Trade Trends News

Trade Trends News

04-01-2024

04-01-2024

It's not just Bud Light.

Last year, beer consumption in the U.S. reached its lowest level in a generation as consumers shifted from traditional favorites to other forms of alcoholic beverages and, increasingly, avoided alcoholic beverages altogether, according to industry group Beer Marketer's Insights.

"It's been a tough year for beer," said David Steinman, BMI vice president and executive editor.

For the first time since 1999, beer shipments fell below 200 million barrels, he said.

Steinman said it was Anheuser-Busch that led the decline. However, Steinman said that while the Bud Light maker made headlines for its sponsorship deal with transgender influencer Dylan Mulvaney, which subsequently led to a boycott by some longtime drinkers, the protests don't explain why overall consumption is still down.

Instead, Steinman said, Anheuser-Busch is at the forefront of accelerating the so-called long-term decline of the country's premium brands, which include Bud Light and its rivals Miller Lite and Coors Light. Anheuser Busch, part of global conglomerate Budweiser InBev, has also suffered from declining sales of hard sodas - a category it has long dominated.

The beer industry also now finds itself facing competition from a slew of new alcohol products, many of which come from nontraditional producers, said Lester Jones, vice president of analytics and chief economist for the American Beer Wholesalers Association.

"For example, some of the world's largest soft drink and energy companies have introduced sugar-sweetened alcoholic beverages to the market, all of which are competing for the same consumption occasions as traditional malt and hop products," he said in an e-mail.

Steinman said that despite the decline in overall consumption, the largest brewers have remained financially resilient as prices have risen in line with or even exceeded inflation. Beer consumers also continue to turn to more expensive beer brands, especially imports such as Modelo Especial, which became the No. 1 beer in the U.S. in 2023.

Beer sales in the rest of the world continue to be strong, Steinman said.

"Dollar sales continue to grow and profits are up as prices rise," he said.

Nonetheless, significant headwinds remain. the craft beer boom of the 2010s has faded, and with the wide variety of alcoholic beverages now available, consumers may be overwhelmed.

Jones said, "The U.S. beer industry is experiencing a frenzy in 2023 against the backdrop of an expanding economy that is creating more jobs and wage growth for many, and an oversupplied alcohol market that is leading to a rapid influx of new products."

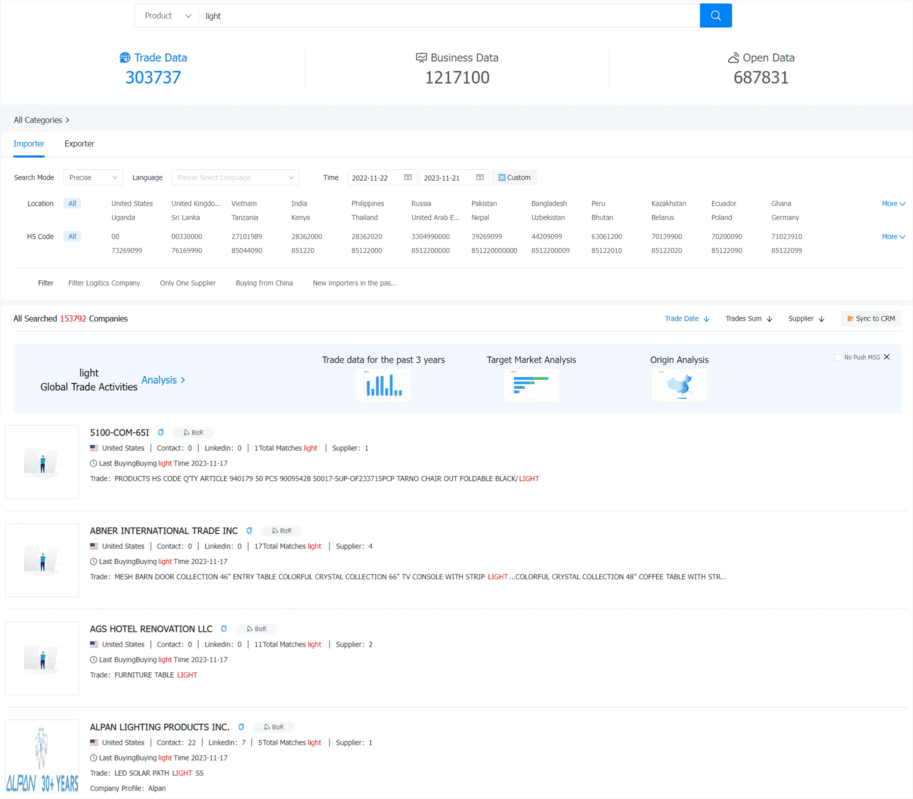

Customs data contains a vast amount of information, and extracting relevant customer contact information can be time-consuming, with results not always meeting expectations. Is it truly the case, or is it because customs data is being used incorrectly, resulting in wasted effort and time?

Utilizing customs data for customer development can be achieved by precisely characterizing all buyers and their procurement systems in the target market. This allows for the quick identification of the most compatible customers, discerning their credit systems and procurement information, determining high-quality customers and profit margins, enhancing development efficiency, and improving overall effectiveness.

In customs data, one can observe the suppliers of buyers. Some of these suppliers are trade companies and also potential customers. In-depth analysis can be conducted on these trade companies, and key customers can be selected for focused development. Information such as buyer contacts, trade partners, procurement cycles, and purchase volumes can be obtained. While customs data may lack contact information due to being derived from bill of lading information, Tendata iTrader provides not only customs data but also business and internet data. This allows for the direct extraction of contact information and positions based on buyer names, making customer development through customs data seamless. (>>> Click To Get Free Access To Customs Data From 80+ Countries)

For new customer development using customs data, three strategies are available for consideration. (>>> Click To Get Free Access To Customs Data From 80+ Countries)

1. Establishing a Customer Database by Country:

Building a customer database is akin to maintaining a work record. Start by using trade tracking features to compile a list of all customers in a country. Analyze each buyer's purchase volume, procurement cycle, product specifications, and supplier system. Finally, filter out 30% of the potential high-quality customers from this country and record them in your customer database, allowing flexible settings by country, time, customer name, follow-up steps, contact phone, email, contact person, etc. (>>> Click For Free Customer Development)

2. Establishing a Customer Database by Peer Companies:

Have a clear understanding of the English names of peer companies (including full names, abbreviations, etc.). Use the global supplier network feature to gather all customers of these peers in the system. Analyze these customers based on purchase volume, procurement cycle, and product models. Finally, filter out key customers from your targeted peers and record them in your customer database. (>>> Click For Free Trial Application)

3. Identifying Newly Appeared Customers in Each Country:

Utilize the trade search function to select a country, set date ranges, limit product names or customs codes, and check "latest." The search results will display high-quality customers that have recently appeared in that country during the specified time period. Since these customers are newly emerging, they may have unstable supplier relationships, requiring focused follow-up. Record these new potential buyers in your customer database. (>>> Click For Free Trial Application)

These three approaches for customer development using customs data can be implemented based on the actual needs of the company. Considering market conditions, industry characteristics, strategic requirements, etc., find a method that suits your preferences. The ultimate goal is to establish and organize a categorized archive of high-quality customers. Once suitable customers are identified, the next step is to make precise contact through various channels such as phone calls, email communication, online chat, etc.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship