Market Insights

Market Insights

2024-09-27

2024-09-27

In 2023, global car exports reached a staggering US$958.7 billion.

This figure signifies a remarkable 25.1% increase compared to $766.3 billion five years earlier in 2019.

When looking at year-over-year changes, the total international spending on exported cars rose by 21.5% from $789.1 billion in 2022.

In terms of global ranking, cars were the fourth most exported product by sales value, following crude oil, refined petroleum oils, and electronic integrated circuits.

Overall, cars constituted 4.1% of all international spending on exported goods, an increase from 3.2% in 2022.

Leading Car Exporting Countries

The five top exporters of cars in 2023 were Germany, Japan, mainland China, South Korea, and the United States. Collectively, these five countries accounted for over half (51.9%) of the car exports sold in international markets.

From a continental perspective, European nations led the way, exporting cars valued at $485.2 billion, which is 50.6% of total international car sales. Asian countries followed, contributing 31%, while North American exporters accounted for 16.5%.

Smaller contributions came from Africa (1.2%), Latin America (0.6%, excluding Mexico but including the Caribbean), and Oceania (0.04%, primarily from Australia).

For reference, the Harmonized Tariff System code prefix for cars is 8703.

Top 15 Car Exporting Countries in 2023

Here are the 15 countries that exported the highest dollar value worth of cars in 2023:

1. Germany: US$177.2 billion (18.5% of total exported cars)

2. Japan: $110.9 billion (11.6%)

3. Mainland China: $77.7 billion (8.1%)

4. South Korea: $68.3 billion (7.1%)

5. United States: $63 billion (6.6%)

6. Mexico: $57.3 billion (6%)

7. Belgium: $43.1 billion (4.5%)

8. Spain: $40.6 billion (4.2%)

9. Canada: $37.9 billion (4%)

10. United Kingdom: $36.9 billion (3.9%)

11. Slovakia: $33.2 billion (3.5%)

12. Czech Republic: $32 billion (3.3%)

13. France: $24.7 billion (2.6%)

14. Italy: $20.5 billion (2.1%)

15. Hungary: $15.6 billion (1.6%)

These 15 countries together accounted for 87.5% of all car exports globally in 2023.

Fastest-Growing Car Exporting Countries

Among the top exporters, the fastest-growing car exporters from 2022 to 2023 included:

· Mainland China (up 73.8%)

· South Korea (up 32.1%)

· Canada (up 28.6%)

· Hungary (up 28%)

In contrast, the United States saw a more modest increase of 9% from the previous year.

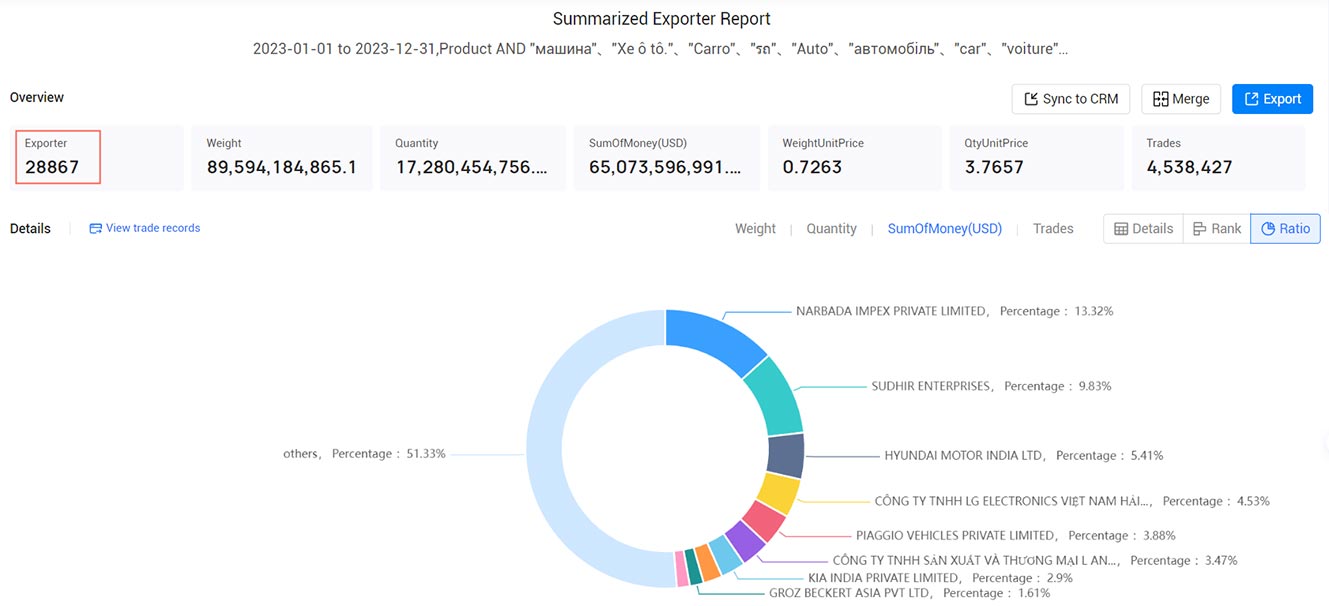

Major Car Exporting Companies

The following companies are recognized as significant players in the car export market from Tendata:

1. NARBADA IMPEX PRIVATE LIMITED: 13.32%, $8,670.14 Million

2. SUDHIR ENTERPRISES: 9.83%, $6,396.63 Million

3. HYUNDAI MOTOR INDIA LTD: 5.41%, $3,522.54 Million

4. CÔNG TY TNHH LG ELECTRONICS VIỆT NAM HẢI PHÒNG: 4.53%, $2,945.05 Million

5. PIAGGIO VEHICLES PRIVATE LIMITED: 3.88%, $2,526.30 Million

6. CÔNG TY TNHH SẢN XUẤT VÀ THƯƠNG MẠI L AND S VIỆT NAM: 3.46%, $2,254.45 Million

7. KIA INDIA PRIVATE LIMITED: 2.9%, $1,884.63 Million

8. MARUTI SUZUKI INDIA LIMITED: 2.22%, $1,446.41 Million

9. GROZ BECKERT ASIA PVT LTD: 1.61%, $1,049.62 Million

10. VOLKSWAGEN INDIA PRIVATE LIMITED: 1.5%, $976.72 Million

These companies are pivotal in shaping the global car export landscape and play an essential role in the automotive industry.

》>Free Get New Potential Customers<《

I. Establish Customer Resource Database by Country

The establishment of a customer resource database is akin to a personalized work record. Start by using trade tracking functionality to compile a list of all customers in a country. Then, analyze each buyer's purchase volume, procurement cycle, product specifications, and supplier system. Pay special attention to the diversification or singularity of a buyer's supply channels, as buyers with diverse supply sources are preferable. Finally, filter out 30% of the potentially high-quality customers from that country and record them in your customer resource database. The database can be flexibly organized by country, time, customer name, follow-up steps, contact phone, email, contact person, etc. (>>>Click to Develop New Customers)

II. Establish Customer Resource Database by Peer Companies

Have a good understanding of the English names (including full names, abbreviations, etc.) of peer companies. Utilize the global supplier networking feature to compile a list of all customers associated with these peer companies. The critical step is to analyze customers from these peer companies based on purchase volume, procurement cycle, product models, etc. Finally, filter out key customers from your identified peers and record them in your customer resource database. (>>>Click to Apply for Free Trial)

III. Identify Newly Appeared Customers in Each Country

Use the trade search function to identify customers newly appeared in a country. Choose the country, set the date range, limit the product name or HS code, and check the "Newest" option. The search results will display high-quality customers that have newly emerged in that country within the specified time frame. Since these customers are new, they may have just started transactions, and the stability of their suppliers may be uncertain. It's essential to focus on following up with these new potential buyers and record them in your customer resource database. (>>>Click to Apply for Free Trial)

These three approaches for developing customers using customs data can be implemented based on the actual needs of the company and oneself. Consider the market environment, industry characteristics, strategic requirements, etc., to find a suitable method. The ultimate goal is to establish and organize a categorized archive of high-quality customers. Once you identify suitable customers, the next step is to precisely contact them through various channels, such as phone calls, emails, and SNS information.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship