Trade Trends News

Trade Trends News

2025-05-23

2025-05-23

The Federation of Thai Industries (FTI) announced on May 22 that Thailand’s domestic car sales increased in April for the first time in 23 months, despite continued declines in production and exports.

According to the FTI, local sales in April rose by 0.97% year-on-year, reversing a 0.54% drop in March.

Surapong Paisitpattanapong, spokesperson for the FTI’s automotive industry division, said:

"Passenger car sales increased, but pickup truck sales declined due to continued tight financing conditions."

Thailand’s car production fell 0.4% year-on-year in April to 104,250 units, following a 6.09% drop in March, marking the 21st consecutive month of production decline.

He noted, "Truck production dropped by 33%, which clearly reflects the weakness in our domestic economy."

Car exports in April fell 6.31% year-on-year, a smaller decline compared to 14.91% in March.

Thailand remains Southeast Asia’s largest automobile production hub and a major export base for some of the world’s leading automakers, including Toyota (7203.T), Honda (7267.T), and China’s BYD (002594.SZ).

Find Profitable Markets

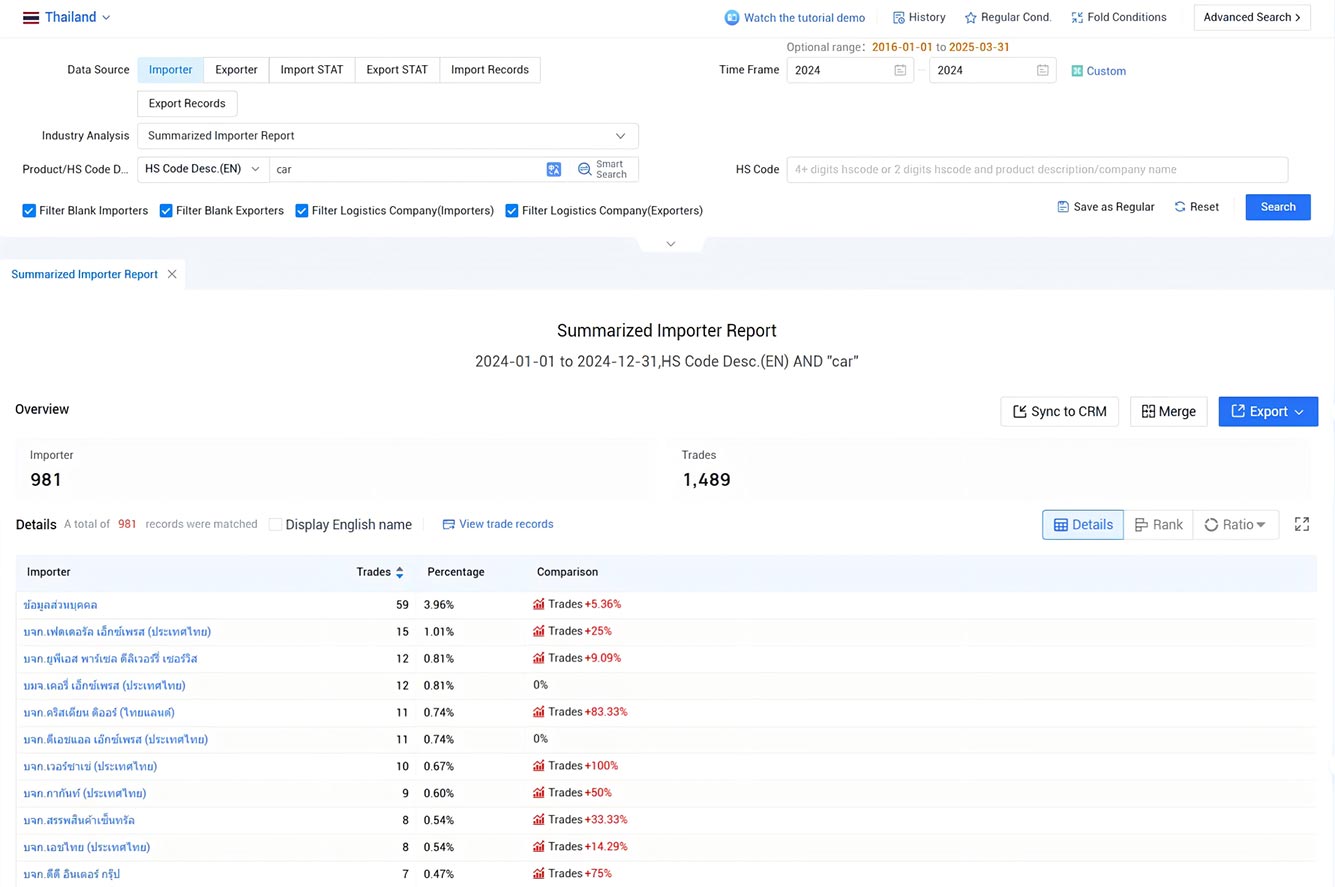

Discover profitable market opportunities for automotive exports and imports with Tendata's powerful analytical tools. Follow the steps below to identify and target the most profitable markets for exporting automotive products:

- Filter automotive import/export data by price to narrow your selection.

- Access Tendata's price analysis dashboard for a curated list of the most profitable markets.

- Focus your import and export efforts on these high-yield markets to maximize your profits.

Thailand Automotive Importers in 2024 by the database Tendata: >> Check the Full List

By implementing these strategies, you can unlock untapped potential and achieve greater profitability in automotive product exports. Start exploring profitable markets with Tendata today and witness a great return on your investment.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship