Trade Trends News

Trade Trends News

2023-08-14

2023-08-14

· Asia accounted for 33% of H1 revenue, up from 23% in the same period last year.

· Europe contributed 31% of revenue, down from 40%.

· RUSAL's average premium relative to LME prices decreased by 41.5%, reaching

$200 per ton.

RUSAL, the Russian aluminum company, announced on Friday that its sales in Asia saw growth in the first half of 2023. However, Europe remains a significant market, contributing over 30% of the company's revenue.

Despite not being a direct target of Western sanctions, RUSAL's production costs have substantially risen due to the impact of Russia's 2022 invasion of Ukraine.

Some Western customers have also shied away from its metals, leading to an increase in the share of Russian-produced aluminum in the London Metal Exchange (LME) registered warehouses.

Nonetheless, RUSAL's performance in the first half of the year indicates that a substantial portion of the relatively sluggish European market is still purchasing Russian-origin aluminum.

The company stated that in the first six months of this year, Asia accounted for 33% of RUSAL's revenue, up from 23% in the same period last year, while Europe accounted for 31%, down from 40%.

Overall, H1 revenue dropped by 17% to $5.9 billion, with Europe contributing $1.9 billion and Asia contributing $2 billion. Due to a 200% import tariff imposed on Russian metals, demand from the United States has dwindled, with sales mainly concentrated in Russia and its neighboring countries.

Outside of Russia, aluminum's energy-intensive production benefits from abundant hydroelectric power. RUSAL operates in Guinea, Jamaica, Ireland, and Sweden. Swiss-based Glencore (GLEN.L) is one of its major customers, with long-term contracts set to expire in 2024.

Amidst global aluminum price declines and supply disruptions from Ukraine and Australia, RUSAL's procurement costs for crucial raw material alumina surged by 55%. Adjusted EBITDA for the first half of the year fell by 84% to $290 million.

The company plans to construct an alumina refinery in Russia and has expressed a focus on reducing reliance on imported raw materials and adjusting export sales. Total primary aluminum sales and production amounted to 1.9 million tons, with increases of 9.8% and 1.2%, respectively.

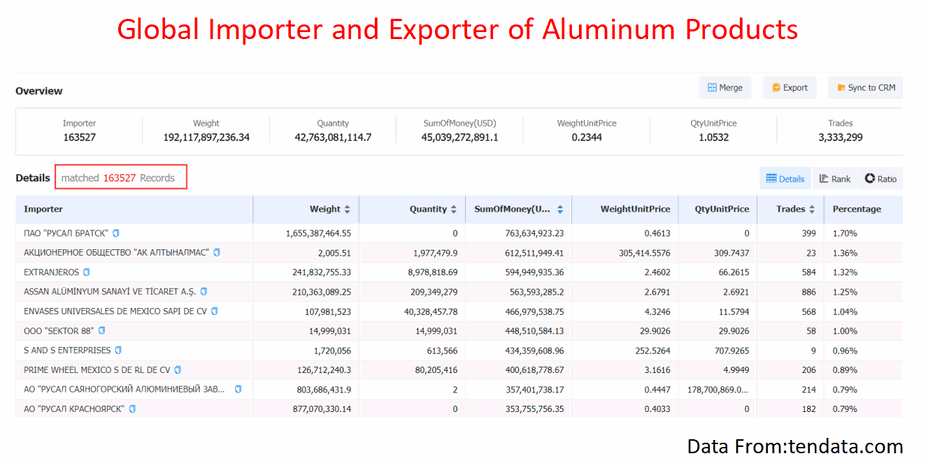

Are You An Asian Aluminum Product Manufacturer Looking To Tap Into Importers In Russia With A Demand For Aluminum Products?

Are You A Russian Exporter Of Aluminum Products Aiming To Expand Into A Broader Market In Asia?

The Fastest Way To Expand Your Market Is Right Here With Tendata!

Just Input The Product Name Or Customs Code, And New Customers Are Just A Click Away!

>>>Click To Quickly Acquire 100,000+ Potential New Customers<<<

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship