Trade Trends News

Trade Trends News

2025-06-13

2025-06-13

In Peru's Pisco desert, rows of two-meter-tall blueberry bushes stretch to the horizon before giving way to sand dunes. Traditional blueberry varieties require cold nights to bear fruit, but genetic innovation has produced cultivars like Eureka Sunset, which thrive in this arid region about 250 kilometers (155 miles) south of Lima. For over a decade, these nutritious berries have flowed north to U.S. supermarket shelves—but now, a new competitor has emerged: China.

As blueberry exports increase, Peruvian growers are seeking new markets, especially as their largest customer—the United States—engages in a global tariff battle with trade partners. China, with its strong demand, has built a massive new port near Lima that cuts trans-Pacific shipping time in half.

"Export shares to different markets will be rebalanced," said Miguel Bentín, general manager of major producer Valle y Pampa. The farm began production in 2012, when output was just one-tenth of today's levels.

The desert, once home primarily to grapes used in making Pisco brandy—the base spirit for the Pisco Sour cocktail—has been transformed as blueberry farmers drill wells up to 100 meters (328 feet) deep and employ workers to tend the crops.

Now, Bentín said, they are looking for new buyers. "Our product's potential in the Chinese market is far from fully realized," he told Reuters at the farm.

Valle y Pampa usually sends 60% of its blueberry exports to the U.S., with the rest going to Europe. But this year, the company plans its first large-scale shipments to China to offset the impact of a 10% U.S. tariff on all Peruvian goods.

According to six ministers, agriculture and export officials, and government reports seen by Reuters, Peru overtook Chile in 2021 to become the world's largest blueberry exporter and has since been expanding into new markets.

"At a fast pace, we're identifying new export markets for agricultural goods in Asia, Europe, and Oceania (Australia)," said Peru's Minister of Foreign Trade and Tourism, Úrsula León, in mid-May. She explained that U.S. tariffs could slow the booming trade of blueberry exports, which brought in around $2.3 billion in export revenue last year. Production for the 2025–2026 harvest season is expected to rise by 25% to reach 400,000 tons.

"Peruvian exports will decline if the U.S. maintains these tariffs—especially in agriculture, textiles, and mining," León added after meeting with the Trump administration. She named India, Indonesia, and China as promising growth markets. Peru is negotiating the removal of the tariffs, calling them a violation of a free trade agreement.

If Peruvian supply drops, U.S. consumers may face rising prices. Peru is the U.S.'s largest blueberry supplier, ahead of Mexico and Chile.

"Since a large amount of produce is imported into the U.S. and is not easily grown domestically, tariffs could impact product availability," said Ben Wynkoop, global grocery and convenience strategy analyst at supply chain software firm Blue Yonder.

"Depending on the severity of the shortage, smaller retailers with less negotiating power may face severe stockouts—especially for blueberries," he added.

Gabriel Amaro, president of Peru's Agricultural Producers Association, said, "This won't be a moderate impact—it will be significant." He noted that farmers are lobbying the government to find ways to mitigate the blow and uphold the free trade agreement.

"Our strategy is market diversification. We have a wide range of products, with a particular focus on expanding into Asia."

David Magaña, a senior research analyst at Rabobank specializing in the global fruit market, downplayed the impact of tariffs, noting that China's berry season is longer than the U.S.'s.

"No one in the industry expects China to overtake the U.S. as the primary destination for Peruvian blueberry exports," Magaña said.

China-Backed Port Is a Game Changer

Peru's broader agricultural exports—including grapes and avocados—rose 22% last year to $12.8 billion, mainly destined for the U.S. and Europe. In the first quarter of this year, blueberry exports fell 30% year-over-year, reflecting a shift in harvest timing. However, despite the quarterly drop in U.S. shipments, exports to China rose from a smaller base.

Meanwhile, the newly constructed Chinese-controlled Chancay Port has halved shipping time to Asia to about 20 days—crucial for preserving fruit freshness. In April, China's Port of Guangzhou also launched a direct shipping route to Chancay.

Fruitist, a U.S. fruit company and one of Peru's largest blueberry exporters, grows most of its blueberries in Peru. Late last year, it shipped 15 to 18 containers of blueberries to China via Chancay.

"This completely changes the logistics game for all fresh fruit traders in Peru," said John Early, global sales director at Fruitist. "There's a huge opportunity to expand this business in China."

Back in the Pisco desert, Valle y Pampa's Bentín agrees. He expects exports to China to ramp up significantly as the grape harvest peaks around August. "Chancay Port, especially with its lower cost and shorter transit time, will be a market game changer," he said.

How to Find More Blueberry Buyers Worldwide?

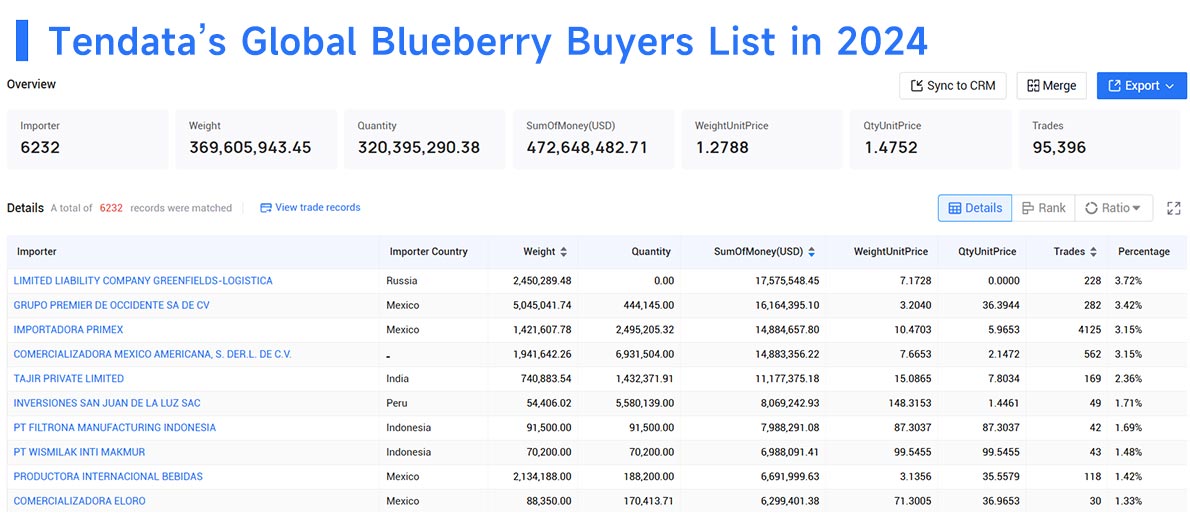

Tendata is a high-end solution for finding global blueberry buyers. A list of global blueberry buyers and their previous shipment values can be easily obtained through Tendata. Simply check the latest blueberry import data on our platform and you can view the entire list of blueberry HS codes. It is a leading import and export data source, providing import and export data for more than 228 countries.

In addition, if you have any questions about buyer data, HS codes, or blueberry import data, please feel free to contact Tendata. Our professionals will do their best to help you. Get a free live demo now!

>> Book a Free Demo <<

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship