Market Insights

Market Insights

2024-06-20

2024-06-20

In 2022, global exports of headphones amounted to US$18.7 billion. This represents a significant growth of 44.3% since 2018, when the total value of exported headphones was $13 billion. Year over year, the export value rose by 10.4% from $17 billion in 2021.

The top three exporting countries for headphones in 2022 were Vietnam, China, and Germany. These countries together accounted for nearly 56.5% of global headphone exports, underscoring their dominant position in the market.

In 2022, Asian countries led the global market in headphone exports, with total shipments valued at $11.8 billion, or approximately 63% of the global total. Europe was the second-largest exporter at 29%, followed by North America with 7.6%. Smaller shares were contributed by Latin America (0.25%), Oceania (0.21%), and Africa (0.04%).

For classification purposes, headphones and earphones, including those with combined microphone/speaker sets, fall under the 6-digit Harmonized Tariff System code 851830.

Top 15 Headphone Exporting Countries in 2022

1. Vietnam: US$5.2 billion (27.8% of total exports)

2. China: $4.1 billion (21.9%)

3. Germany: $1.3 billion (6.8%)

4. Hong Kong: $1.1 billion (5.9%)

5. United States: $922.8 million (4.9%)

6. Netherlands: $807.2 million (4.3%)

7. Malaysia: $531.7 million (2.8%)

8. Italy: $490.5 million (2.6%)

9. Mexico: $462.8 million (2.5%)

10. Czech Republic: $456.3 million (2.4%)

11. Singapore: $421.5 million (2.3%)

12. Belgium: $365.3 million (2%)

13. Sweden: $312.5 million (1.7%)

14. France: $202.5 million (1.1%)

15. Denmark: $199.2 million (1.1%)

These 15 countries collectively accounted for 90% of global headphone exports in 2022. Vietnam, Singapore, Italy, and the Netherlands experienced the fastest growth in exports since 2018. Conversely, Hong Kong and Belgium saw declines in their export volumes.

Countries with Trade Surpluses in Headphones

The countries with the highest net exports (exports minus imports) of headphones in 2022 were:

1. Vietnam: US$5.1 billion (up 218.1% since 2018)

2. China: $3.6 billion (up 163.1%)

3. Hong Kong: $534.5 million (down 16.4%)

4. Malaysia: $476 million (up 38.6%)

5. Italy: $199.6 million (up 653%)

6. Netherlands: $49.9 million (down 283.8%)

7. Czech Republic: $14 million (down 76%)

8. Kyrgyzstan: $4.4 million (reversing a $1.1 million deficit)

9. Samoa: $393,000 (reversing a $44,000 deficit)

10. Myanmar: $151,000 (reversing a $650,000 deficit)

11. North Korea: $22,000 (up 175%)

12. Saint Kitts/Nevis: $10,000 (down 92.5%)

13. Pitcairn: $2,000 (data unavailable for 2021)

14. Christmas Island: $1,000 (down 83.3%)

Vietnam surpassed China in 2019 to become the top country with the highest surplus in the international trade of headphones, showcasing its competitive edge in this sector.

Countries with Trade Deficits in Headphones

The countries with the highest net import deficits (imports minus exports) of headphones in 2022 were:

1. United States: -US$5.8 billion (up 507% since 2018)

2. Japan: -$1 billion (up 56%)

3. Canada: -$753.1 million (up 73.4%)

4. India: -$611.7 million (up 129.2%)

5. Australia: -$596.1 million (up 70%)

6. France: -$498.1 million (up 43.7%)

7. United Kingdom: -$415.4 million (up 1.5%)

8. United Arab Emirates: -$343.2 million (up 1,091%)

9. Germany: -$341.4 million (up 26.9%)

10. Taiwan: -$224 million (up 335%)

11. Norway: -$164.3 million (up 32.8%)

12. South Korea: -$147.4 million (down 29.3%)

13. Spain: -$141.6 million (up 35.4%)

14. Switzerland: -$132.3 million (up 73.1%)

15. Israel: -$131 million (up 110.6%)

The United States had the largest trade deficit in headphones, reflecting a significant reliance on imports to meet its high demand.

Leading Headphones Manufacturing Companies

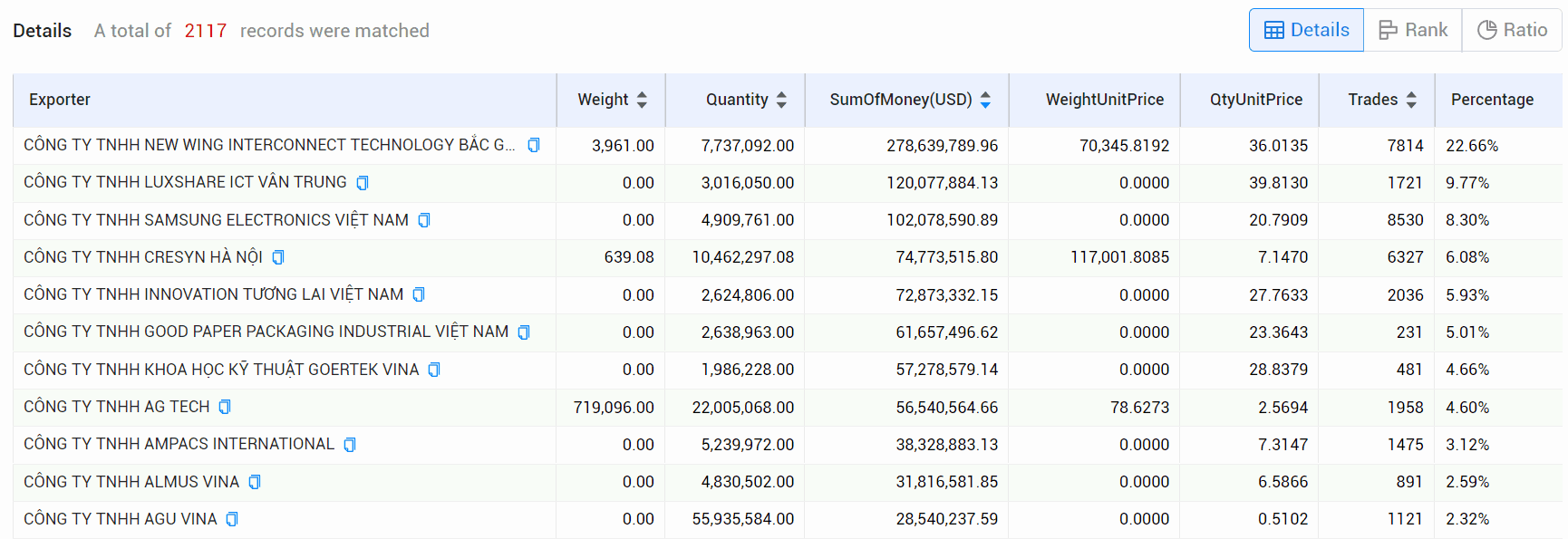

According to Tendata, the following companies are prominent in designing and manufacturing headphones:

1. CÔNG TY TNHH NEW WING INTERCONNECT TECHNOLOGY BẮC GIANG (22.66%, $278.64 million)

2. CÔNG TY TNHH LUXSHARE ICT VÂN TRUNG (9.77%, $120.08 million)

3. CÔNG TY TNHH SAMSUNG ELECTRONICS VIỆT NAM (8.3%, $102.08 million)

4. CÔNG TY TNHH CRESYN HÀ NỘI (6.08%, $74.77 million)

5. CÔNG TY TNHH INNOVATION TƯƠNG LAI VIỆT NAM (5.93%, $72.87 million)

6. CÔNG TY TNHH GOOD PAPER PACKAGING INDUSTRIAL VIỆT NAM (5.01%, $61.66 million)

7. CÔNG TY TNHH KHOA HỌC KỸ THUẬT GOERTEK VINA (4.66%, $57.28 million)

8. CÔNG TY TNHH AG TECH (4.6%, $56.54 million)

9. CÔNG TY TNHH AMPACS INTERNATIONAL (3.12%, $38.33 million)

10. CÔNG TY TNHH ALMUS VINA (2.59%, $31.82 million)

These companies represent key players in the global headphones market, contributing significantly to the industry's growth and development.

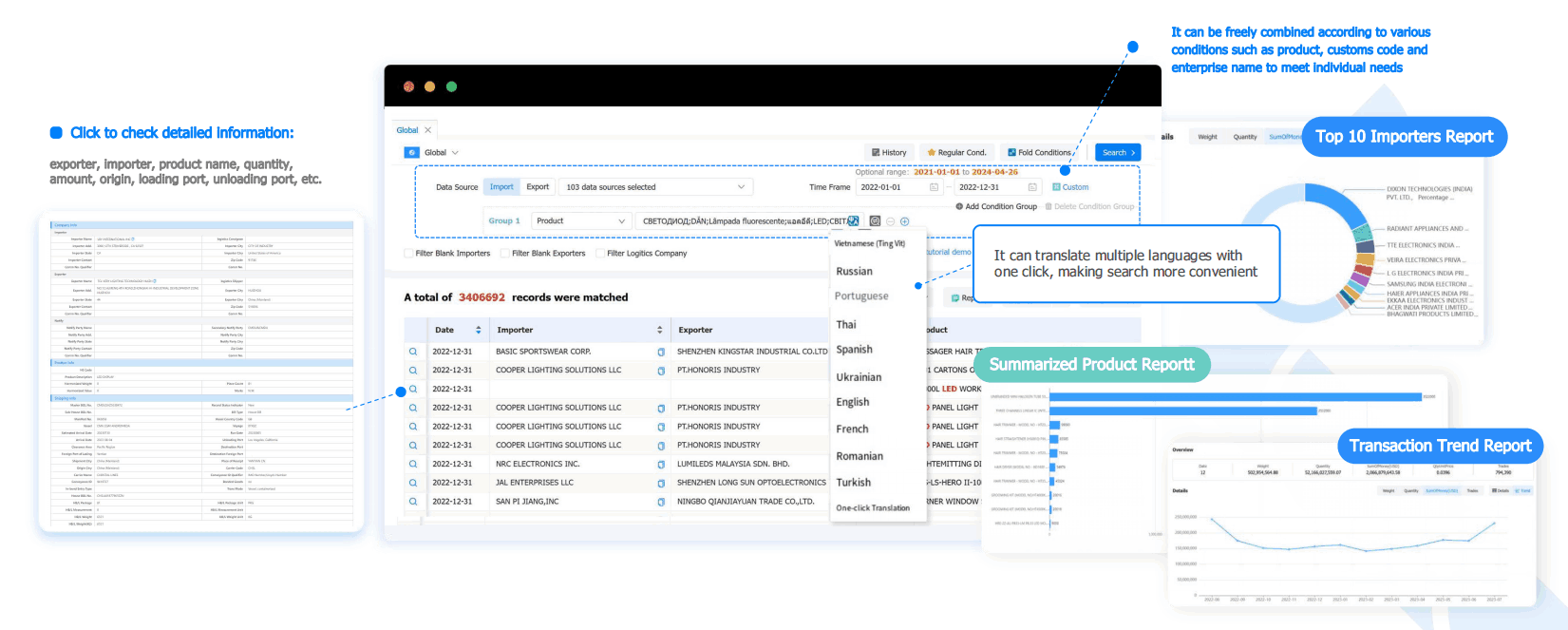

Retrieve Global Trade Data and Monitor Market Trends

Tendata support one-click queries to track the global transaction details of specific products. Reflect the purchasing and supply activities throughout the entire supply chain and comprehensively display the state of the entire trade network.

Based on the statistical analysis of transaction data, view industry and product market trends to help businesses gain insights into market changes.

Tendata provides real-time, accurate, and detailed customs data, presenting the specifics of each transaction. Customized search criteria meet various filtering needs.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship