Trade Data Provider

Trade Data Provider

2025-05-29

2025-05-29

After years in the import-export business, I've noticed that peers who run stable operations usually refer to global trade data. It's not a magic key, but it definitely helps you understand the market and your customers more clearly. Recently, opinions in the industry have been mixed—some say it's “useless,” while others still rely on it to find clients. The truth is, the value doesn't lie in the data itself, but in how you use it.

1. Data Is Not a Miracle, It's a Tool

With increasing competition in import-export—Vietnamese factories focusing on price, Indian clients comparing solutions—many have started to question the value of global trade data. In reality, different people use it differently, and therefore draw different conclusions:

Those who find it useless may have treated it like a directory, blasting out development emails only to get no response. Those who find it useful treat it like a map: first locating markets and identifying potential clients, then knocking on doors with tailored solutions. In essence, data is like a compass—it can point you in the right direction, but you still have to walk the path yourself. Today, the real challenge in international trade is not just having direction, but also knowing how to adapt.

2. Four Practical Tips to Bring Your Data to Life

01 Identify Market Trends to Set a Direction

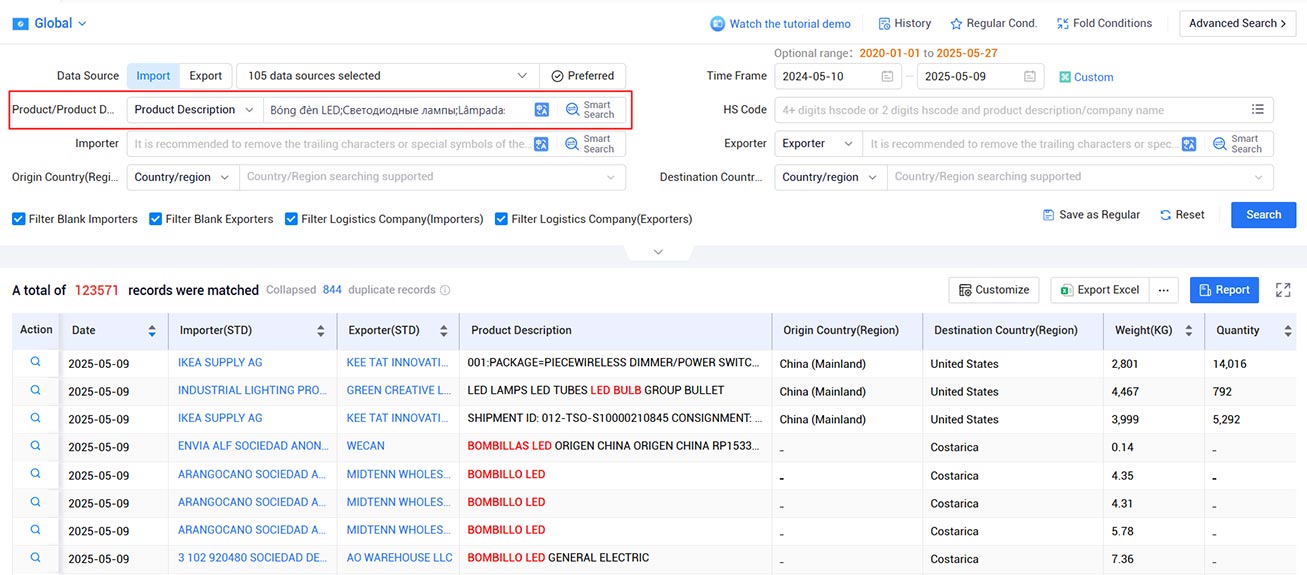

Wondering whether your product has potential overseas? Use trade data to check import volumes and supplier distribution.

For example, a friend who sells LED bulbs searched the keywords in the data, filtered by “importing country,” and then checked “suppliers” for competitive insights. He discovered that Indonesia imports around $500,000 worth monthly, with local suppliers accounting for less than 20%. He jumped in and now ships three containers a month.

❗❗ (Apply for a free trial of global trade data)

02 Rehearse Before Trade Shows to Improve Efficiency

Trade shows aren't about passively waiting for clients—preparation is key.

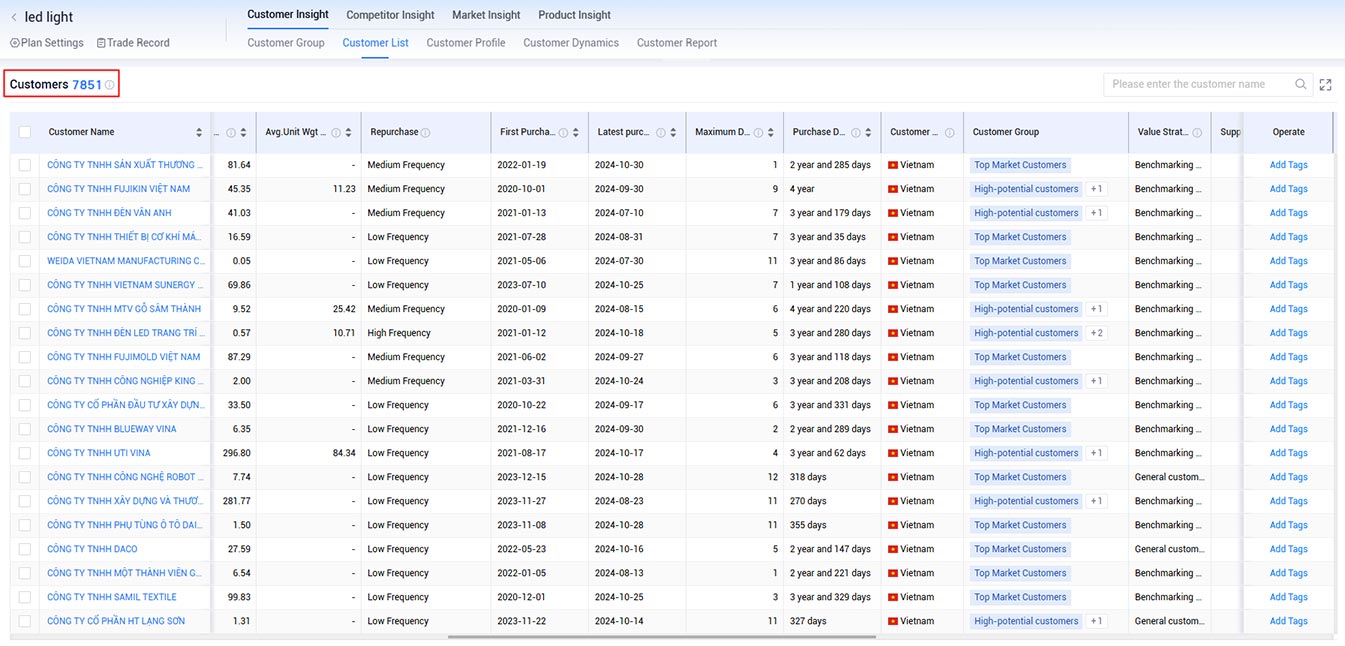

Before the Canton Fair, you can use data to filter buyers from “Vietnam + importing HS code 85395100 (LED bulbs) from your country in the past year.” This may yield over 7,000 companies. Then check their records one by one: which port they use (might care about logistics), how many boxes they order (indicates scale), and whether they've changed suppliers (may be comparing quotes).

You can then approach each prospect with specific talking points.

❗❗ (Apply for a free trial of global trade data)

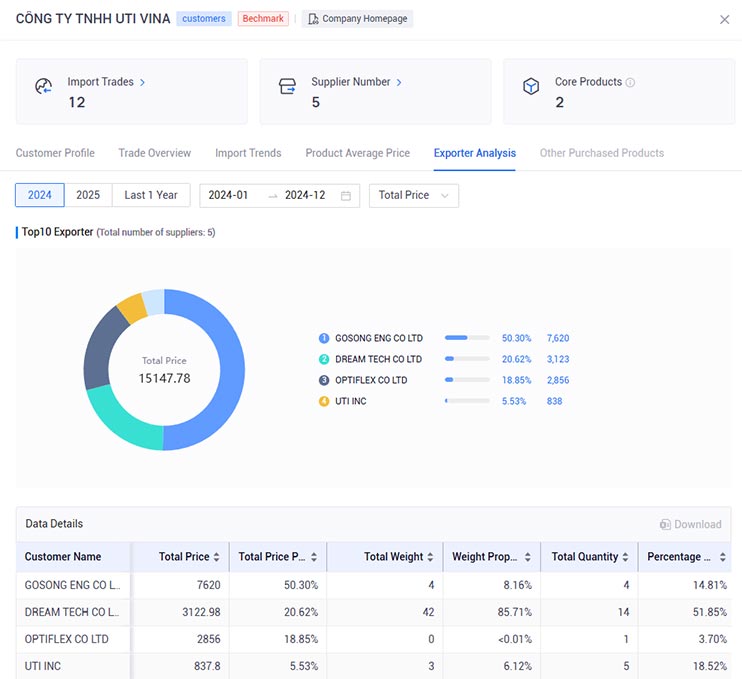

03 Analyze Competitors' Clients to Find Opportunities

Studying your competitor's clients isn't about stealing them—it's about spotting potential collaboration.

For example, if a Brazilian buyer hasn't ordered from your competitor in two months, they might be looking for a new supplier. Don't quote them immediately; instead, check their website for new product launches, and offer complementary products—like light bulb bases if they're buying lamps. Start with small trial orders.

Note: This applies to public data. Avoid digging into confidential info—industry reputation matters more than orders.

❗❗ (Free competitor research available)

04 Track Existing Clients for Timely Follow-up

Ongoing clients also need attention—especially changes in their purchasing behavior.

If a Spanish client used to order 200 boxes of indoor lights monthly, but in Q1 ordered 150 indoor + 100 outdoor lights, check local policy and you might discover a “community lighting upgrade” initiative. Recommend solar street light samples—and you could land a $50,000 order.

Keep an Excel sheet to log each client's purchase frequency, product structure, and port of shipment. Every quarter, spend 30 minutes reviewing:

If order volume fluctuates by more than 20%, ask why.

If they change ports twice, check if they're having logistics issues.

3. Data Is a Tool, Not a Crutch

Let's be honest:

Global trade data can tell you where the clients are, but not how to close them. It reveals your competitor's customers, but not those customers' real pain points. A newbie recently bought some data and sent emails like “I know you buy from X company”—only to get blocked.

Data is a great tool—but you must use it smartly, not bluntly.

In today's trade landscape, you can't do without data, but you also can't rely on it alone. What truly works is translating the “numbers” in the data into “pain points” your clients care about. For example:

If a client orders 100 boxes each time, propose a 50-box trial plan.

If a client buys from three suppliers, offer a bulk-purchase discount policy.

In the end, global trade data is a powerful tool, but it won't directly win you orders or expose a buyer's exact needs. It helps you identify prospects, but success depends on your communication skills and market understanding.

Those who use data well are not just “data-savvy,” but also “client-savvy” and self-aware. There are no shortcuts—just consistent learning and practice to find what works best for you.

❗❗ (Apply for a free trial of trade data for 228+ countries and regions)

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship