Trade Data Provider

Trade Data Provider

2025-08-07

2025-08-07

Customs data is a powerful tool for identifying real importers, but only if used correctly. Many businesses struggle with inaccurate product filtering, misleading trade figures, and poor-quality contact data. Tendata outlines practical strategies to solve these issues and maximize the value of customs data for international business development.

1. Problem: Inaccurate Product Filtering Due to Vague Descriptions and HS Code Confusion

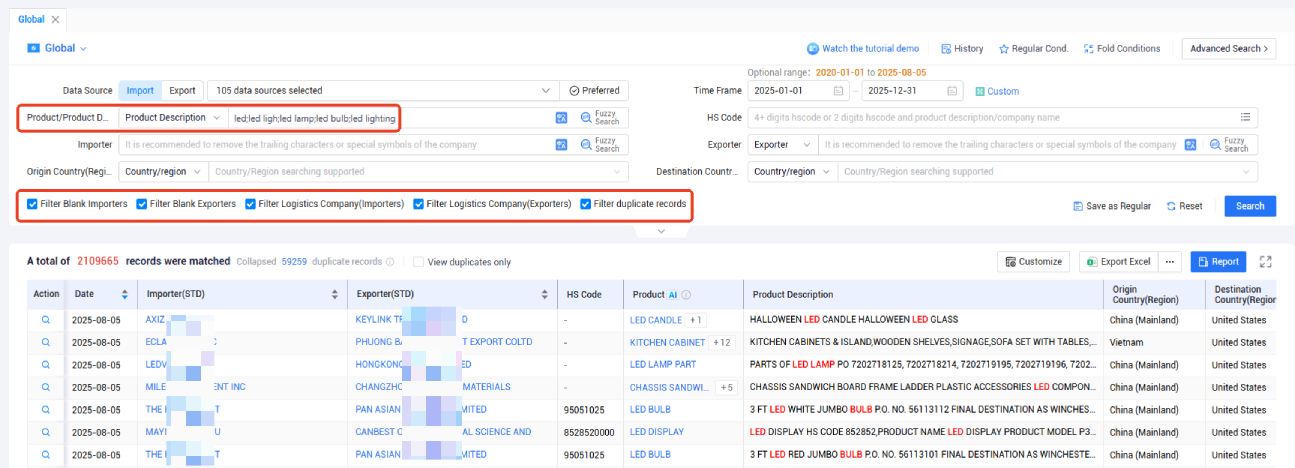

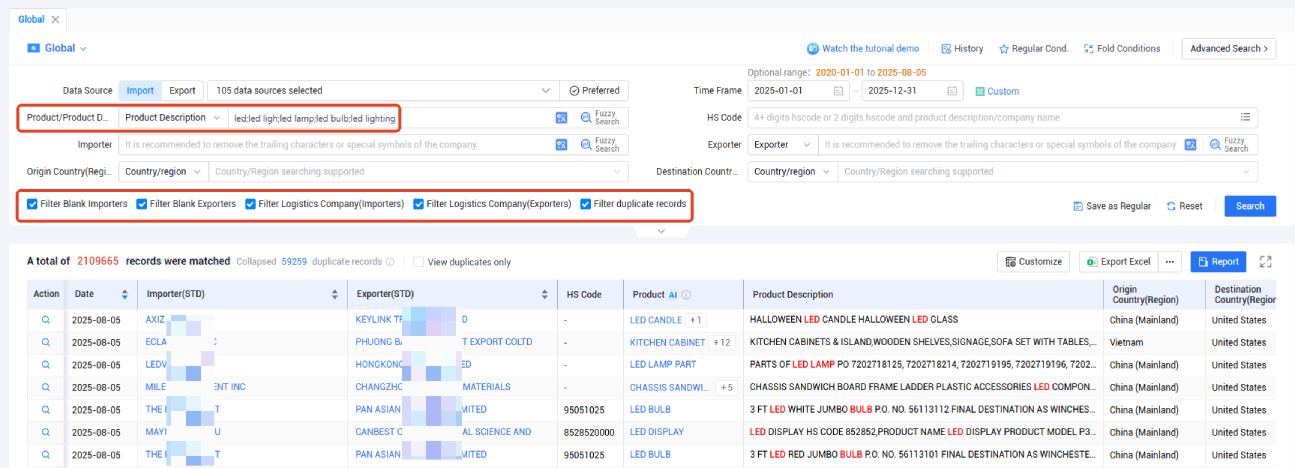

The same product can be described using multiple keywords (e.g., "LED light," "LED bulb," "LED lamp") or be classified under different HS codes. This leads to incomplete or irrelevant search results.

✅ Solution: Use Multi-Keyword and Multi-Code Search Strategies

Step 1: Create a Keyword List by Product Level

Primary keywords: General terms like "LED"

Secondary keywords: Variants such as "LED light," "LED lamp," "LED bulb"

Industry terms: Informal names like "LED fixture," "LED lighting"

Run separate searches for each keyword, then merge and de-duplicate the results. This ensures comprehensive coverage and minimizes missed opportunities.

Example:

When sourcing data for LED lights, search using all of the following terms:

“LED light”

“LED lamp”

“LED bulb”

“LED lighting”

Step 2: Use HS Codes as a Supplementary Filter

Collect the most common HS codes used for the product in target markets (e.g., 940530, 940592 for LED lighting). Run searches using each code, and then cross-reference with keyword-based results.

⚠️ Important: HS codes should be used as a filtering aid, not a sole determinant. Always verify product relevance on the company’s official website.

2. Problem: Inconsistent Quantity and Unit Data Make Procurement Volume Unreliable

Units in customs data vary by buyer—CTN (cartons), PCS (pieces), SET (sets)—making it difficult to compare procurement volumes. For example, one carton may contain 10 or 50 units.

✅ Solution: Focus on Import Frequency, Not Quantity

Rather than comparing quantities, track how often a company imports a specific product.

Example:

Company A imports LED lights 8 times/year

Company B imports only 2 times/year

Regardless of the number of cartons, Company A shows more stable demand and is a higher-priority lead.

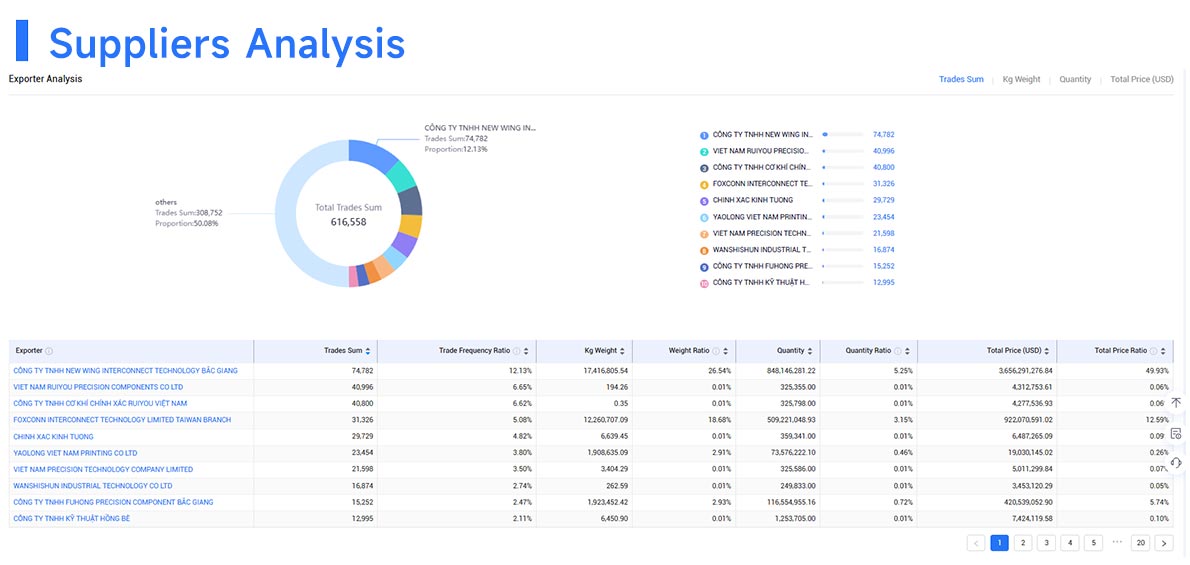

✅ Use Supplier Count to Judge Buyer Potential

If a buyer works with multiple exporters, it indicates strong demand and potential for switching suppliers. Conversely, if they only buy from one exporter, they may have an exclusive contract and be harder to convert.

3. Problem: Misleading Trade Values Due to Estimated or Underreported Prices

Some countries (like the U.S.) report estimated import values, while others (like some in South America) may underreport values to reduce taxes, leading to inaccurate pricing data.

✅ Solution: Stop Using Import Value to Judge Customer Size

Avoid using “import amount” as a filter. Instead, evaluate buyer scale through:

Website presence: multiple branches, broad product catalog

Social media: LinkedIn followers, event participation, or product launches

✅ Use Pricing in Negotiation, Not Prospecting

Avoid statements like “we saw your import price in customs data.” Instead, offer two pricing options (e.g., standard vs. customized product) and observe the buyer’s sensitivity to price during discussion.

4. Problem: Trade Frequency Misjudged Due to Data Splits

In some countries (e.g., India, Argentina), a single shipment is recorded as multiple entries if it contains different products or declarations. This inflates the perceived trade frequency.

✅ Solution: Combine by Import Date + Supplier

If the same buyer imports from the same supplier on the same day, treat it as one transaction. If imports come from different suppliers or on different dates, count them as separate transactions.

Example:

Buyer C imports LED lights from 3 Chinese companies on March 10 → 3 separate trades

Buyer C imports 3 items from the same supplier on March 10 → 1 trade

5. Problem: Freight Forwarders & Agents Mixed In With Real Buyers

Many "importers" in customs data are actually logistics companies or customs brokers—not actual product buyers.

✅ Solution: Verify Buyer Type via Website

Logistics websites often mention services like “customs clearance,” “warehousing,” or “shipping.”

Real buyers display product catalogs, e-commerce capabilities, or distribution info.

Example:

If a company’s site says, “We offer global clearance for lighting products,” it’s likely a freight forwarder—exclude them.

✅ Filter Company Names with Keyword Rules

Freight companies often include terms like:

“Logistics”

“Shipping”

“Forwarding”

“Agency” or “Agent”

Use this as a first filter, but always confirm via the website, as some real buyers may also have similar names.

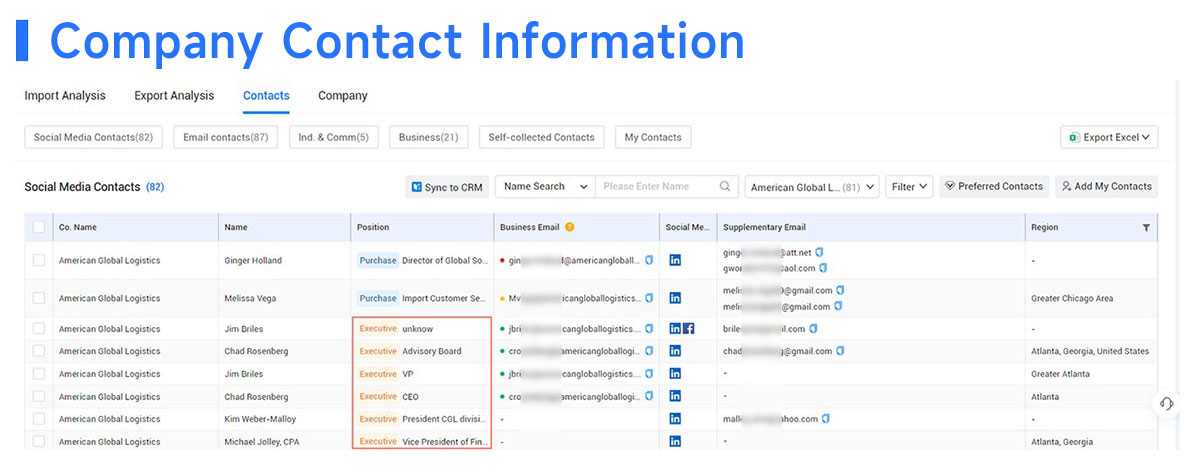

6. Problem: No Direct Contacts; Low-Quality Emails from Platforms

Customs data lacks direct contact information. Many paid platforms offer generic or scraped emails, which are often outdated or irrelevant, leading to high bounce rates (up to 40%).

✅ Solution: Find Decision-Makers and Verify Emails Manually

Step-by-step guide:

Search company name on LinkedIn to find relevant positions (e.g., "Purchasing Manager", "Sourcing Specialist").

Search for the person’s email using Google (e.g., “John Smith @ company.com”) or guess based on common formats (e.g., firstname.lastname@company.com).

Use tools like Hunter.io to validate emails before sending your outreach.

✅ Build Relationships via Social Media Before Emailing

Engage with prospects on LinkedIn first:

Like or comment on their posts

Mention relevant topics (e.g., “We also focus on energy-efficient LED lighting”)

Once rapport is established, send a connection request or message to ask for their contact details

This approach significantly improves response rates compared to cold emailing.

Final Thoughts

Customs data isn’t perfect—but its unique value lies in helping you identify real importers. Don’t waste time obsessing over inaccurate quantity, trade value, or unit discrepancies. Instead:

🎯 Focus Your Efforts On:

Using multiple keywords and HS codes to capture all potential buyers

Verifying buyer legitimacy via websites and filtering out logistics providers

Manually sourcing high-quality contacts instead of relying on platform-scraped emails

By doing so, you’ll turn customs data from a messy dataset into a strategic tool for international sales success.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship