Trade Data

Trade Data

2025-04-30

2025-04-30

France remains a key player in the global trade landscape, with a dynamic and diverse import-export ecosystem. In 2024, France continues to demonstrate steady growth in trade, bolstered by its strategic position in Europe and strong economic ties with both the EU and international markets. In this article, we explore the latest France trade data, highlighting key trends in imports, exports, and major trading partners.

France's Imports: Key Trends in 2024

In 2024, France's imports are expected to reach approximately $860 billion, continuing the upward trajectory seen over recent years. In 2023, France's total imports amounted to $830 billion, marking a 2.5% year-on-year increase. Among the top imported goods, fossil fuels have seen the fastest growth, with a 16.2% increase year-on-year in 2024. This surge is driven by global energy price fluctuations and the ongoing recovery in industrial production. Organic chemicals and pharmaceuticals also experienced notable growth, increasing by 14.2% and 8.6%, respectively.

Top Imported Products in France (2024)

Fossil Fuels (Including Oil): $160.5 billion (18.7% of total imports)

Machinery (Including Computers): $89.2 billion (10.4%)

Vehicles: $78.9 billion (9.2%)

Electrical Machinery & Equipment: $70.5 billion (8.2%)

Pharmaceuticals: $34.5 billion (4.0%)

Plastics & Plastic Products: $32.1 billion (3.7%)

Optical, Technical, and Medical Equipment: $24.3 billion (2.8%)

Organic Chemicals: $20.1 billion (2.3%)

Iron & Steel: $19.6 billion (2.3%)

Automotive Parts & Accessories: $18.2 billion (2.1%)

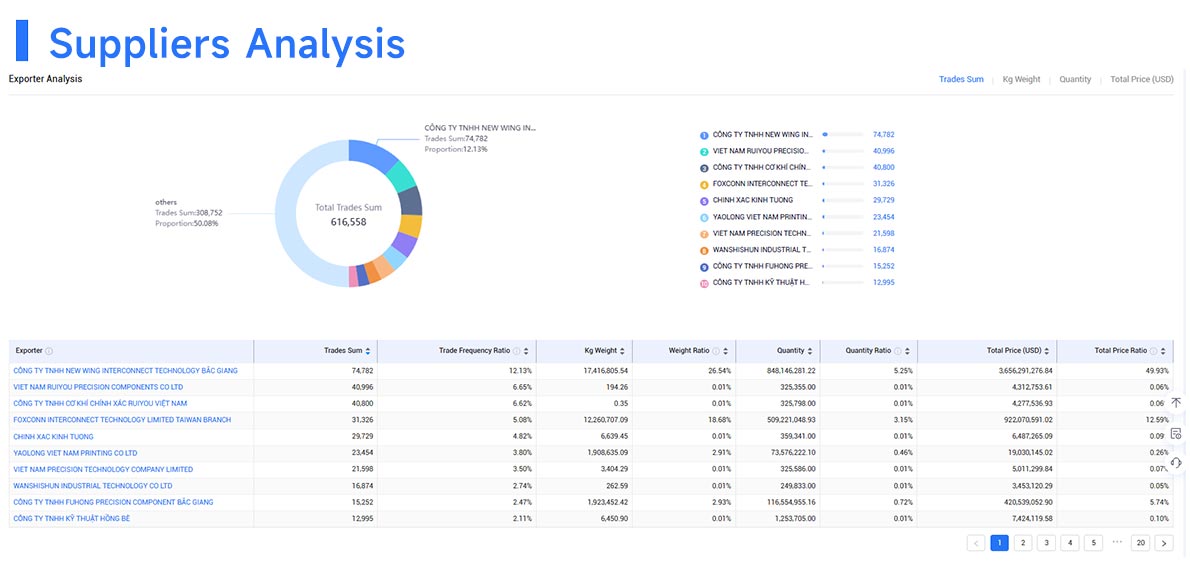

Key Suppliers to France in 2024

In 2024, the leading suppliers of goods to France remain largely consistent with previous years, with Germany being the largest source, contributing 36.1% of total imports. Other major suppliers include China (7.8%), Belgium (5.4%), and the U.S. (5.3%).

Top Import Suppliers to France (2024)

Germany: 36.1% of total imports

China: 7.8%

Belgium: 5.4%

United States: 5.3%

Italy: 4.2%

Netherlands: 3.1%

Spain: 2.9%

Switzerland: 2.3%

Russia: 2.0%

Turkey: 1.8%

>>>> Get France Trade Data <<<<

France's Exports in 2024

In 2024, France's exports are expected to exceed $625 billion, marking a 3.2% increase from $606 billion in 2023. The country remains a global leader in several high-value export sectors, including aerospace, automotive, and pharmaceuticals.

Top Export Products from France (2024)

Machinery (Including Computers): $69.8 billion (11.2% of total exports)

Vehicles: $53.5 billion (8.6%)

Motors & Equipment: $48.2 billion (7.7%)

Pharmaceuticals: $40.1 billion (6.4%)

Fossil Fuels (Including Oil): $36.4 billion (5.8%)

Aircraft & Spacecraft: $34.6 billion (5.5%)

Plastics & Plastic Products: $27.3 billion (4.4%)

Perfumes & Cosmetics: $25.2 billion (4.0%)

Beverages, Spirits, Vinegar: $24.4 billion (3.9%)

Iron & Steel: $21.1 billion (3.4%)

>>>> Get France Trade Data <<<<

Key Markets for France's Exports in 2024

France's export destinations have remained stable in 2024, with Germany still the largest importer of French goods, accounting for 14.4% of total exports. Other major markets include Italy (9.2%), the U.S. (8.5%), and Belgium (8.1%), highlighting the importance of France's trade relationships within the European Union and across the Atlantic.

Top Export Markets for France (2024)

Germany: 14.4% of total exports

Italy: 9.2%

United States: 8.5%

Belgium: 8.1%

Spain: 7.8%

United Kingdom: 6.2%

Netherlands: 5.3%

China: 4.6%

Switzerland: 4.1%

Poland: 2.9%

>>>> Get France Trade Data <<<<

Key Insights and Opportunities

Energy Sector: France's fossil fuel imports and exports are experiencing a boom. Companies in the energy sector should keep an eye on France’s growing demand for petroleum and natural gas, alongside its increased exports of these products.

Aerospace and Aircraft Manufacturing: As one of the global leaders in aircraft and spacecraft production, France’s aerospace industry continues to thrive. Exporters in this sector should explore opportunities in high-tech components and aviation technology.

Pharmaceuticals and Chemicals: Despite a slight decline in pharmaceutical exports, organic chemicals and plastics are seeing steady demand both domestically and abroad. Companies in the chemicals and medical industries may benefit from France's well-established production capabilities.

Luxury Goods and Cosmetics: With perfumes and cosmetics accounting for 4% of exports, France’s luxury goods market remains strong. The global demand for high-end beauty products offers valuable opportunities for companies in this sector.

Conclusion

France trade data for 2024 reflects its ongoing role as a key player in global commerce. From energy products and aerospace to luxury goods and chemicals, the country's diverse export and import landscape offers substantial business opportunities. Whether you're looking to enter the French market or optimize your supply chain, Tendata provides real-time trade insights to help you navigate this competitive environment.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship