Trade Trends News

Trade Trends News

2025-07-04

2025-07-04

Beijing has leveraged one of its biggest bargaining chips in trade negotiations with Washington—critical mineral exports—by imposing export controls to exert pressure.

According to the latest customs data, China's magnet exports to the United States in May plunged 93.3% year-on-year, highlighting a flashpoint in the ongoing trade war between the world's two largest economies.

Last month, China exported approximately 46.4 metric tons of magnets to the U.S., marking a dramatic 81% drop from April's 246.3 tons. This sharp decline illustrates how export controls are directly impacting magnet exports from China to key markets.

Data released Friday also showed that total magnet exports in May fell 74.3% year-on-year, while export value dropped over 76.1%. Magnets are a key product within China's critical mineral export category, particularly those used in high-tech and defense applications.

In response to Washington's broad-based tariffs on Chinese goods, Beijing imposed export restrictions, triggering a sharp decline in shipments to the U.S. and placing significant pressure on American manufacturers in the defense, energy, and automotive sectors that rely heavily on China's magnet exports.

At the same time, magnet exports to Europe's industrial powerhouse Germany dropped 70% year-on-year in May, while shipments to Japan plunged 84.1%.

Addressing concerns over critical mineral export controls, He Yadong, spokesperson for China's Ministry of Commerce, stated on Thursday that China is expediting the review of rare earth export license applications in accordance with relevant laws and regulations, and that a batch of approvals has already been granted.

He added, “China is willing to strengthen communication and dialogue with relevant countries on export control issues and actively promote the facilitation of compliant trade.”

On April 4, following former President Donald Trump's imposition of “Liberation Day” tariffs and broad-based duties on Chinese goods, China implemented export controls on seven rare earth elements and magnets—major rare earth products containing those elements. These controls have had an immediate and visible effect on magnet exports.

Under the new rules, exporters must apply for a license—a process that can take up to 45 days—and provide proof that the exports will not be used for military purposes.

Following a round of U.S.-China trade talks in London this month, Trump claimed on social media that “all magnets and any required rare earths will be pre-supplied by China.”

However, neither side has released an official readout of the meeting. Reuters reported earlier this week that the talks failed to resolve military-grade rare earth issues and suggested that China may be linking the lifting of magnet exports restrictions to the U.S. easing controls on AI chip exports.

The European Union has also raised concerns about the export curbs. Reuters reported Friday that securing rare earth supplies will be a top priority at the upcoming EU-China summit in Beijing next month.

Morgan Stanley noted in a report that “China's control over rare earth supply has become a precise and forceful tool of strategic leverage. Its near-monopoly over the supply chain ensures that rare earths—and by extension magnet exports—remain a crucial bargaining chip in trade negotiations.”

The investment bank also said China is systematically working to refine its mechanisms to make magnet exports a more effective strategic lever.

According to the latest U.S. Geological Survey data, China holds 44 million metric tons of rare earth reserves—about 49% of the global total.

In 2024, China's rare earth mineral production reached 270,000 metric tons, accounting for approximately 69.2% of the world's total output. In contrast, U.S. production was just 45,000 metric tons last year.

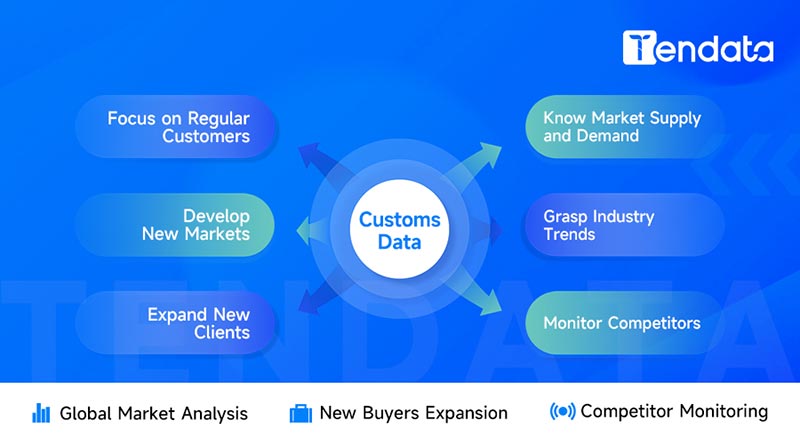

Tendata provides more than 10 billion trade data, covering 228 countries and regions, accumulating more than 10 billion trade transaction details, and a trade database of more than 230 sub-industries.

Searching product keywords or HS codes in Tendata iTrader will allow you to view tens of thousands of active potential customers in the past year, as well as customers' purchase records, including purchase amount, quantity, time, frequency, and their suppliers/buyers. These companies in the Customers List are all customers with needs, and can be used for foreign trade customer development.

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship