Trade Trends News

Trade Trends News

2025-04-22

2025-04-22

Mass-produced Chinese caviar has been increasingly appearing on menus in American restaurants—but that trend may shift as tariffs imposed by former President Donald Trump target Chinese imports.

While avian flu has pushed American stores to ration eggs costing $10 a dozen, salty fish roe has become a staple in upscale dining.

Now, in Nashville, it's found on a $68 sour cream and onion dip; in San Francisco, it's topping a $73 egg salad—these sticky, briny pearls have become a culinary statement.

Although caviar—particularly sturgeon roe—has long been considered a luxury worth splurging on, wholesale prices have dropped significantly in recent years.

"We're seeing a full-blown caviar moment," said Edward Panchernikov, operations director at New York's caviar-focused restaurant Caviar Russe. "Every time someone asks why, I give the same answer: mass-produced Chinese caviar flooding the market at ultra-low prices."

Due to international trade rules under the Convention on International Trade in Endangered Species (CITES), wild-sourced caviar is illegal. Russian caviar, which once dominated the market, now accounts for a small share and is subject to U.S. sanctions.

Today, most of the caviar imported into the U.S. comes from China, where low labor costs, abundant waterways, and government support help keep prices down.

Exact numbers are scarce—caviar represents a tiny fraction of overall imports—but according to the European Market Observatory for Fisheries and Aquaculture Products, the average U.S. import price per kilogram dropped from about $440 in 2014 to around $240 in 2020.

China's caviar industry has been dogged by food safety scandals and accusations of unfair pricing, which importers say has harmed public perception.

However, due to the sheer scale of Chinese aquaculture, even within a single sturgeon farm, caviar quality can vary widely.

Much like a top vineyard can produce both world-class wines and bargain bottles sold in supermarkets, the same Chinese farm might offer Michelin-grade Oscietra alongside lower-tier products sold at deep discounts.

Chinese caviar spans a wide price range—chefs report wholesale costs (after importer markups) ranging from $500 to $1,500 per kilogram, while retailers say prices can go as low as $400.

The pricing pressure across the board makes it tough for smaller American farms to compete. For example, Marshallberg Farm, which supplies caviar to New York's Plaza Hotel, says its break-even cost to produce a kilogram of caviar is between $1,000 and $1,200.

Despite these challenges, chefs note that some of the world's most expensive and sought-after sturgeon roe is now produced in China.

"The texture, the flavor, the saltiness—it's just right," said Kim of Coqodaq. More importantly, the low cost allows chefs to be more generous with portions, helping to create an atmosphere of indulgence.

At The Modern, a Michelin two-star restaurant in Midtown Manhattan, the bar menu features a $39 caviar hot dog: two cocktail sausages, each topped with about four grams of Chinese-raised golden Oscietra, nestled in mini brioche buns.

Over in the West Village, Bangkok Supper Club offers a similar taste of luxury with a $22 bite-sized sea urchin and crab cake topped with caviar.

If caviar is now more affordable, why are diners still paying high prices? Part of the reason is perception: caviar remains a symbol of luxury, and awareness of quality differences lags behind.

"Consumers don't think twice," said Leane Wong, co-owner of Marshallberg Farm. "They figure, it's caviar—it's supposed to be expensive. They don't stop to question where it's from."

Even though Chinese caviar dominates the market, many importers still avoid disclosing the country of origin when selling directly to consumers.

Retail websites might boast about the "pristine waters of Qiandao Lake," but rarely mention China.

"There's still some stigma," said Hossein Aimani, head of Paramount Caviar, which supplies Chinese caviar to restaurants like Le Bernardin in New York.

Promoting the origin of caviar to drive demand and pricing is a time-honored tradition—almost as old as the caviar trade itself.

The appeal of caviar has always been its flair for excess. Like fine champagne, it carries a seductive undercurrent beneath its high price, storied history, and overt financial opulence—part of why we save it for special occasions.

Now that caviar is no longer rare, chefs are having fun with it, treating it like an everyday ingredient, thanks to lower production costs. In tough economic times, they need dishes that attract diners, spark curiosity, and still remain within reach.

But as tariffs on Chinese imports begin to bite, the relative affordability of high-quality caviar may soon change. The continued expansion of Chinese aquaculture could lead to an oversupply of mid-tier caviar, saturating the market. As a result, more restaurants may resort to purchasing lower-cost, lower-quality caviar to fill the gap.

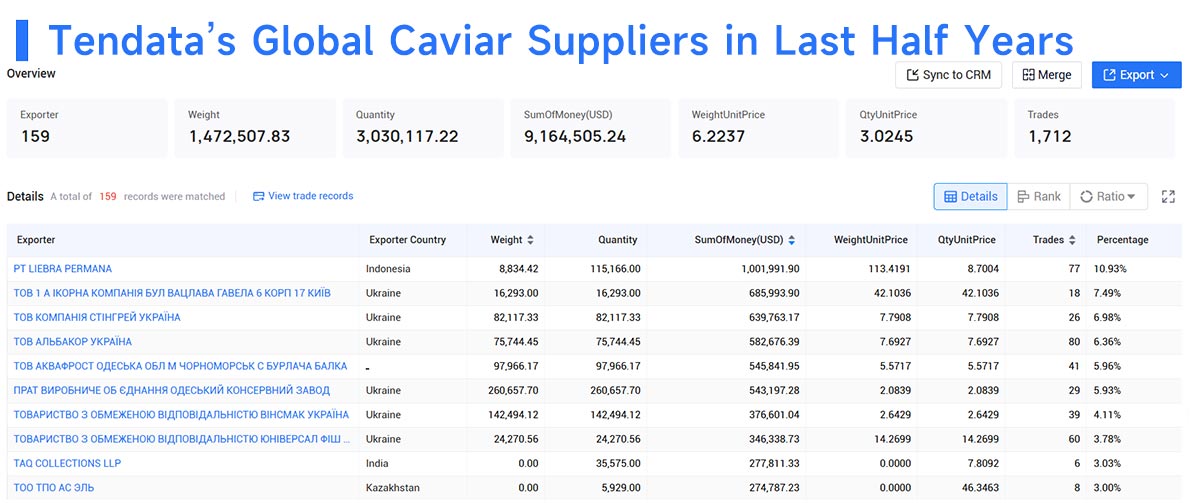

When U.S. caviar buyers look to diversify their sources beyond China, global trade data platforms like Tendata offer a powerful solution. Tendata allows importers to quickly identify suitable suppliers from around the world, providing insights into export volumes, pricing trends, and shipment histories. By leveraging this data, buyers can make informed decisions, discover reliable alternatives in countries such as France, Italy, or Iran, and navigate shifting market conditions with greater confidence. Below are some examples to show you the list of global caviar suppliers with export records in the past six months provided by Tendata. You can also get further market analysis, price analysis, supplier background check, etc. on Tendata.

1.PT LIEBRA PERMANA(10.93%, $1 Million)

2.ТОВ 1 А ІКОРНА КОМПАНІЯ БУЛ ВАЦЛАВА ГАВЕЛА 6 КОРП 17 КИЇВ(7.49%, $0.69 Million)

3.ТОВ КОМПАНІЯ СТІНГРЕЙ УКРАЇНА(6.98%, $0.64 Million)

4.ТОВ АЛЬБАКОР УКРАЇНА(6.36%, $0.58 Million)

5.ТОВ АКВАФРОСТ ОДЕСЬКА ОБЛ М ЧОРНОМОРСЬК С БУРЛАЧА БАЛКА(5.96%, $0.55 Million)

6.ПРАТ ВИРОБНИЧЕ ОБ ЄДНАННЯ ОДЕСЬКИЙ КОНСЕРВНИЙ ЗАВОД(5.93%, $0.54 Million)

7.ТОВАРИСТВО З ОБМЕЖЕНОЮ ВІДПОВІДАЛЬНІСТЮ ВІНСМАК УКРАЇНА(4.11%, $0.38 Million)

8.ТОВАРИСТВО З ОБМЕЖЕНОЮ ВІДПОВІДАЛЬНІСТЮ ЮНІВЕРСАЛ ФІШ КОМПАНІ(3.78%, $0.35 Million)

9.TAQ COLLECTIONS LLP(3.03%, $0.28 Million)

10.ТОО ТПО АС ЭЛЬ(3%, $0.27 Million)

>> Get A Free Demo <<

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship