Trade Trends News

Trade Trends News

2025-05-16

2025-05-16

Hong Kong’s exports surged by 18.5% year-on-year in March, while imports rose 16.6%, according to data released by the Census and Statistics Department on Monday. Economists note that the full impact of the U.S.-China tariff war has yet to materialize.

Looking ahead, the Hong Kong SAR Government anticipates that new U.S. tariffs imposed earlier this month will pose significant challenges to trade. However, it remains hopeful that the steady economic growth in Mainland China will help support overall trade performance, particularly Hong Kong’s exports.

In March, the value of Hong Kong’s exports totaled HKD 455.5 billion (USD 58.7 billion), representing an 18.5% year-on-year increase. Imports climbed 16.6% to HKD 500.9 billion, resulting in a trade deficit of HKD 80.7 billion for the quarter.

Cumulatively in Q1 2025, Hong Kong’s exports rose 10.9% compared to the same period in 2024, while imports increased 9.8%.

A government spokesperson commented, “Hong Kong’s exports to Mainland China posted strong growth, while performance across other major Asian economies was mixed. Exports to the United States saw a notable increase, and exports to the European Union also recorded mild growth.”

With the United States significantly raising tariffs in early April, global trade tensions have sharply escalated—posing new risks to Hong Kong’s exports and merchandise trade more broadly.

“Nevertheless, the continued recovery of the Mainland economy and Hong Kong's deepening engagement with diversified trade partners should help stabilize Hong Kong’s exports amid external uncertainty,” the spokesperson added.

The government affirmed its commitment to supporting enterprises in navigating international trade challenges and will continue to monitor the situation closely.

Key markets that recorded significant year-on-year growth in Q1 Hong Kong’s exports included:

·Vietnam: +69.1%

·Taiwan: +40.6%

·Mainland China: +16.2%

Exports to the United States increased by 4% in Q1, while imports from the U.S. declined by 6.2%. In March alone, exports to the U.S. rose by 11.4%, and imports grew by 2.9%—reinforcing the strength of Hong Kong’s exports in key Western markets despite mounting tariffs.

Professor Terence Chong, Executive Director of the Lau Chor Tak Institute of Global Economics and Finance at The Chinese University of Hong Kong, commented that the repercussions of the tariff war may not be fully reflected in the first-quarter data on Hong Kong’s exports.

“The trade war will inevitably impact Hong Kong’s exports and re-exports to the U.S.,” he noted. “While export-driven growth may become more difficult to rely on, the expansion into Southeast Asian markets could help offset some of the losses.”

Despite rising trade barriers, Hong Kong’s position as a free port allows it to remain a viable re-export and consumer destination. “We could become a hub where tourists purchase affordable American goods, which may boost the retail sector and indirectly support Hong Kong’s exports ecosystem,” Chong added.

The U.S. has drawn criticism for disregarding established international trade norms, disrupting the global trade system developed post–World War II.

Former President Donald Trump introduced aggressive “reciprocal tariffs” targeting both adversaries and allies, aiming to reduce America’s USD 1.2 trillion trade deficit.

China, the primary target of these measures, has faced U.S. tariffs totaling up to 145%, with some items reaching 245%. Beijing responded in kind by levying 125% tariffs and implementing export controls.

Trump also increased duties on small parcels from Mainland China and Hong Kong, with rates raised to 120%, and ordered the termination of the “de minimis” exemption starting May 2.

As a result, Hongkong Post suspended all U.S.-bound parcel deliveries by land, sea, and air.

Despite the geopolitical headwinds, Financial Secretary Paul Chan stated in a blog post that he expects Hong Kong’s GDP to post steady growth in Q1 2025.

A series of high-profile international events has revitalized the tourism sector, boosting retail and hospitality industries—two critical contributors to the local economy and indirectly beneficial to Hong Kong’s exports.

Do you want to know more about Hong Kong's imports and exports? Do you want

to know which countries in Southeast Asia Hong Kong has increased its exports to

and which products it has increased its exports to? Market analysis is concerned

about international trade people need to be carried out regularly. To get the

latest import/export market dynamics, it is not enough to wait for news reports

and check the lagging data on the official website of each country, but you must

use a tool that can track the latest market dynamics. Tendata is such a tool,

and its AI analytic model uses 100+ charts and graphs to help

importers/exporters analyze the market from many different perspectives.

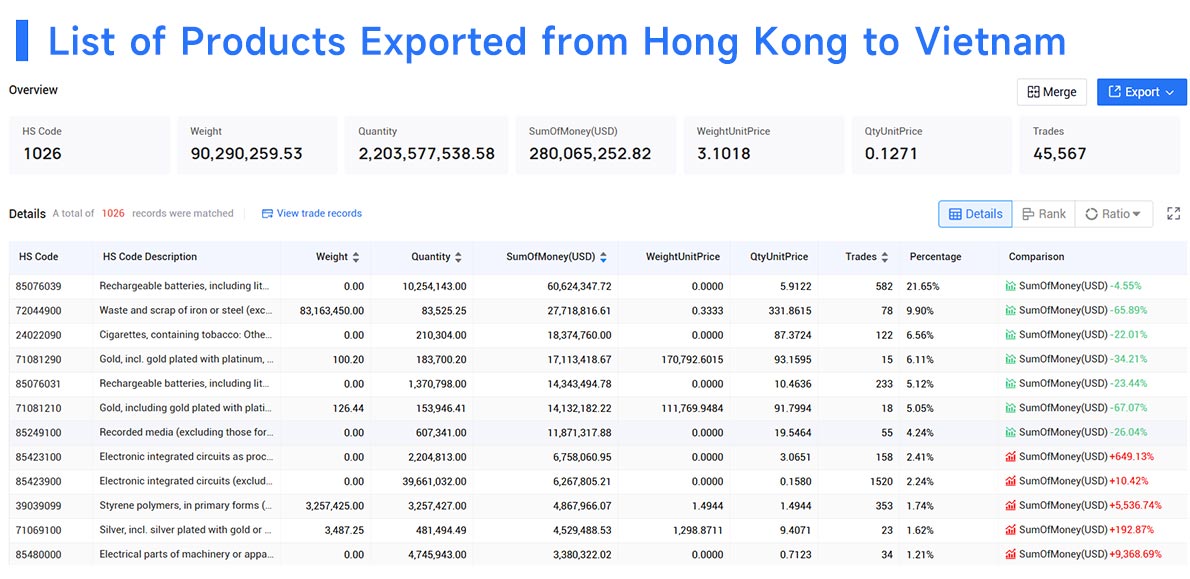

To show you some of the market analysis provided by Tendata. Below is the list of major products exported from Hong Kong to Vietnam in January-April 2025:

1.HS Code:85076039(21.65%, $60.62 Million):Rechargeable batteries, including lithium-ion batteries and battery packs, n.e.s. (excl. of lead-acid or nickel-metal hydride type)

2.HS Code:72044900(9.9%, $27.72 Million):Waste and scrap of iron or steel (excluding slag, scale and other waste of the production of iron and steel; radioactive waste and scrap; fragments of pigs, blocks or other primary forms of pig iron or spiegeleisen; waste and scrap of cast iron, alloy steel or other alloys)

3.HS Code:24022090(6.56%, $18.37 Million):Cigarettes, containing tobacco: Other cigarettes containing tobacco

4.HS Code:71081290(6.11%, $17.11 Million):Gold, incl. gold plated with platinum, unwrought, for non-monetary purposes (excl. gold in powder form)

5.HS Code:85076031(5.12%, $14.34 Million):Rechargeable batteries, including lithium-ion batteries and battery packs, n.e.s. (excl. of lead-acid or nickel-metal hydride type)

6.HS Code:71081210(5.05%, $14.13 Million):Gold, including gold plated with platinum, unwrought, for non-monetary purposes (excluding gold in powder form)

7.HS Code:85249100(4.24%, $11.87 Million):Recorded media (excluding those for sound or image recordings, discs for laser reading systems, magnetic tapes, cards incorporating a magnetic stripe and goods of heading 3707)

8.HS Code:85423100(2.41%, $6.76 Million):Electronic integrated circuits as processors and controllers, whether or not combined with memories, converters, logic circuits, amplifiers, clock and timing circuits, or other circuits

9.HS Code:85423900(2.24%, $6.27 Million):Electronic integrated circuits (excluding microprocessors, controllers, memory devices and amplifiers)

10.HS Code:39039099(1.74%, $4.87 Million):Styrene polymers, in primary forms (excl. polystyrene, styrene-acrylonitrile copolymers (SAN) and acrylonitrile-butadiene-styrene copolymers (ABS)): the rest.

From the table, we can see that the exports of some products are on the rise. For these products, we can then further analyze to which Vietnamese buyers Hong Kong is exporting to, what specific products are being exported, and at what prices ......

>>More Detailed Market Analysis with Tendata<<

You May Also Be Interested In:

1. China and Colombia Sign Strategic Belt and Road Cooperation Framework

2. Global Electric Vehicles Sales Rise in April Despite Trade Disruptions

3. Brazil Is the World's Largest Beef Exporter

4. The U.S. Is the World's Largest Propane Exporter

Category

Leave Message for Demo Request or Questions

T-info

T-info T-discovery

T-discovery

My

Tendata

My

Tendata Market Analysis

Market Analysis Customer

Development

Customer

Development Competitor

Monitoring

Competitor

Monitoring Customer Relationship

Customer Relationship