Trade Trends News

Trade Trends News

2025-06-23

2025-06-23

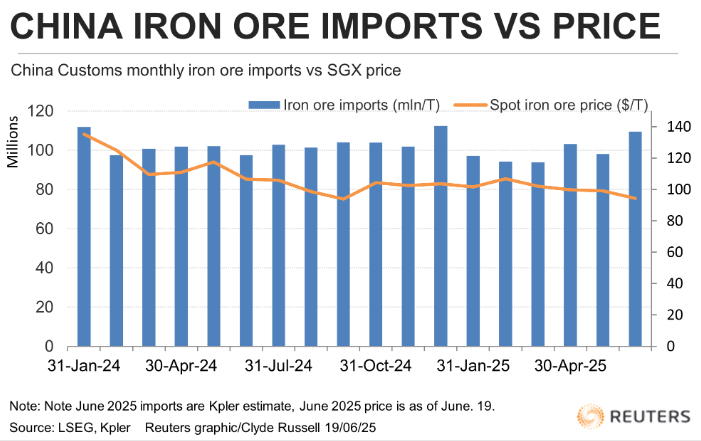

China's iron ore imports in June are expected to hit the highest monthly volume of the year, revealing a resilience that the struggling steel sector itself appears to lack.

According to commodity analytics firms London Stock Exchange Group (LSEG) and Kpler, China—which purchases around 75% of the world's seaborne iron ore—is projected to import close to 110 million metric tons of this key steelmaking raw material. These soaring iron ore imports underscore how demand remains strong despite broader industry weakness.

Kpler estimates June arrivals at 109.56 million tons, while LSEG forecasts 109.1 million tons.

This would represent an 11% increase over May’s official figure of 98.13 million tons, and would mark the highest monthly import volume since December's 112.49 million tons, which was the second-highest on record.

But why are Chinese steelmakers and traders purchasing more iron ore even as the steel industry faces mounting pressure at home and abroad?

One possible answer lies in price movements—spot iron ore prices hit an eight-month low in early June, making the timing favorable for increasing iron ore imports.

Iron ore futures traded on the Singapore Exchange have been trending downward since peaking at $107.81 per ton on February 12, 2025.

On June 18, prices dipped to $94.17 per ton, the lowest since September 30, before rebounding slightly to $94.30.

Due to the time lag between procurement and delivery, these lower prices likely had minimal impact on June's iron ore imports, but they highlight broader trends that may sustain imports in the near future.

Another factor driving increased iron ore imports may be inventory restocking. According to SteelHome, port inventories fell to a 16-month low of 132 million tons in early June.

Strong iron ore imports throughout the month lifted inventories to 133.4 million tons by June 13, but this still trails 2024 levels by 9%.

The question now is: how long can these high levels of iron ore imports last if the steel industry continues to weaken?

Steel Sector Weakness

Official data released on June 16 revealed a 6.9% year-on-year drop in May's crude steel output, down to 85.55 million tons.

From January to May, total steel output was 431.63 million tons, marking a 1.7% decline year-on-year.

Production is likely to fall further. The China Iron and Steel Association recently forecast a 4% annual decrease in steel output for 2025.

Meanwhile, the real estate sector—one of steel's biggest consumers—continues to underperform.

Despite recent stimulus, the market has shown little positive reaction, with new home prices falling 0.2% in May, based on National Bureau of Statistics data.

There’s also growing uncertainty in export-focused manufacturing, especially under the threat of higher U.S. tariffs, as former President Donald Trump proposes duties up to 55% on all imports.

Steel prices are dropping as well. On June 19, rebar contracts on the Shanghai Futures Exchange closed at 2,982 yuan/ton ($414.74), 14% below the February high.

Prices had fallen as low as 2,912 yuan earlier in the month—the lowest since February 2020.

If not for strong steel exports, the outlook would be bleaker. In May, China exported 10.58 million tons, a 9.6% year-on-year increase.

Cumulative exports for the year reached 48.47 million tons, up 8.9%, setting a new record.

Yet as protectionism rises globally, even these strong iron ore imports and steel export numbers may not be sustainable long-term.

Trade Data: Tendata has accumulated 10 billion+ trade transaction details from 228+ countries and regions, supporting one-click query of major import and export countries, customer distribution, product volume and price, etc., which helps import and export enterprises to accurately understand the global market and the trade environment of the target market.

Business Data: Tendata has a total of 500 million+ in-depth enterprise data, involving 198 countries and 230+ industry segments, covering the current operation status, financial information, product information, business relationships, intellectual property rights, etc. The data is fine, which makes it easy to assess the real strength of the target customers in depth, and expand the potential customer base.

Internet Data: Tendata's total of 850 million+ contact data, integrating social media, emails and other multi-channel contacts, helps to reach key contacts of enterprises with one click and improve the efficiency of customer development, as well as news and public opinion monitoring, which helps to grasp the Internet information in a timely manner.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship