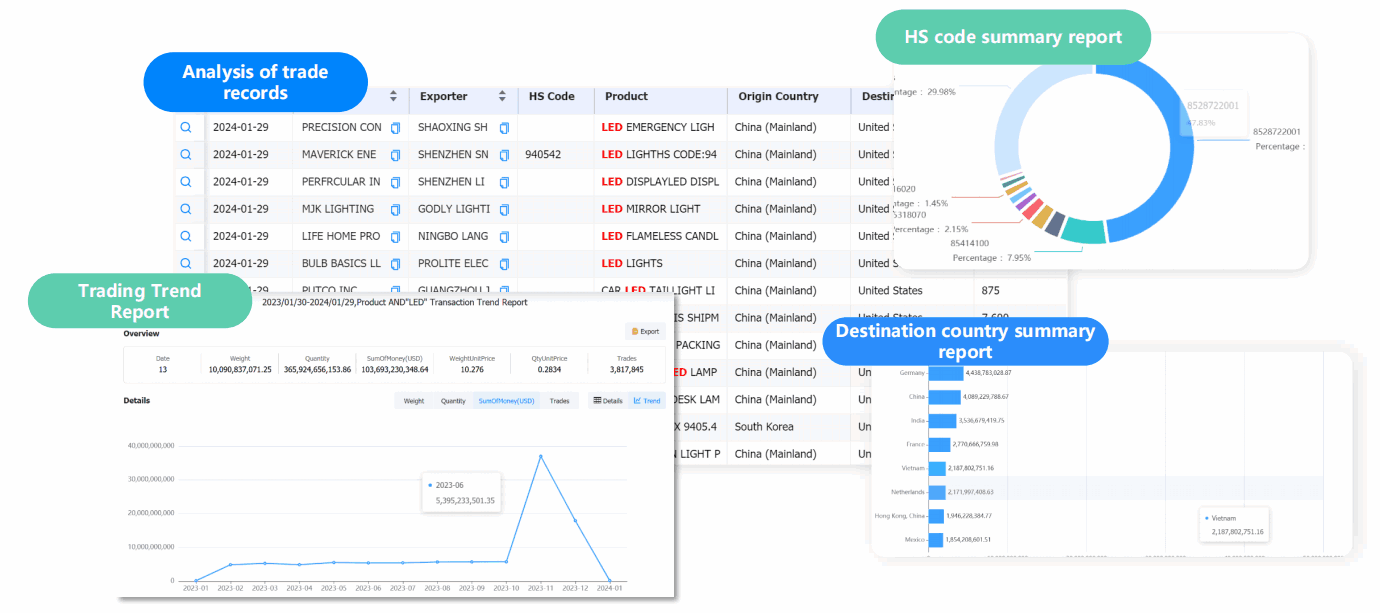

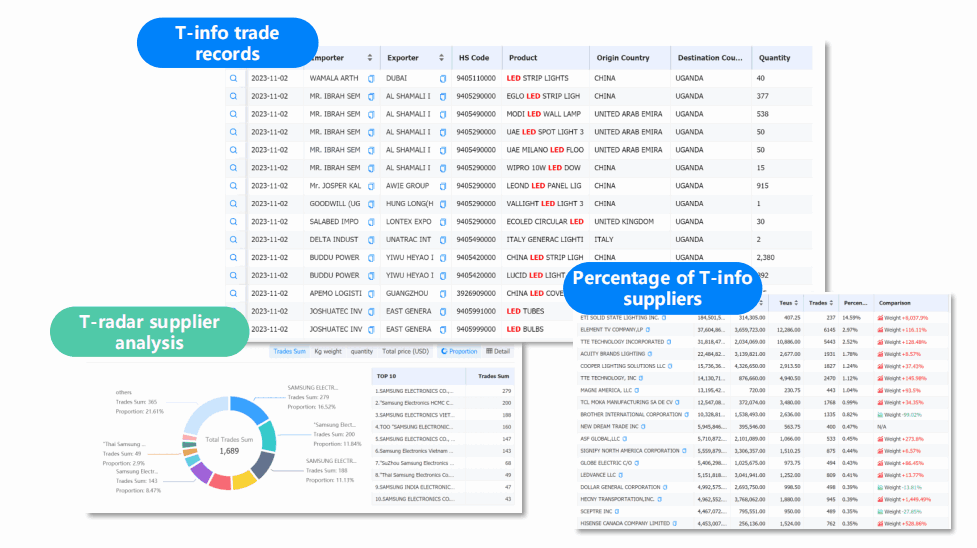

Analysis of the Overall Trade Situation and Trends in the Industry

Through its powerful digital platform and in-depth reporting services, Tendata helps users to analyse the overall situation and future trends of the industry, so as to achieve more accurate market positioning and strategic planning.

Analysis of Specific Product Trade Trends in the Target Market

Tendata can provide comprehensive data support and analytical reports for analysing trade trends for a product in a single market, helping you to understand how that product is being traded in that market and identify business opportunities.

>>Get A Free Demo<<

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship